Last Night's Market Recap

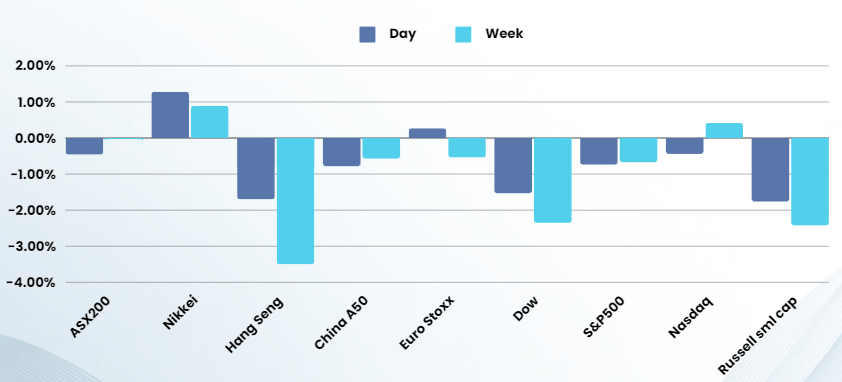

S&P 500 - Heatmap

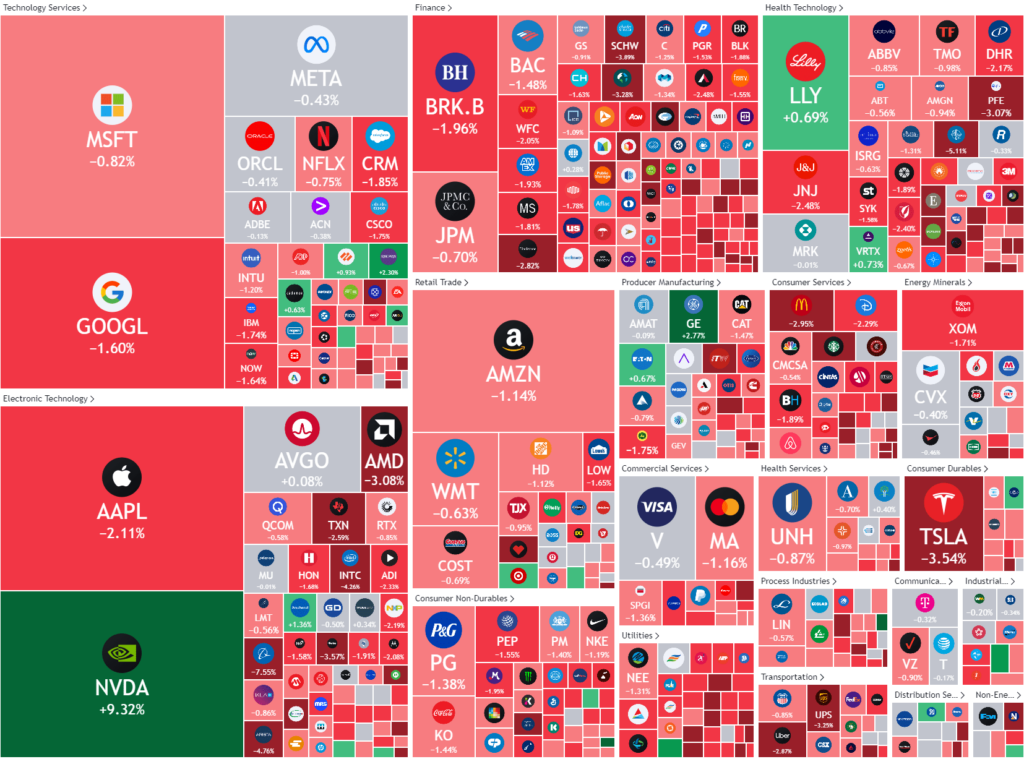

Overnight – Bond yields drag stocks lower despite Nvidia’s AI optimism

Stocks slipped from record highs as rising Treasury yields on signs of sticky inflation dented rate-cut hopes offsetting an Nvidia-led charge higher in tech stocks.

