Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Fed minutes show concerns on Inflation, Nvidia beats

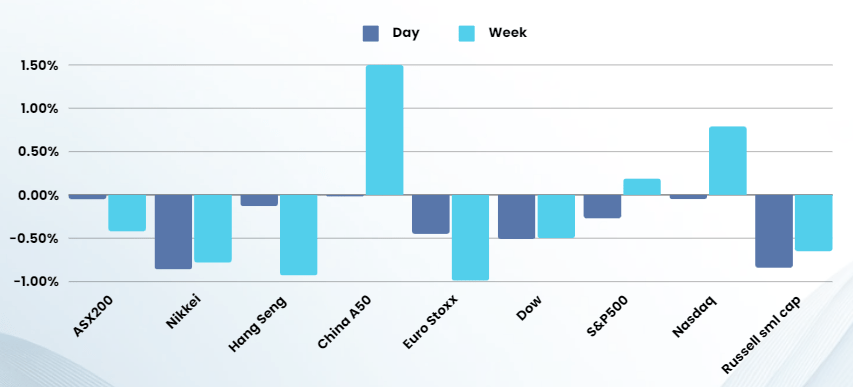

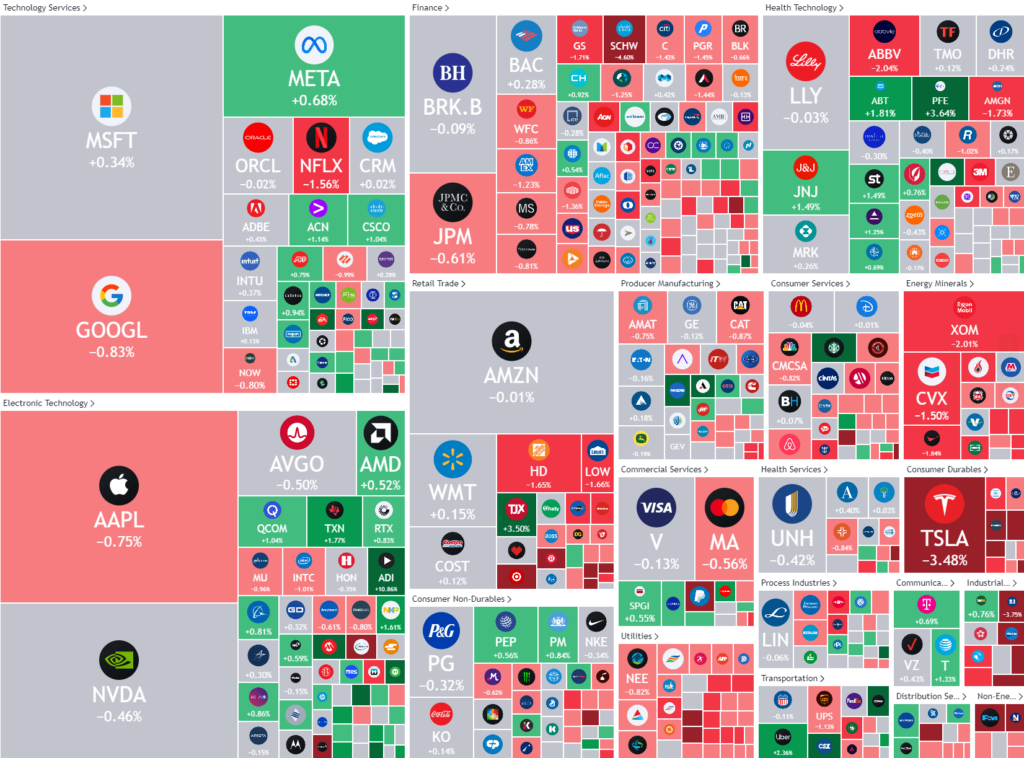

Stocks closed lower Wednesday, a day after notching a record high as investors digested the minutes from the Federal Reserve May meeting showing concerns about progress on inflation.

