Last Night's Market Recap

S&P 500 - Heatmap

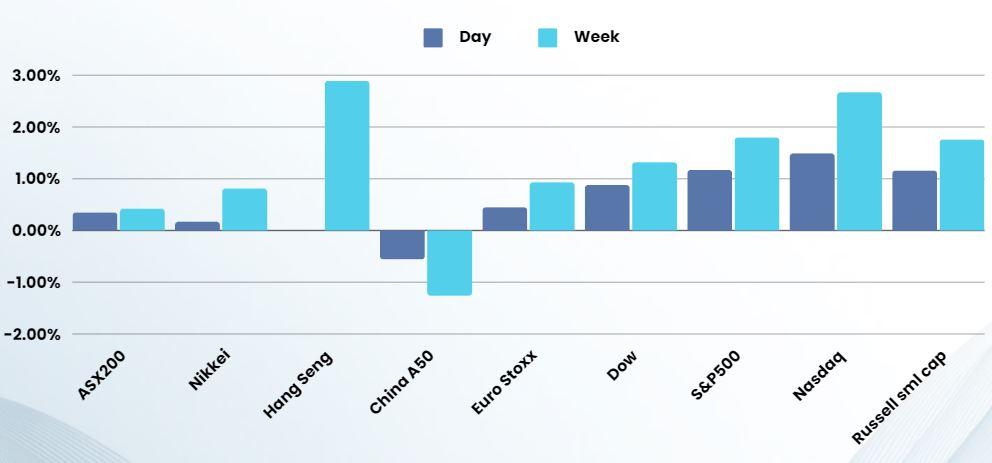

Overnight – Stocks push to new highs on “cooling” inflation

Stock pushed to new highs as consumer inflation cooled more than expected following three months of upside surprises, boosting hopes for sooner rate rates and sending Treasury yields sharply lower

The overall consumer price index slowed to 0.3% pace in April from 0.4% a month earlier, slower than the 0.4% pace economists had expected, boosting hopes that the disinflation trend is back on track. That took the annual figure to 3.4%, down from a 3.5% pace. The core CPI, which strips out volatile food and energy prices, rose 0.3% versus March levels, while the annual core CPI inflation rate eased to 3.6% from 3.8% in March. The slowdown in consumer prices came a day after a producer price inflation came in hotter than expected. But on the heels of the hot producer price report, a cooler-than-expected consumer price report has immediately eased concerns of rapidly rising inflation, fueling investors’ hopes for rate cuts in the coming months. Elsewhere on the economic front, retail sales were unchanged in April, trailing forecasts for a 0.4% gain, as consumers continued to struggle.

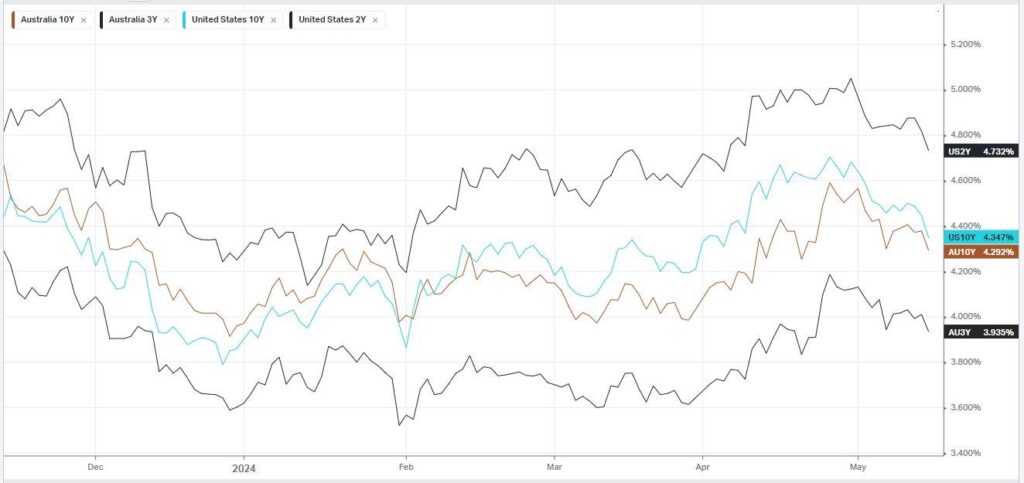

Traders see a 50.5% chance that the U.S. central bank will start cutting rates in September, according to the CME FedWatch Tool. Treasury yields fell sharply on the news with the 10-year Treasury down 10 basis point to 4.34%.

