Last Night's Market Recap

S&P 500 - Heatmap

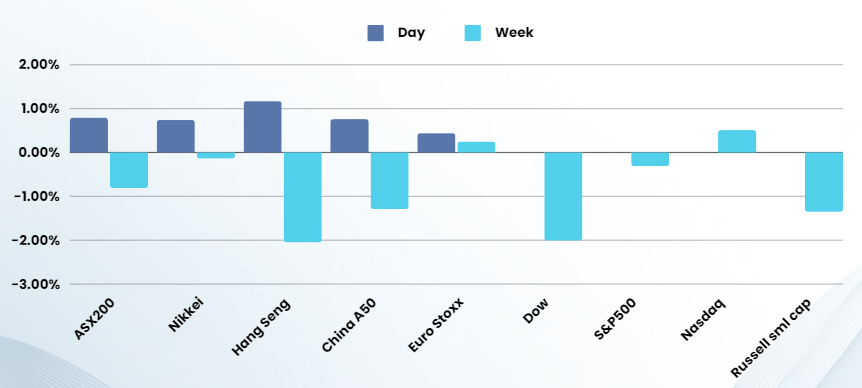

Overnight – Markets quiet as America pays respect on Memorial Day

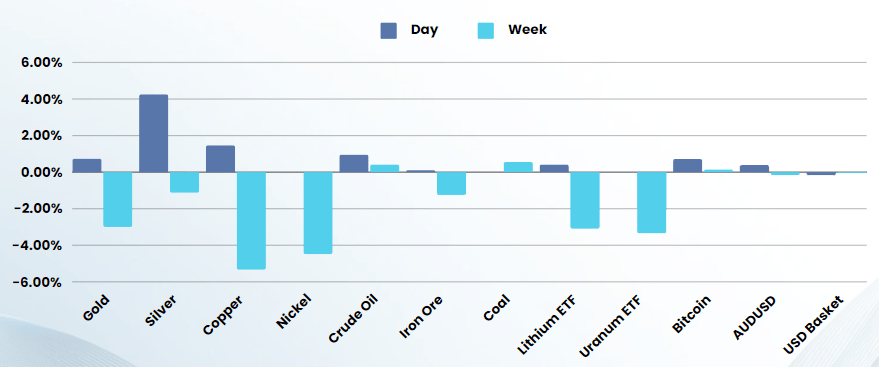

Futures and metals prices ground higher in thin markets overnight as the US paid respect to their fallen on Memorial Day and the UK had a Bank Holiday

In very quiet markets, we saw nothing of note. Here is what will be moving markets this week

Core PCE (US) – The Fed’s preferred inflation gauge — the personal consumption expenditures (PCE) price index — due on Friday will be closely watched for clues about the direction of interest rates over the rest of the year.

The data comes as markets are becoming resigned to the higher-for-longer interest rate narrative after last week’s Fed minutes, along with cautious sounding remarks from policymakers who expressed doubt whether inflation is indeed on a sustainable downward trajectory to its stated 2% target level.

Fed Speakers (US) – Investors will get the chance to hear more from several Fed speakers during the week, including Governor Michelle Bowman, Cleveland Fed President Loretta Mester, Governor Lisa Cook, New York Fed President John Williams and Atlanta Fed President Raphael Bostic.

Rate cut expectations in Europe (EU) – The European Central Bank is now in a position to begin cutting interest rates down from a record high of 4% at its upcoming policy meeting next week, the ECB’s chief economist Philip Lane told the Financial Times. Speaking in an interview with the FT, Lane said that “barring major surprises, at this point in time there is enough in what we see to remove the top level of restriction.” Spurred on by data showing inflation in the euro zone nearing the ECB’s 2% target, markets are widely betting that the central bank will lower its benchmark deposit rate by 25 basis points at its June 6 gathering.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7824 (+0.01%)

With the US and UK on holidays for Memorial Day, we are unlikely to see any major movements today.

Oil rebounded with the focus on an OPEC+ supply meeting on Sunday and US demand at the start of the summer driving season. Metals also rallied, with gold, silver, platinum, and copper all higher.

Focus will be on AU retail sales at 1130am

Company Specific:

- Alumina and Neuren Pharmaceuticals both host AGMs.

- Elders trades ex-dividend.