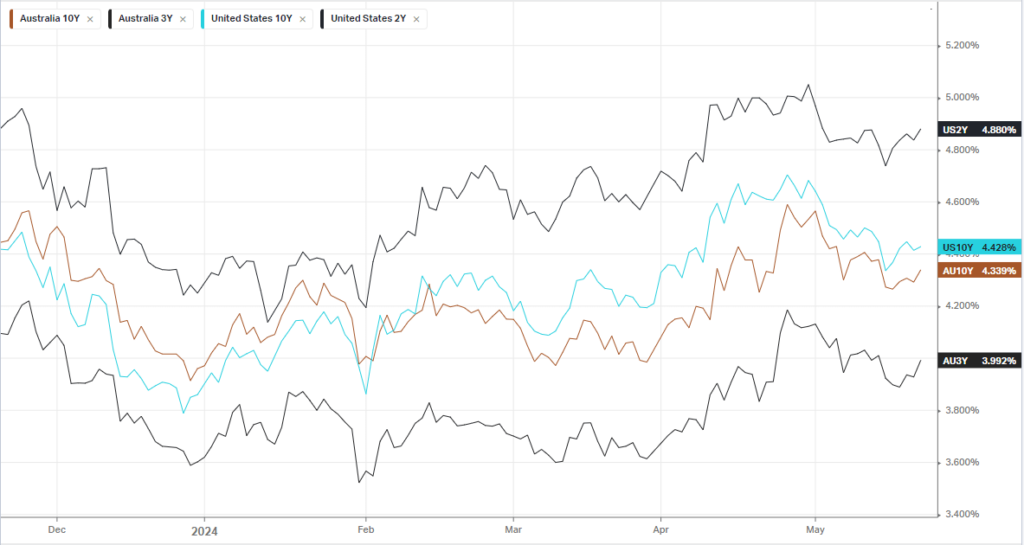

Participants noted “recent data had not increased their confidence in progress toward 2 percent and, accordingly, had suggested that the disinflation process would likely take longer than previously thought,” according to the Federal Reserve’s Apr. 30-May. 1 meeting released Wednesday. The most recent inflation reading showing consumer inflation had slowed more than expected last month was released after the Fed’s May meeting. Since the data, Fed members have welcomed the slower pace inflation, though continued to stress further data would needed. “I need to see a few more months of inflation data that looks like it is coming down,” said Cleveland Fed President Loretta Mester on Tuesday. Those comments echoed recent remarks from other Fed members including Boston Fed President Susan Collins and Fed Governor Christopher Waller.

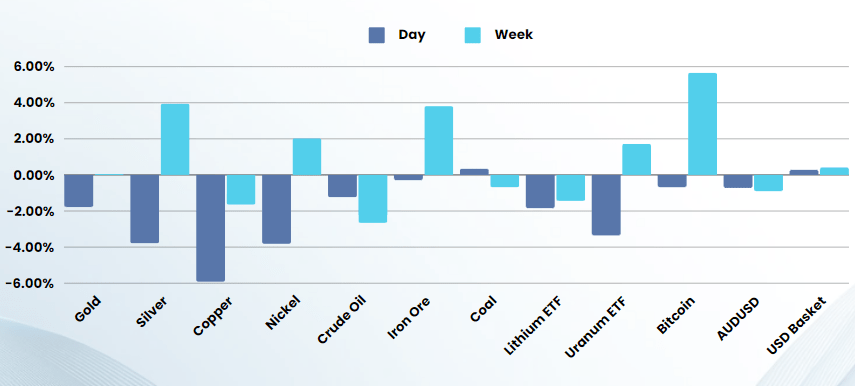

The concerns around inflation were also echoed in the UK’s inflation data, coming in at 2.3%, close to the target band, however the core items barely dropped, setting back hopes for a June rate cut. The inflation worries pushed bond yields higher which saw metals take a big hit from record highs with gold falling 2% and silver 3%. Copper and Nickel also had the rug pulled after recent spectacular rallies falling 6% and 4% respectively.

Earnings

- Nvidia -0.46% (+6.5% after market) – as usual the company reported upbeat guidance for the current quarter as first-quarter results topped Wall Street estimates, driven by robust AI-led demand in its data center business. The chipmaker also announced a ten-for-one forward stock split. These jump in data center growth “reflect higher shipments of the NVIDIA Hopper GPU computing platform used for training and inferencing with large language models, recommendation engines, and generative AI applications,” the company said. Looking ahead to fiscal Q2, the company forecasts revenue of $28B, give or take 2%, that was above estimates for $26.54B. Adjusted gross margin was expected to come in at 75.5% for Q2.

- Target -8% – after its latest quarterly earnings missed analysts expectations amid weak discretionary spending.

- TJX Companies +3% – after the TJ Maxx parent posted better-than-expected first-quarter results and raised its annual profit forecast,

- Lululemon Athletica -7% – after the athletic apparel retailer announced the departure of Chief Product Officer Sun Choe.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7796 (-0.99%)

The ASX will be dragged down by the materials sector today as major commodities all took a hit on rising bond yields triggered by inflation concerns. The Nvidia boost after the bell in New York will do little to support the AU index as recently hot sectors like consumer discretionary and Financials are likely to see some profit taking with rates likely to stay elevated for longer than the market has predicted.

This move is not remotely surprising given Central bankers from multiple Boards have repeatedly warned markets they are in no rush to cut rates, the market just hasn’t listened.

Company Specific:

- BHP Group Ltd ADR , meanwhile, fell more than 4% after its improved 38.14 billion pound, or $49.87B, offer to takeover rival Anglo American) was rejected. Anglo American did, however, say it would keep dialogue open with BHP and requested a one-week extension, signalling that a potential deal remains of interest.

- Nufarm releases earnings

- GQG Partners, Gold Resources, Karoon Energy, Pepper Money, Resolute Mining, Stanmore Resources and Ventia Servicesall host AGMs.

- Aristocrat Leisureand Orica trade ex-dividend.