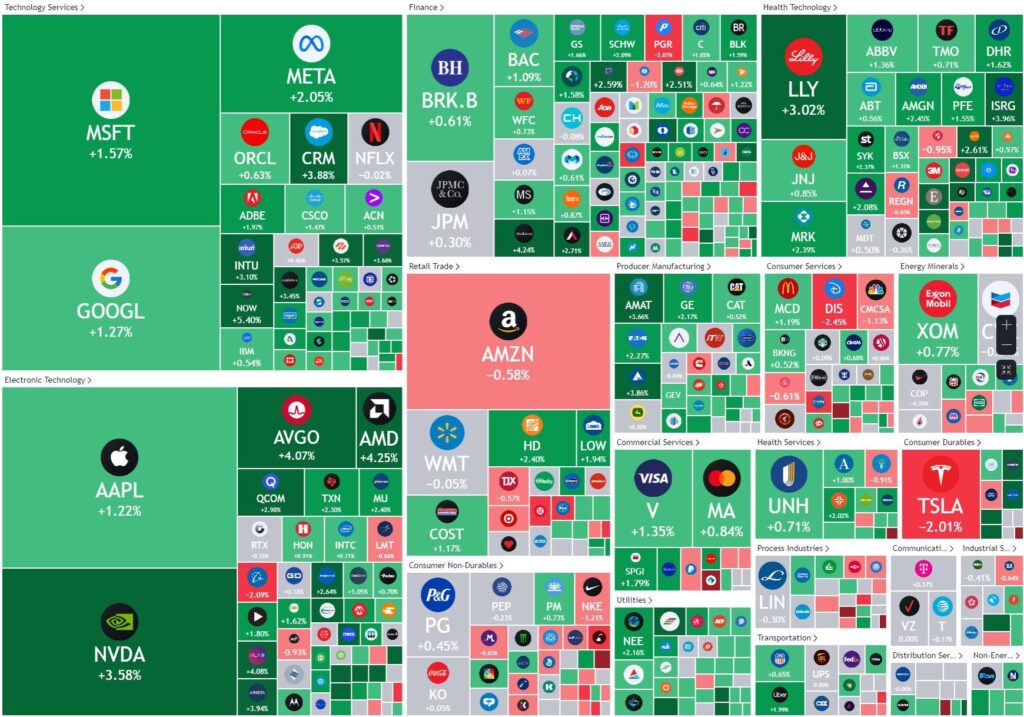

Big tech and chip stocks including Apple, Google, META, and Nvidia led the broader market rally, with latter boosted by signs that demand for its existing chips haven’t been impacted ahead of the release of its next-gen Blackwell GPUs.

“Despite anticipation of next-generation Blackwell GPUs in the 2H, we see limited signs of a demand pause KeyBanc Capital market said in a note. The bullish remarks come just a week ahead of the chipmaker’s quarterly results due May 22.

Bonds

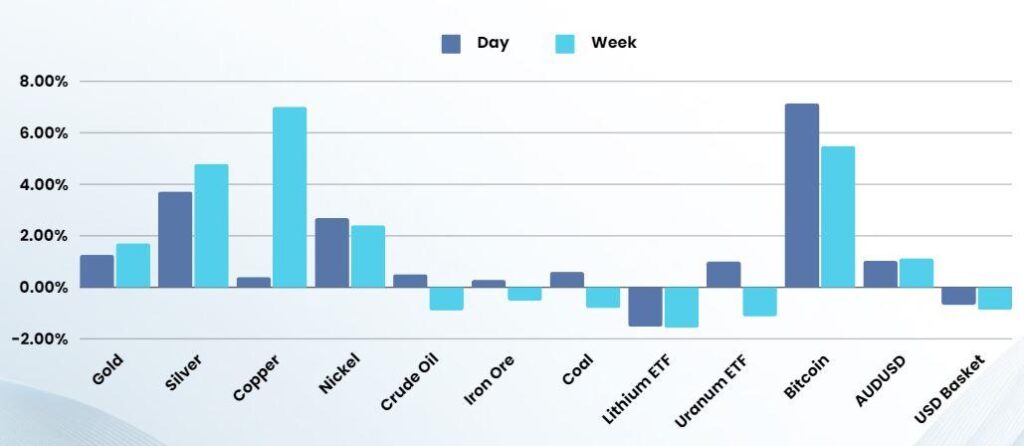

Commodities & FX

The Day Ahead

ASX SPI 7834 (+0.53%)

Australian shares are set to rise following US CPI data that increased hopes for a Fed rate cut, driving all three major US benchmarks to record highs and lowering bond yields. The Dow, S&P 500, and Nasdaq Composite rose 0.9%, 1.2%, and 1.4%, respectively. The S&P 500 closed at 5308.15, and the VIX neared its lowest level since December. The US 10-year government note yield fell to 4.34%.

National Australia Bank noted that the CPI data met expectations, relieving markets. Market pricing for a September Fed easing firmed, and equities hit new highs. Goldman Sachs anticipates a rate cut in July, while other major financial institutions expect a cut in September. Cisco Systems shares rose over 5% after a strong forecast, while meme stocks like GameStop and AMC suffered significant losses.

Company Specific:

- Key Australian stocks, including Aristocrat Leisure, GrainCorp, and Incitec Pivot, are set to release earnings.