Last Night's Market Recap

S&P 500 - Heatmap

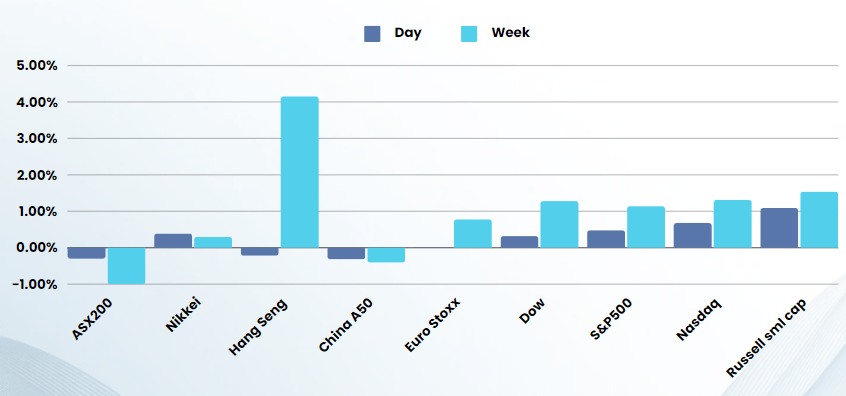

Overnight – Nasdaq hits fresh high despite higher Inflation

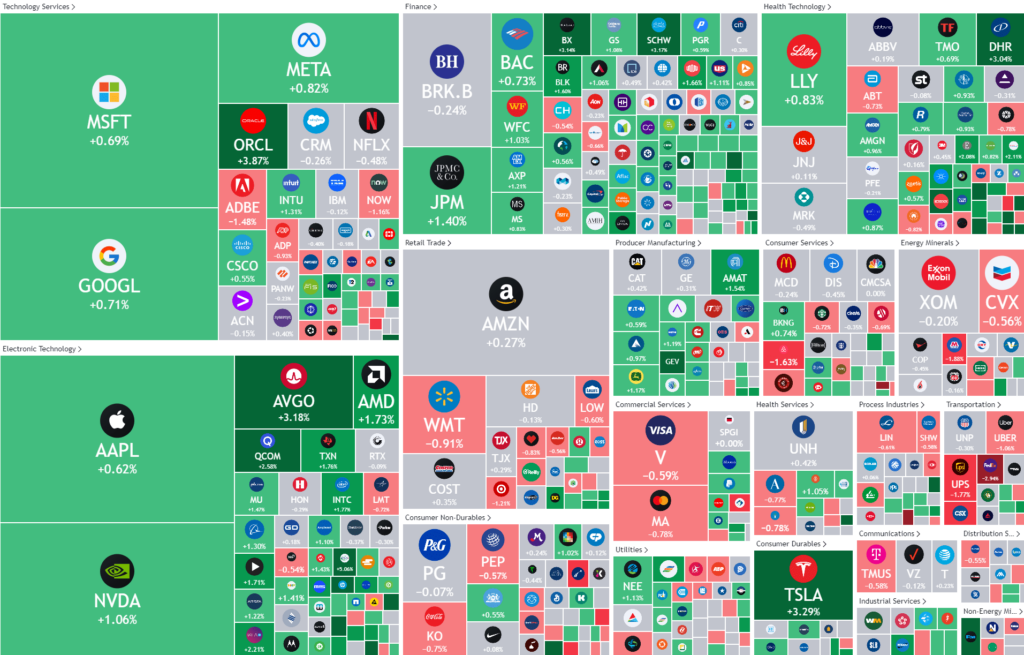

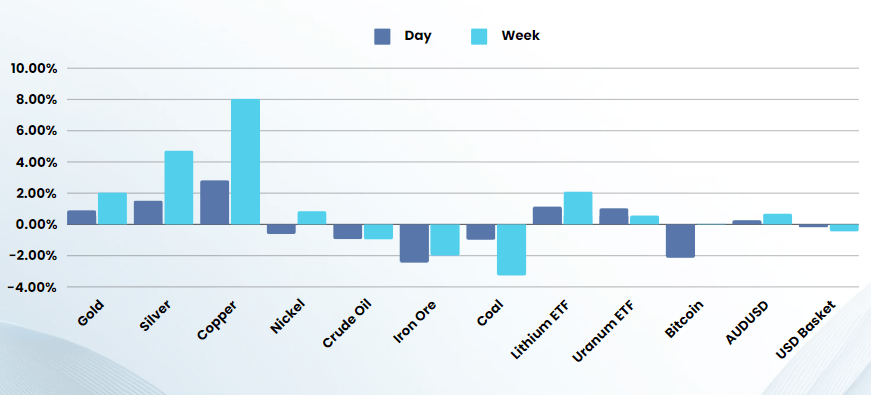

Stocks ignored a hotter-than-expected inflation report as Federal Reserve chairman Jerome Powell said the current level of interest rates is working to curb inflation. In commodities, copper continued its bull run to fresh 2-year highs at $11,000t ($5.05lb) on shortage concerns.

