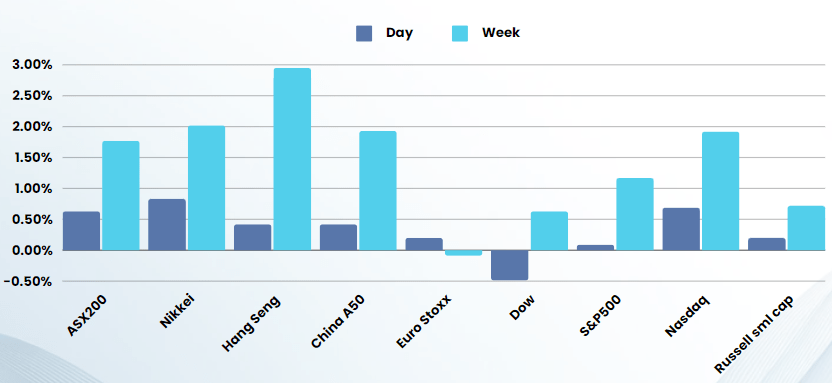

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks mixed, Metals higher on Asian Central Bank buying

Stocks traded in tight ranges Monday, with investors cautious ahead of more cues on interest rates and earnings this week. Metals held their Asian session gains with Gold and Copper settling at record highs and Silver pushing to 12-year highs at $32

Gold buying from Asian and Russian central banks drove prices to record highs, while silver has begun playing catch-up with the Gold/Silver ratio very low historically. The buying from China and their peers is seen to be a switch out of USD due to the spiralling US debt

The Nasdaq closed at a record high while the S&P 500 gained slightly as technology stocks advanced ahead of Nvidia’s highly anticipated earnings and investors gauged the timing of an interest rate cut by the Federal Reserve. Investors will look for evidence in Nvidia’s earnings that the AI chip leader can maintain its explosive growth and stay ahead of rivals.

The focus this week is squarely on more cues from the Federal Reserve on the future path of interest rates, with the minutes of the central bank’s late-April meeting due on Wednesday. Fed officials had kept rates steady at that meeting and warned that they needed more confidence that inflation was coming down. But Fed Chair Jerome Powell had also said that rates were eventually expected to come down in 2024. Several Fed officials are also set to speak this week, with particular focus on the members of the Fed’s rate-setting committee. The Fed cues come amid increased focus on the bank’s plans to cut interest rates, especially after slightly softer inflation readings for April pushed up hopes for a September rate cut.

Beyond more cues on interest rates, markets were also awaiting purchasing managers index data for May, which is set to offer more cues on U.S. business activity. Any signs of cooling could factor into the outlook for interest rate cuts.

Crude prices edged lower Monday, handing back some of last week’s gains, amid political uncertainty after Iran’s president died in a helicopter crash. Iranian state media said bad weather caused the crash on Sunday, and the death of Ebrahim Raisi, a hardliner long seen as a potential successor to Supreme Leader Ayatollah Ali Khamenei, comes amid simmering tensions in the oil-rich Middle East.

Bets on a Copper shortage continued with record highs in both COMEX (US) Copper and LME (London) at $5.11lb and $11,000t respectively. Uranium stocks also continued their run higher as Russian suppliers retaliated to the US ban by threatening to cut off US utilities within 60 days

