Last Night's Market Recap

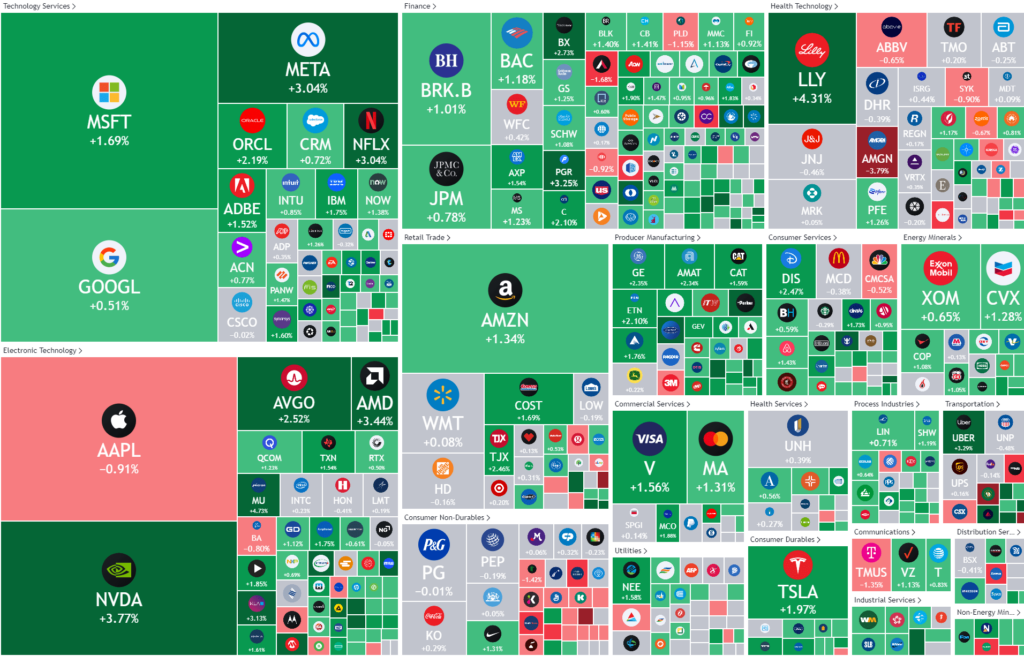

S&P 500 - Heatmap

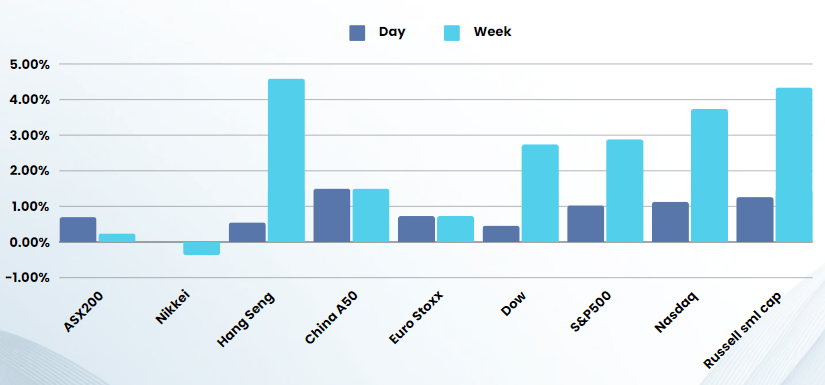

Overnight – Stocks continue rally on rate cut “Hopium”

Equities started the week on the front foot Monday as revived hopes for a September Federal Reserve interest rate cut triggered a sea of green across Wall Street.

