Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks flat as investors wait on Inflation data, Copper spikes

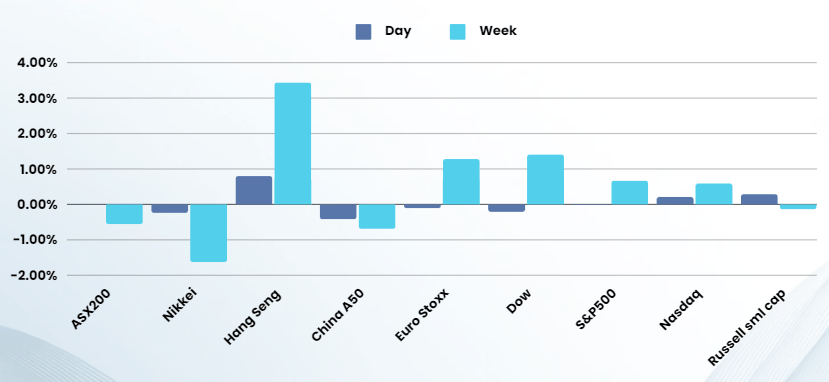

Stocks as investors awaited key inflation report due later this week that will likely play a role in shaping the Federal Reserve’s monetary policy outlook.

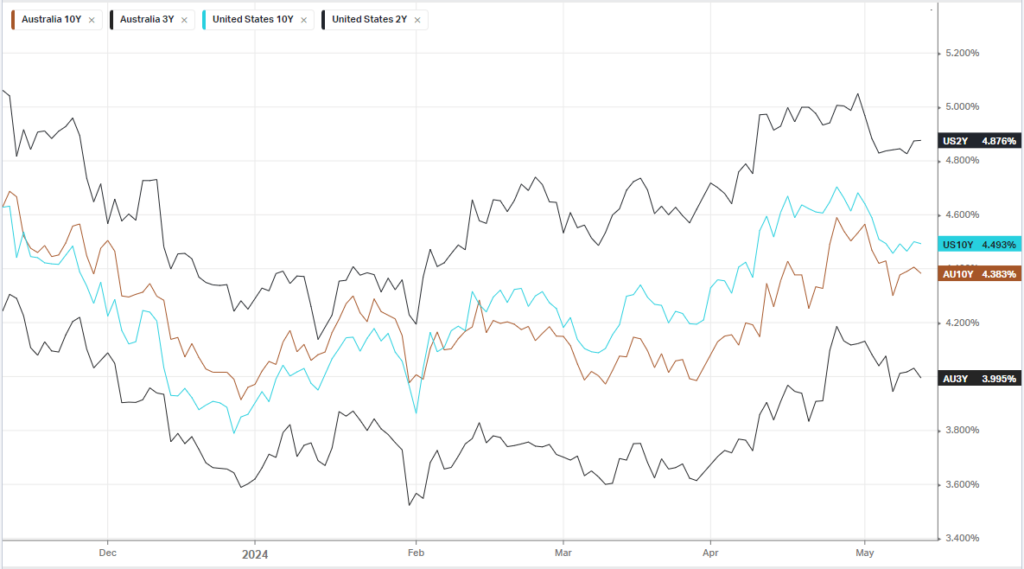

Investor sentiment on risk assets remains cautious as investors look ahead to key inflation data this week, with the producer price index and consumer price index due on Tuesday and Wednesday, respectively. The data are set to arrive following a string of hotter-than-expected inflation reports in Q1 that forced investors to not only push out rate cut bets but reduce the number of cuts expected to just two for the year. The data arrive just as fed speakers continue to signal higher for longer interest rates.

Fed Vice Chair Philip Jefferson said Monday that current level level of interest rates is appropriate until further signs that inflation is on a sustainable path toward the 2% target.

