Last Night's Market Recap

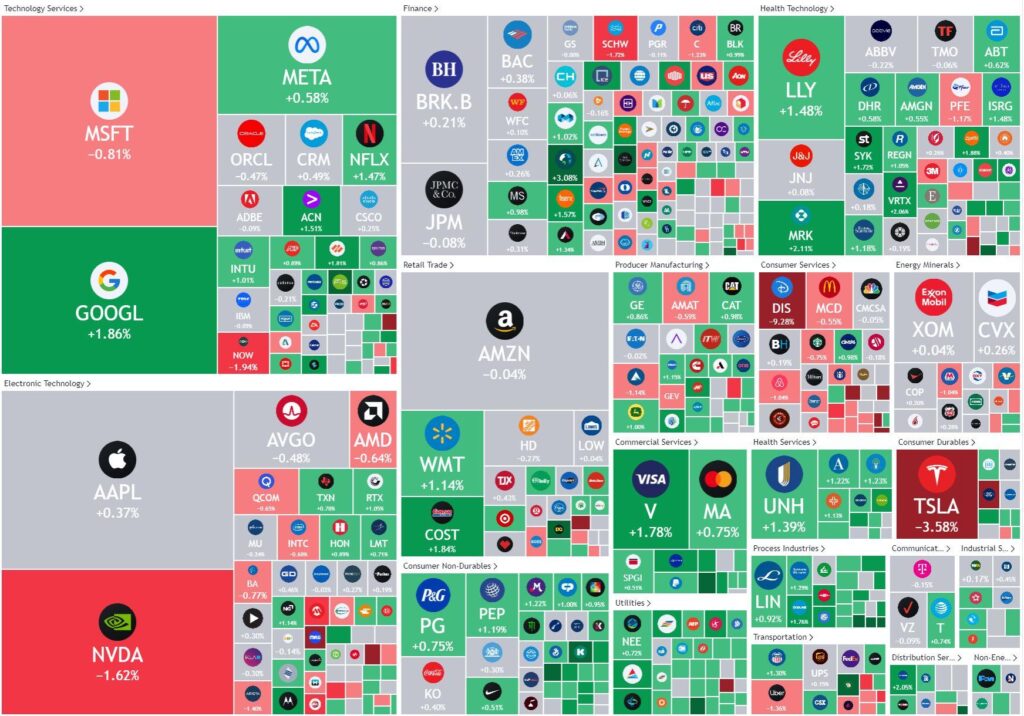

S&P 500 - Heatmap

Overnight – Stocks mixed in quiet trade as Disney disappoints

It was a quiet night in markets as equities finished mixed as investors continued to digest a slew of corporate earnings including weak subscriber growth from Disney

Disney reported adjusted earnings per share of $1.21 in its fiscal second-quarter, topping Wall Street estimates, although shares in the entertainment giant were hit by weakness in its traditional TV and box office businesses.

Apple unveiled a slew of new iPad pro, which includes the new M4 chip, and iPad Air tablets in a virtual event on Tuesday. The new iPad launch comes just ahead of the company’s developer conference next month, when some expect the tech giant to unveil its artificial intelligence strategy. Some believe Apple is set to unveil its long awaited AI strategy at WWDC

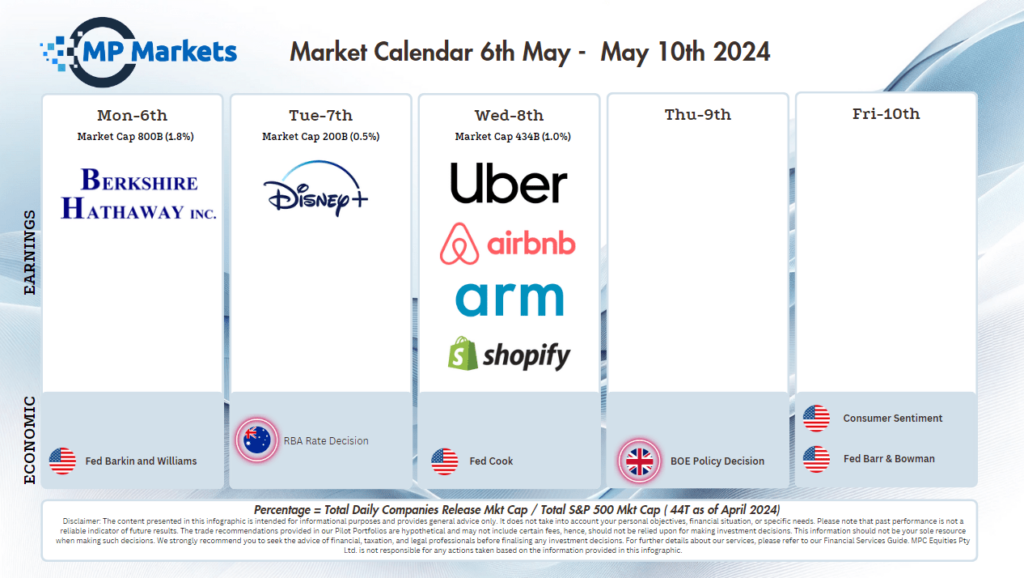

Earnings:

- Walt Disney -9% – after the entertainment giant’s Disney+ subscriber growth fell just short of estimates and warned about a slowdown in its theme parks devision, a key growth engine.