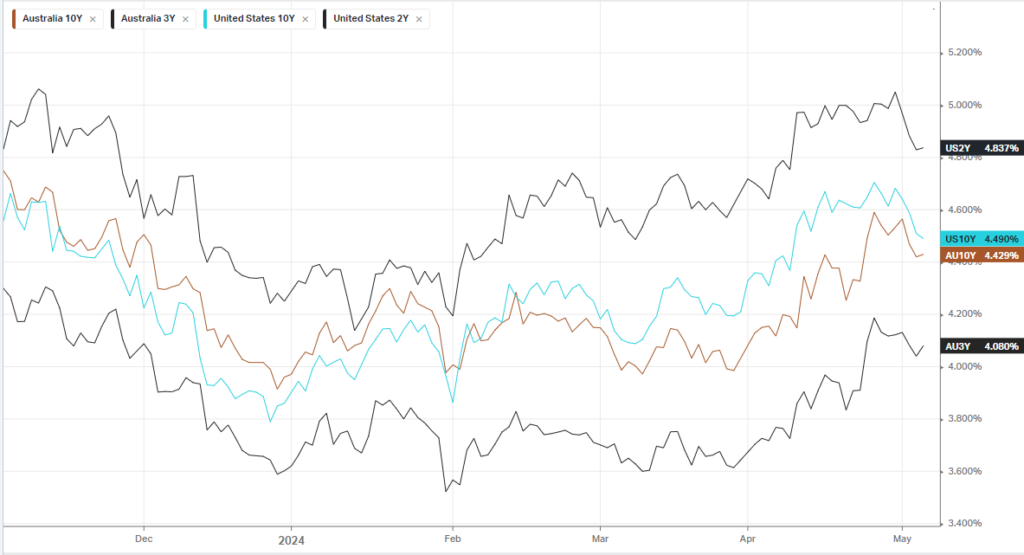

The rate cut bets seem premature given the US hasn’t had a negative payrolls since December 2020, the unemployment rate remains under 4% and inflation remains stubborn.

Fed officials, who are set to deliver a slew of remarks this week, acknowledged the slowing job growth and signalled that the next Fed move will likely be a cut rather than a hike, a stance that hasn’t changed in 6 months. Richmond Fed president Richard Barkin said he believes that the current policy is restrictive, though signal that the recent data had knocked confidence on how quickly the central bank can bring down in inflation toward its 2% target. New York Fed president John Williams said Monday that eventually there will be rate cuts, though cautioned that the recent trade upside surprise in the inflation data was a worry for the central bank.

Gaza ceasefire deal uncertain as Israel reportedly signals unwillingness to accept ‘softened’ agreement. Hamas reportedly accepted the terms of a ceasefire deal brokered by Egypt and Qatari, but an Israeli official told Reuters that the deal was a “softened” version of an earlier Egyptian proposal. The official further told Reuters that the Hamas’ announcement “appears to be a ruse to cast Israel as the side refusing a deal.” The Israeli official said the deal included outcomes that it had not agreed to, stoking uncertainty about whether Tel Aviv will ok the deal to temporarily end the months-long war in Gaza.

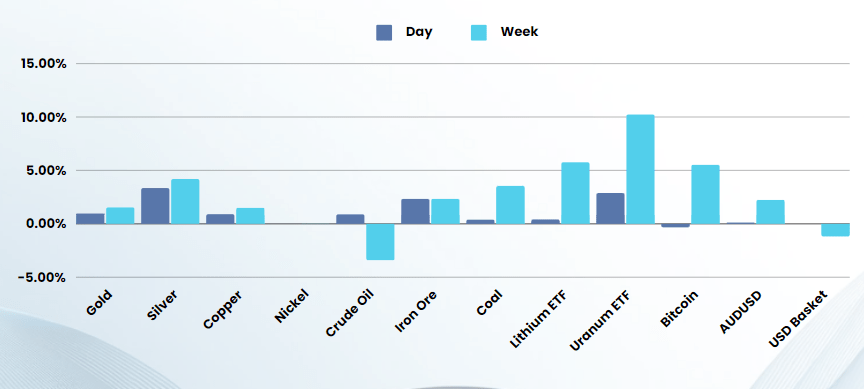

Commodities and precious metals like Gold, Silver and Copper also benefited from the rate cut hopes with Gold rallying 1%, Silver nearly 4% and Copper 1% which is back to testing 2-year highs

