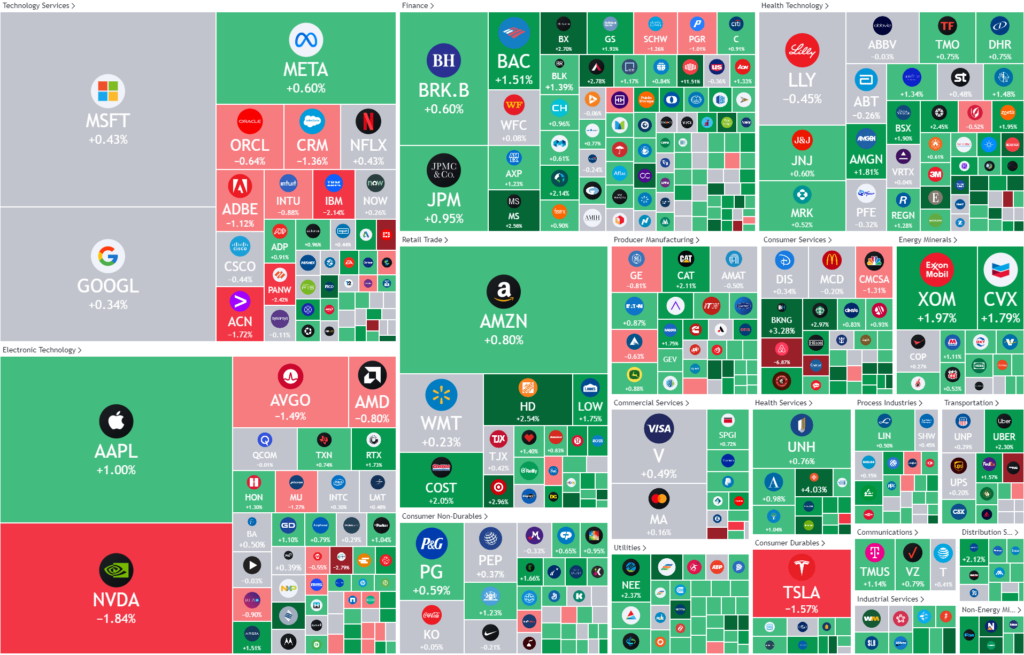

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks dragged higher by rate cut optimism

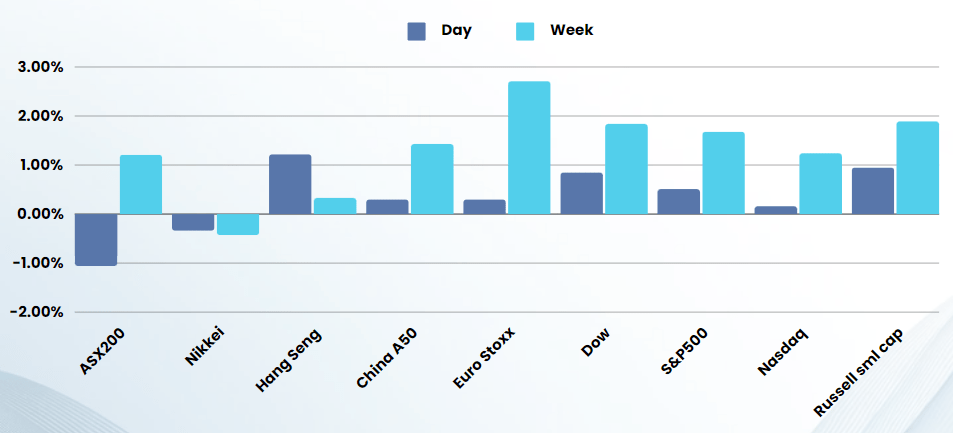

The DOW notched its 7th straight gain for the day as slightly higher US jobless claims pushed Treasury yields back to levels prior to rate hike chatter in early April

U.S. Federal Reserve policy has been the main driver of investor sentiment in 2024. Renewed hopes the central bank will cut rates have pushed the benchmarks higher in the last week. After a flat day on Wednesday, the S&P 500 resumed its upward trajectory and closed above 5,200 points for the first time since April 9. US equity markets have clawed back losses incurred during April on fears the Fed may ultimately raise interest rates, and as tensions in the Middle East threatened to escalate.

The number of Americans filing new claims for unemployment benefits increased more than expected to a seasonally adjusted 231,000 last week, data showed. Economists polled by Reuters had forecast 215,000 claims. Last week’s data showing slowing job growth in April and job openings falling to a three-year low in March had investors pricing in one or two rate cuts by the Fed this year. Prior to that, traders were pricing in just one rate cut.

Fed speakers also help support the market as San Francisco Federal Reserve President Mary Daly said “There is “considerable” uncertainty about where U.S. inflation will head in coming months” while adding she still has faith that price pressures are continuing to ease.

The investor sentiment pattern, in the US equity market in particular, is of extreme selective hearing with any weakness in the economy cheered because it will trigger rate cuts, while any strength in the economy is cheered as “proof” of a soft landing.