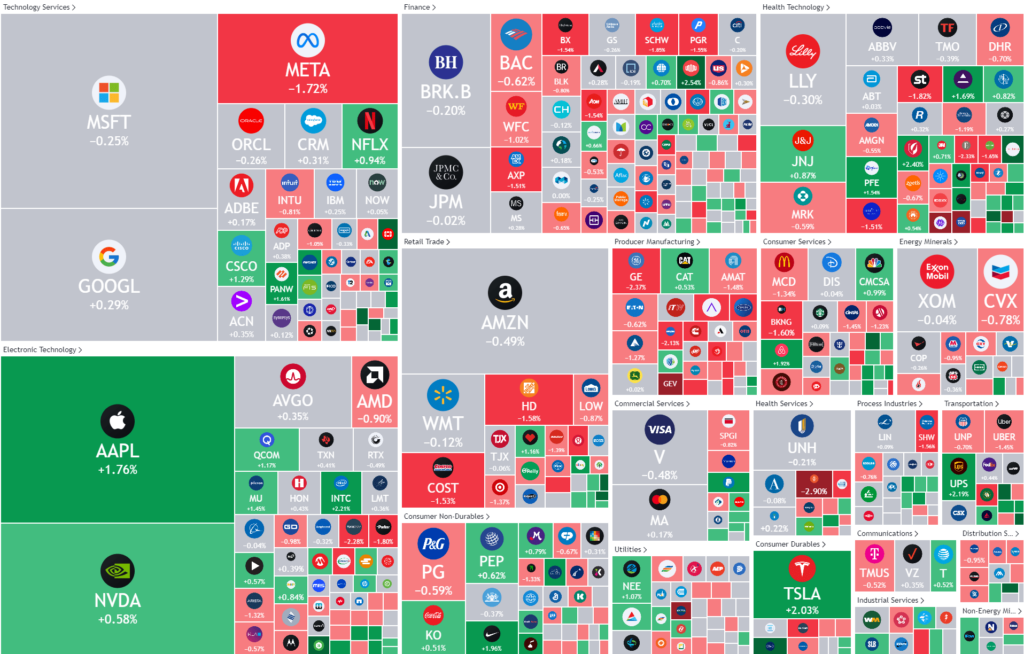

Semiconductors were buoyant as Arm Holdings gained 7% after announcing plans to develop artificial-intelligence chips, according to a report in Nikkei Asia, with the U.K.-based chip designer announcing plans to set up an AI chip division. Arm aims to build a prototype by spring 2025, the report said, with mass production, likely to be handled by contract manufacturers, expected to start in the autumn of 2025. Intel rose more than 2% after the Wall Street Journal reported that the tech giant was in advanced talks with Apollo Global Management for the manufacture of a $11 billion chip plant in Ireland.

Also, Tesla gained 2% after Reuters reported that President Joe Biden is set to announce new China tariffs as soon as Tuesday, targeting sectors including electric vehicles, medical supplies and solar equipment.

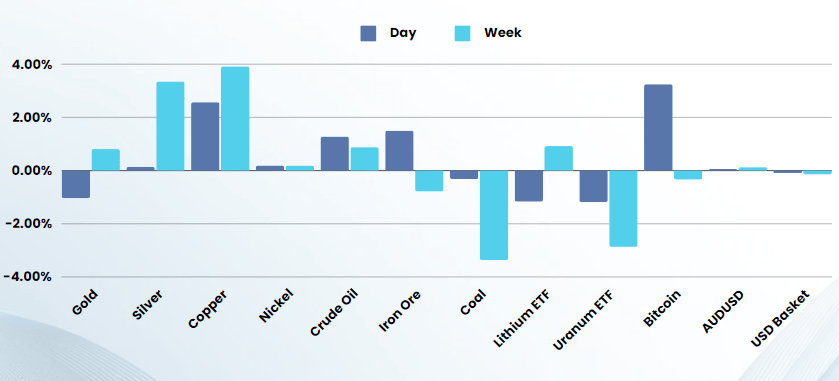

In commodities, copper continued its bull run to fresh 2-year highs at $10,200t ($4.77lb) on shortage concerns

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7776 (-0.01%)

The ASX is in for a quiet day leading into key US inflation data and the Federal Government budget tonight. Tonight’s federal budget will forecast a surplus of $9.3 billion for this financial year, after which the bottom line will plunge into successive deficits that will be larger than forecast six months ago.

The mining sector will also be in focus after BHP’s offer for Anglo American was rebuffed for a second time. Lithium and nickel miners, who have lobbied for tax breaks from the government, are also said to be among the big winners from the budget