Last Night's Market Recap

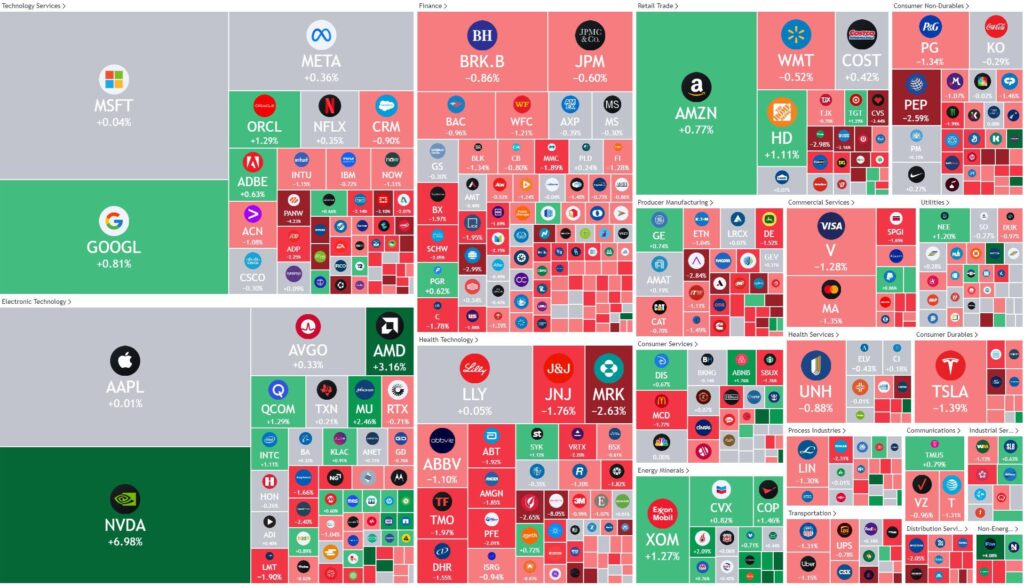

S&P 500 - Heatmap

Overnight – Nvidia dwarfs’ market, adding half a Trillion in market cap this week

The Nasdaq closed above 17,000 for the first time ever Tuesday, underpinned by a surge in Nvidia amid ongoing AI-led optimism.

Nvidia stock rose 7%, in an almost “meme stock rally” putting on $200B in market cap in a day with little catalyst. The tech giant’s market value surpassing $2.8 trillion, rallying 20% or $570B in market cap since its quarterly results, solidifying its position as the third most valuable company on Wall Street.

To put that in perspective, Nvidia gained a the market cap of Cisco in one night and has gained more than the market cap of the worlds biggest bank, JP Morgan, in a week

Demand for AI was given further credence over the weekend after Elon Musk’s xAI said it had raised $6 billion to fund AI development. Apple stock gave up gains to close flat even as the iPhone maker’s smartphone shipments in China were 52% higher in April than a year ago, according to data from a research firm affiliated with the Chinese government.

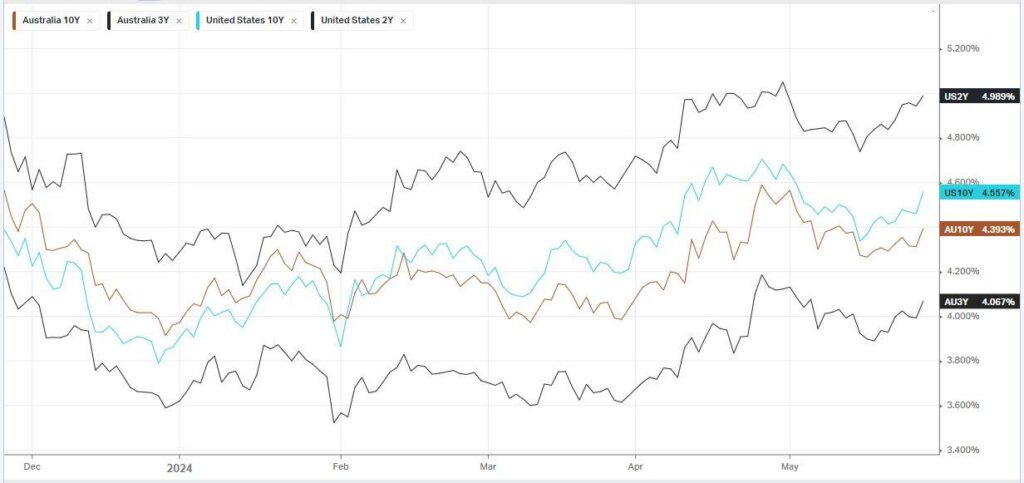

Treasury yields were higher as expectations that there is still a ways to go until the Fed begins cutting rates were strengthen following data pointing to a stronger consumer. Consumer confidence unexpectedly rose in May, the Conference Board survey released Tuesday, pointing to strength in the consumer, which drives the bulk of U.S. economic growth.

Traders continue to price out expectations for a rate cut in September. The CME Fedwatch tool shows traders pricing in a 50.7% probability the central bank will keep rates steady, along with a 43.6% chance of a 25 basis point rate cut. The data came ahead of the release of PCE price index data on Friday, widely seen as the inflation release that the Federal Reserve concentrates on. Friday’s PCE reading is expected to show some cooling in inflation. But inflation is also set to remain well above the Fed’s 2% annual target range.

Bonds

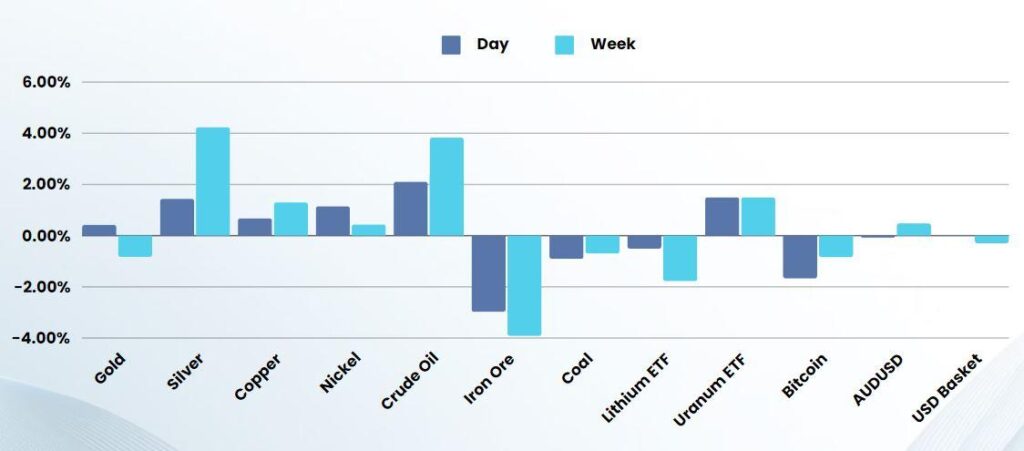

Commodities & FX

The Day Ahead

ASX SPI 7746 (-0.59%)

Iron ore and higher yields will drag down the ASX today with all eyes on CPI at 1130. While Nvidia is masking the broader weakness in the US market, there will be no where to hide once the “meme stock” rally falters.

CPI is expected to dip to 3.4 per cent year-over-year from 3.5 per cent in May

Company Specific:

- Fisher & Paykelexpects net profit in fiscal 2025 to bounce to NZ$310 million ($287 million) to $NZ360 million after it slowed to $NZ132.6 million this year due to three “abnormal items”.

- Macquarie Technology hosts an investor meeting

- Nufarm shares trade ex-dividend