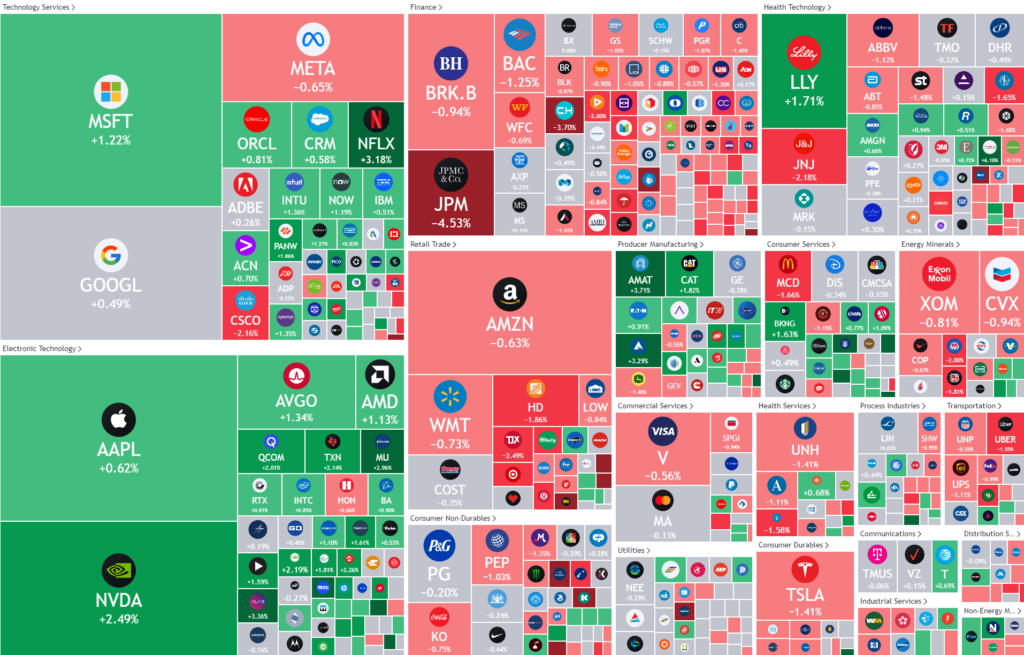

Bonds

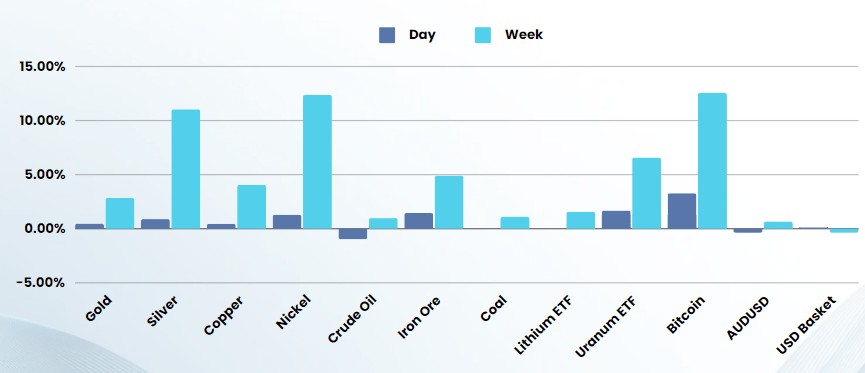

Commodities & FX

The Day Ahead

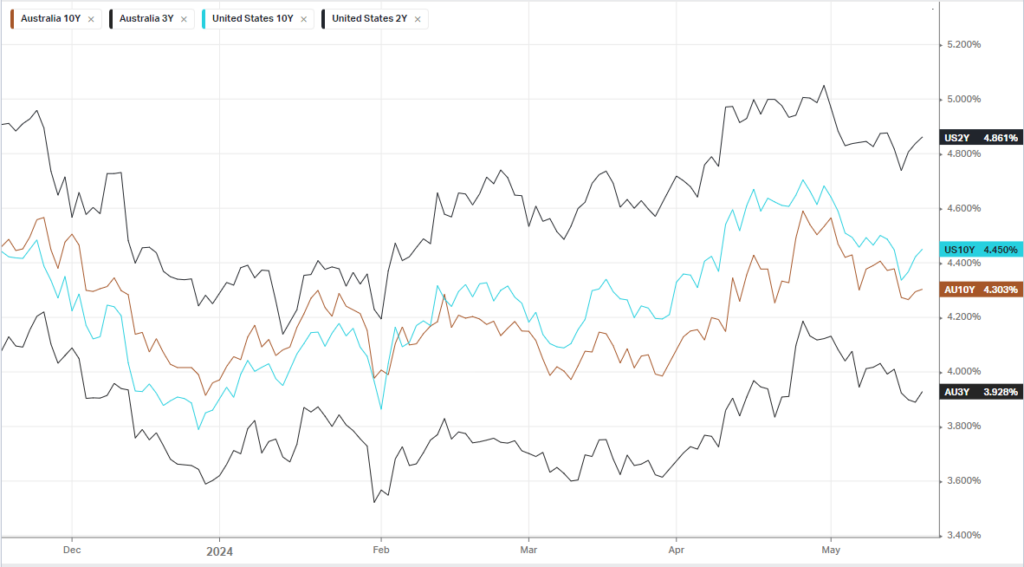

ASX SPI 7879 (-0.01%)

investors will turn their attention to the minutes of the Reserve Bank’s May policy meeting at 11.30am for more details on how serious its consideration of a rate increase after strong first-quarter inflation figures. Since then, weaker-than-expected jobs and wages data have led the market to swing back to pricing rate cuts, implying a less than 50 per cent chance of a reduction to 4.1 per cent by Christmas.

Company Specific:

- Technology one and James Hardie are scheduled to delver updates today