U.S. producer prices grew by a faster-than-anticipated rate of 0.5% on a monthly basis in April, due mainly to elevated costs for services and goods, in a sign of lingering inflationary pressures early in the second quarter. It was a quicker pace than an increase of 0.3% economists had predicted and up from a downwardly revised month-on-month contraction of 0.1% in March. In the twelve months through April, the producer price index for final demand moved up by 2.2% as expected — the largest uptick since a jump of 2.3% in April 2023. An updated mark for the previous month was also revised lower to 1.8%.

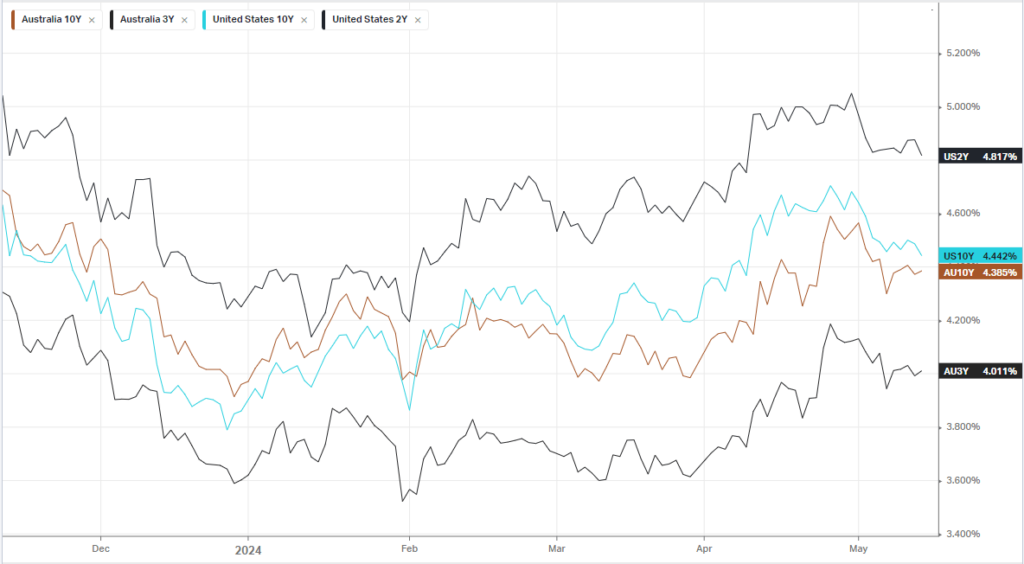

The more closely watched consumer price index is due tonight, and these readings come after inflation remained largely sticky through the first quarter, dashing expectations of early interest rate cuts this year.

A string of Federal Reserve officials have warned in recent weeks that the central bank was in no hurry to begin cutting rates, and needed more confidence that inflation was moving back towards its 2% annual target. In the wake of growing concerns about inflation, Fed chairman Jerome Powell continued to downplay the need too push rates higher, saying the current level of rates were restrictive and working to curb inflation.

“I don’t think it’s likely that the next move will be a rate hike,” Powell said at the Foreign Bankers Association meeting in Amsterdam on Tuesday. “It’s more likely we’ll be holding the policy rate where it is” to curb inflation, Powell added

In a sign that markets are frothy, meme stocks rallied overnight with “Roaring Kitty” posting a series of tweets that added to the rally in GameStop, now up 330% in a week despite the company performing horribly. Retail traders have rejoiced in the return of the of “Roaring Kitty” saying it is the catalyst the market is looking for to break through the “inflation and rates noise”. which is possibly the dumbest thing I’ve ever seen written in my 30 years in markets

MPC’s favourite commodity play currently, Copper, made a fresh record at $5.05lb on shortage concerns. Fuelling this rally, Canadian asset manager, Sprott, famous for their physical commodity hoarding trusts in Gold, Silver and Uranium filed papers to launch a Physical Copper trust. To give some context, Sprott launched its Physical Uranium Trust in July 2021 when Uranium was around $30lb, it has since rallied 300% in just under 3 years

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7764 (+0.46%)

Miners will be in focus this morning, after the federal government outlined $17.6 billion in tax credit support for the critical minerals sector, as well as $6.7 billion tax incentive for hydrogen. A 10% production tax credit totalling $7 billion over the decade for all 31 critical minerals to drive critical minerals processing in Australia. Lithium and Nickel miners are likely to be the biggest beneficiaries while Andrew Forrest and FMG should be big winners, with their FFI initiatives.

Company Specific:

- CSR releases earnings. Waypoint REIT hosts an AGM.

- In New York, BHP’s US listed shares closed up 2.8 per cent, while the London-listed shares of Anglo American slid 3.2 per cent, after unveiling its own divestment plan to focus on its potash, copper and iron ore assets. Anglo American rejected a second takeover offer from BHP earlier this week.