The reality that buying broader equity market at current levels may be correct, however the risk/reward is stacked heavily to the downside

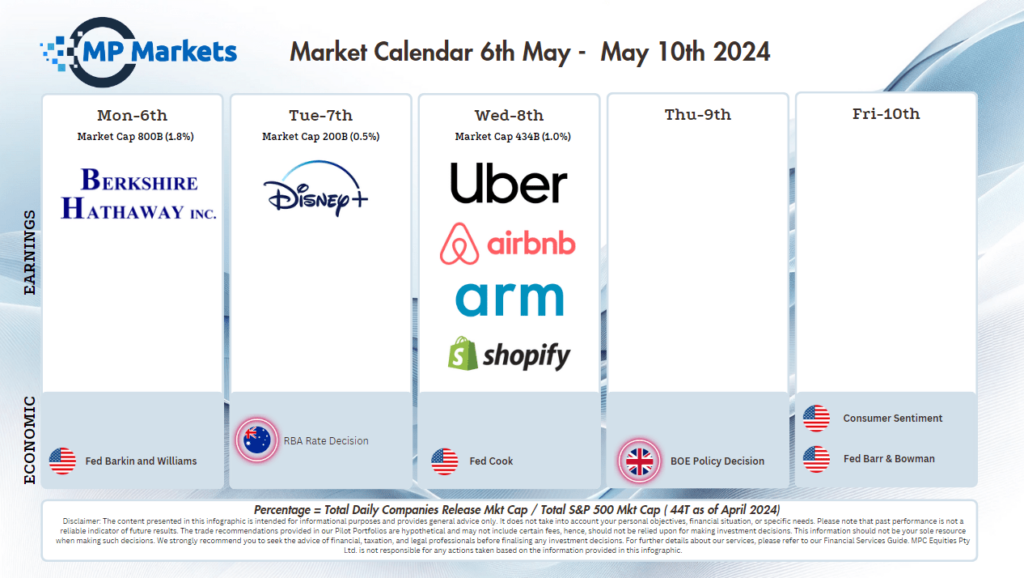

Earnings:

- Roblox -22% – the video-gaming platform cut its annual bookings forecast, in a sign that people were dialing back spending amid an uncertain economic outlook and elevated levels of inflation.

- Robinhood -3%- despite the online brokerage beating estimates for first-quarter profit, thanks to robust crypto trading volumes and rate hikes that boosted its net interest revenue the stock fell 3%

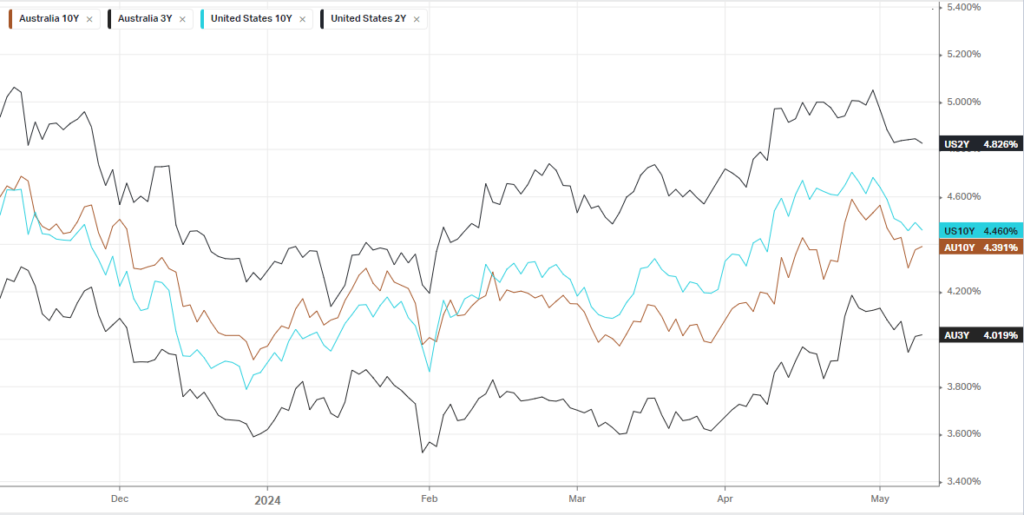

Bonds

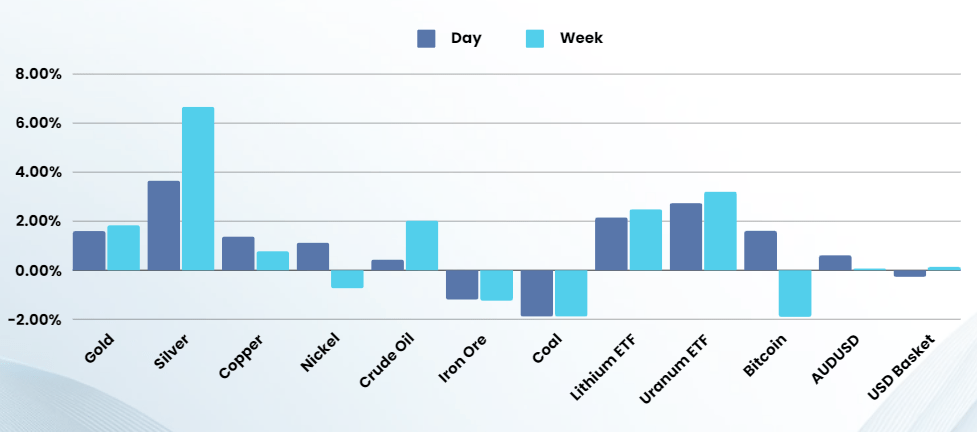

Commodities & FX

The Day Ahead

ASX SPI 7767 (+0.29%)

The local market should be in for a solid start to the day with commodities dragging the materials sector higher, Rate cut hopes helping the REITs and uranium and oil rallies helping energy.

The consumer discretionary and Bank sector may see some selling after a string of updates yesterday that saw significant selling due to reduced consumer spending and higher levels of “Loan in Arrears” (more than 90 days overdue) signaling a tipping point for Australians disposable income

Company Specific:

- QBE Insurance group – QBE confirmed full year outlook with premium growth in the mid-single digits for fiscal 2024 thanks to rate increases.

- Life360 releases earnings results. West African Resources hosts an AGM.