Last Night's Market Recap

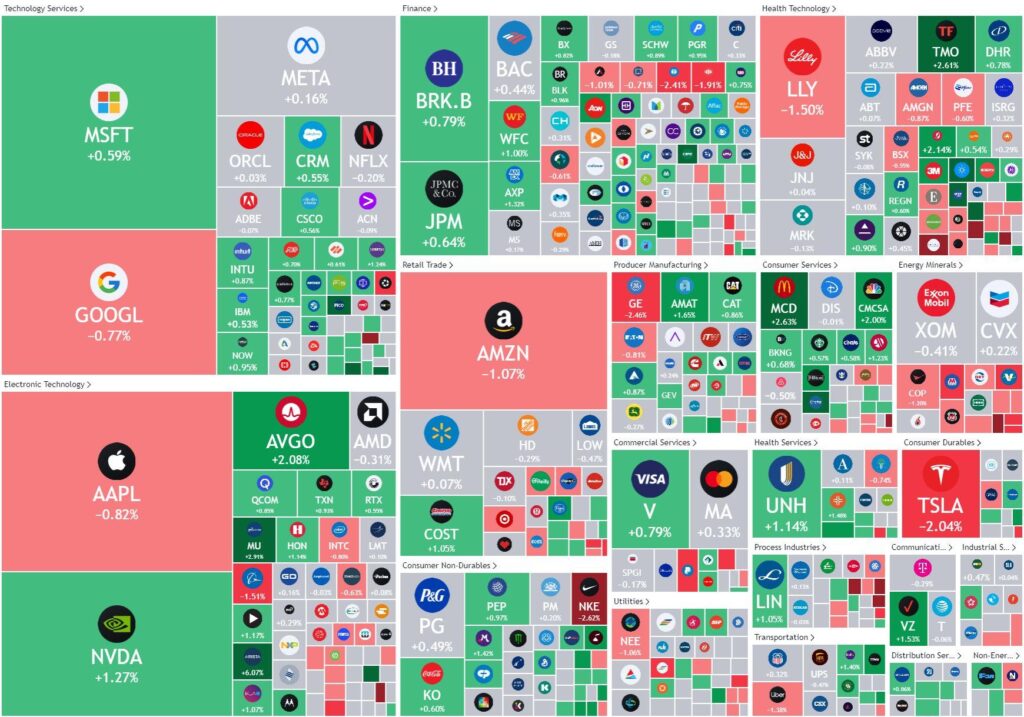

S&P 500 - Heatmap

Overnight – Stocks mixed as consumer weakens

Stocks edged higher Friday night to clinch a fourth-weekly win as the broadening out of the rally amid mostly stronger quarterly results continued to support stocks just as signs of sticker inflation muddies the outlook for sooner rate cuts.

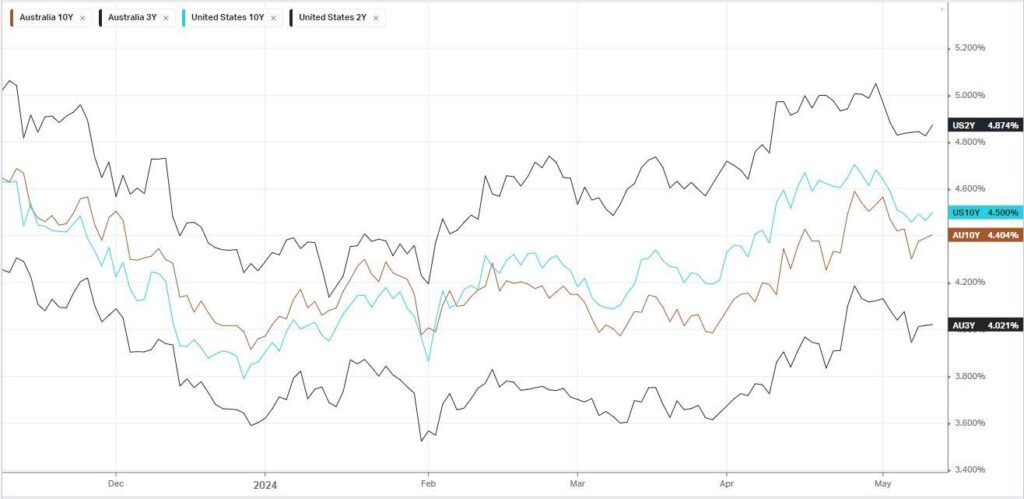

The University of Michigan Survey of Consumers sentiment index fell to reading of 67.4 for May, down from 77.2 in April as one-year inflation climbed to 3.5%, up from 0.4% a month ago. The fresh signs of consumer jitters about rising price pressure come just as Fed speakers continue to signal a wait and see approach about whether to cut rates.

Minneapolis Fed Pres. Kashkari expressed caution Friday about whether the current level of interest rates are restrictive enough, saying that he couldn’t rule out the possibility of a rate hike.

Well over 80% of the S&P 500 have reported first quarter results, and companies are on track to have increased earnings by 7.8%, up from an expectation of 5.1% growth in April, according to LSEG IBES.

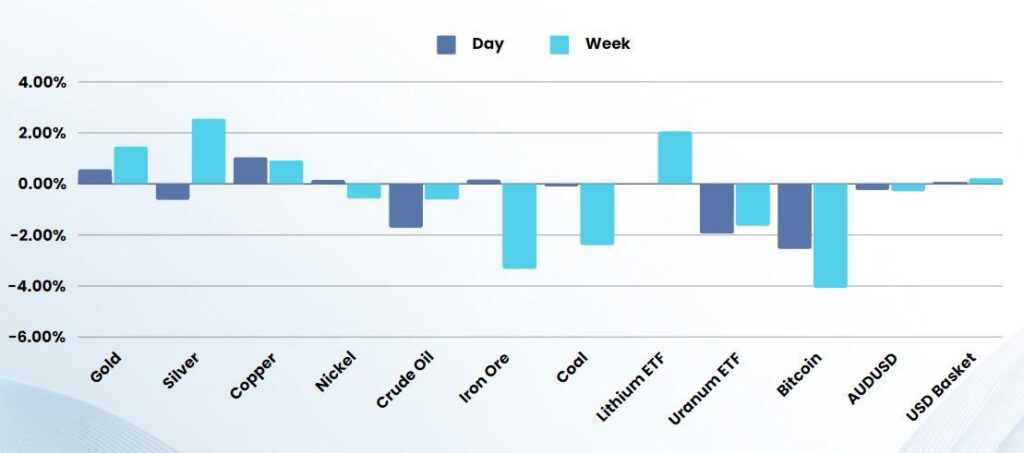

Gold continued to grind higher on reports of heavy Chinese Central Bank buying, while copper hit a fresh 2-year highs around $10,500t

Earnings:

- Taiwan Semiconductor Manufacturing +4.5% – as its 60% jump in April revenue from a year ago underscored the strength in demand for artificial-intelligence-related hardware, helping other chipmakers add to gains.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7765 (-0.02%)

The ASX is unlikely to have an eventful day as global markets lay in wait for the key US inflation data on Tuesday and Wednesday.

Retailer may see some selling as weak US consumer data could compound last weeks weakness. Gold and copper stocks should benefit from a rally in the underlying, while energy stocks are likely to come under pressure