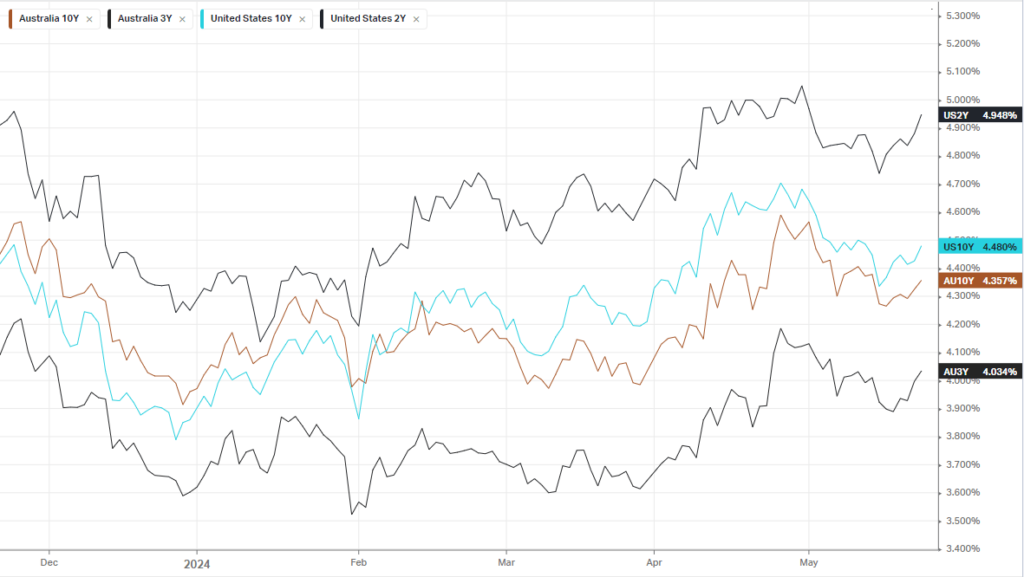

The move higher in bond yields was driven by further signs of Inflation in the Flash US PMI Composite Output Index highlighting that “the rate of inflation accelerating to register the second-largest monthly increase seen over the past eight months.” The Index rose sharply from 51.3 in April to 54.4 in May, stoking fresh fears that a underlying strength in the economy could spark a revival inflation, cooling investor expectations for rate cuts just a day after the Fed’s May meeting minutes showed members were concerned about stalling disinflation.

Adding to fears about demand-led inflation, initial jobless claims fell more than expected, sending US2Y Treasury yields up 5.7 basis points to 4.94%, forcing traders to rein in their bullish bets on stocks. Atlanta Fed president Raphael Bostic said Thursday, however, that the last couple of inflation prints suggest inflation remains on track to return to the 2% target, albeit at a slow pace.

Nvidia rescued the day with a 9% rally to a to a record high after the chipmaker’s first quarter earnings blew past estimates. The firm also offered up a stronger-than-expected revenue forecast for the current quarter, and announced a 10-for-one forward stock split.

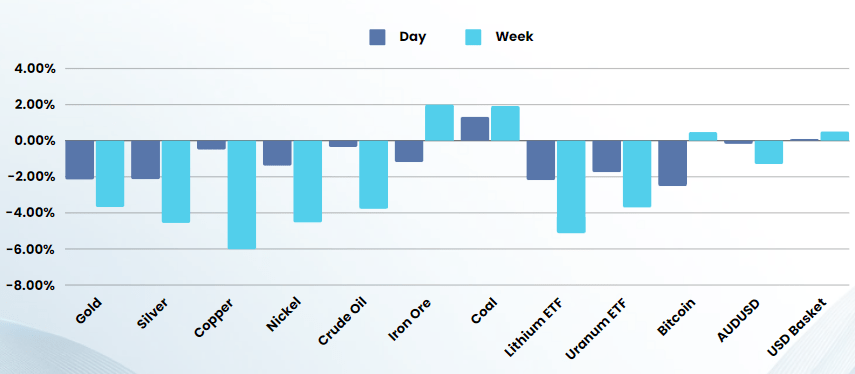

Metals continued to pull back on the rising yields although the investment thesis remains valid as China converts a record amount of US Treasuries and USD to Gold, Silver and other commodities, reducing its exposure to US denominated assets due to the spiralling US debt, currently sitting at $34T and rising at least $1T every 100 days. This spiral is highly likely to result in a credit downgrade to the US, meaning the interest rate the country pays on its bonds will have to increase

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7759 (-1.05%)

The ASX is in for a tough end to the week as reality once again comes home to roost on interest rates and inflation. The markets continual blind optimism that rates will be cut this year is misguided at best with pundits and analysts stubbornly trying to save face on their rate cut calls early in the year.

The sell of is likely to be broad, with interest rate sensitive sectors like consumer discretionary, banks, industrials and REITs likely to bare the brunt of the move. Stocks with high debt ratios or lending exposure should be avoided at all costs

Company Specific:

- In Australia on Friday, Appen, Syrah Resources and Vulcan Energy Resources all host AGMs.