Uranium also continued its rally with Canadian uranium stocks particularly well bid in line with the recent move in Australian Uranium stocks, the countries most likely to fill the Russian supply gap in the coming years

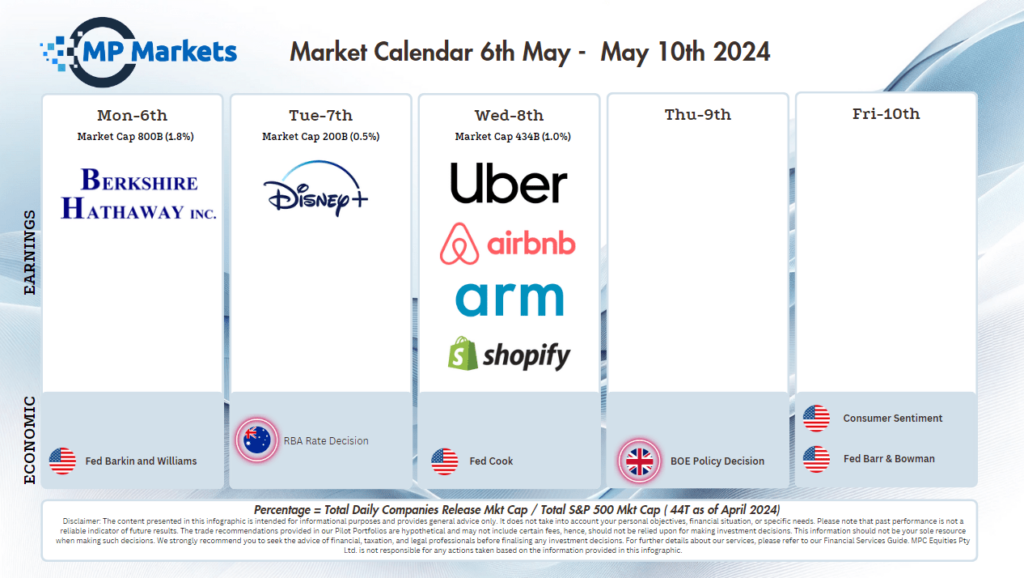

Earnings:

- Berkshire Hathaway +1% – Warren Buffett’s investment fund reported quarterly results over the weekend that included a 40% jump in Q1 operating earnings from a year earlier. The legendary investor increased levels of cash to record high of $189B, sold a 13% stake in Apple which he described as profit taking and showed a shift to short term bonds (2-5 years) and diversifying geographically.

- Spirit Airlines -10% – a wider than expected Q1 loss and weaker guidance as the airline carrier flagged the impact of the grounding of a number of its aircraft due to ongoing issues with Pratt & Whitney Geared Turbofan engines.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7734 (+0.49%)

The ASX will be laser focused on the RBA rate decision at 1430 today given the recent wild shifts in rate calls from pundits and bank economists. Interest rate sectors like REIT’s and Consumer discretionary have had a solid upside run in the last week and are likely to be vulnerable to any hawkishness from the Gov Bullock in the press conference today.

The trend of masking poor results with buybacks continues with ANZ “one upping NAB” with a $2B buyback despite a 7% drop in in profit and a outlook that was described as “challenging”

The materials sector will be buoyed by the rally in Iron ore, gold and copper while the financials sector will benefit from the ANZ buyback

Company Specific:

- ANZ has reported a 7 per cent decline in cash profit at $3.55 billion in its first half results. The major bank also announced a $2 billion share buyback and declared its proposed interim dividend at 83¢ per share, partially franked at 65 per cent. “Both the domestic and international environments are expected to remain challenging across the remainder of the year,” ANZ chief executive Shayne Elliott said.

- Coronado Global Resources releases earnings.G8 Education and Iluka Resources host AGMs. NAB shares trade ex-dividend.