- Kenvue +6% – after the consumer health company, a spinoff from Johnson & Johnson, beat Wall Street estimates for first-quarter profit, adding it would cut 4% of its global workforce as part of a plan to cut costs.

- Palantir Technologies -14% stock tumbled more than 14% after the data analytics firm’s annual revenue forecast fell short of analysts’ estimates.

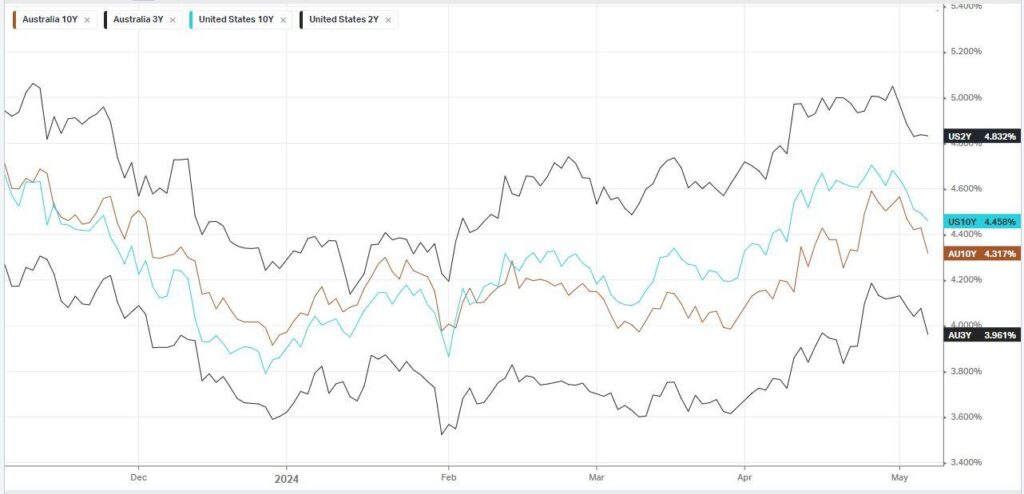

Bonds

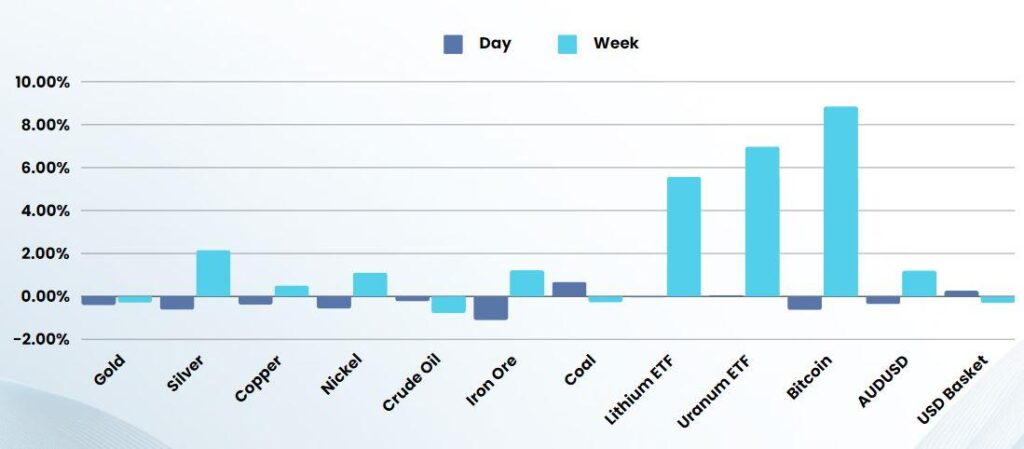

Commodities & FX

The Day Ahead

ASX SPI 7832 (+0.22%)

The ASX is likely to drift off from the open today as market pundits each grab the soap box to argue “what the RBA really meant” at yesterdays central bank meeting. After watching the press conference, one might question why the journalist bothered asking questions they had already written the answer to, seemingly unable to realise that the RBA’s stance on rates is balanced and data dependent, despite the RBA Gov repeating it over and over.

Weaker commodity will likely drag down the materials sector, while the banks could lose some heat after yesterdays late rally