Last Night's Market Recap

S&P 500 - Heatmap

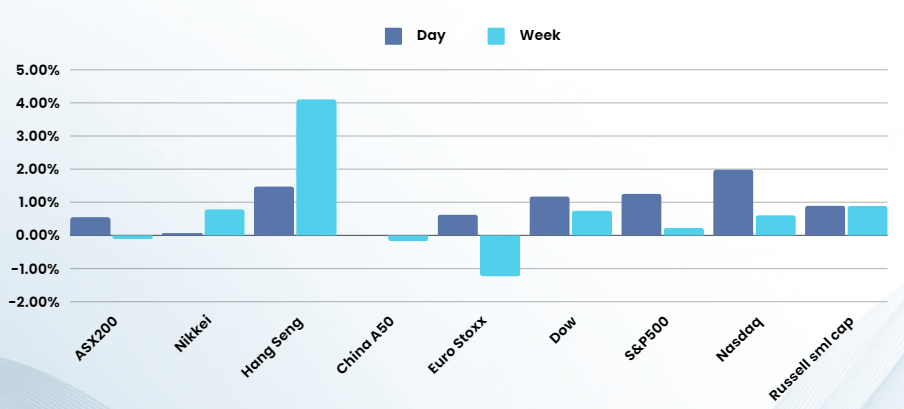

Overnight – Goldilocks scenario back, as Employment numbers “not too hot, not too cold”

Equities surged to a higher close on Friday as a softer-than-expected employment report bolstered the case for rate cuts from the Federal Reserve while also providing evidence of U.S. economic resilience.

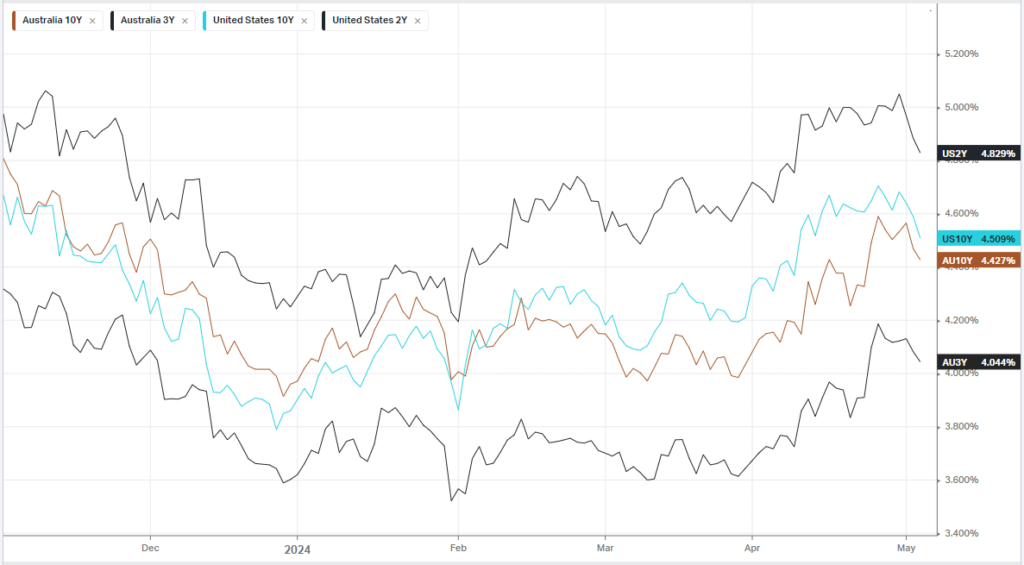

All three major U.S. stock posted robust gains. The tech-heavy Nasdaq led the pack, rising 2% with an assist from Apple shares following the iPhone maker’s record share buyback announcement. All three indexes notched their second straight Friday-to-Friday gains, capping a week in which markets were encouraged by Fed Chair Jerome Powell’s more dovish-than-expected statements following Wednesday’s rate decision. The Labor Department’s employment report showed the U.S. economy added fewer jobs than expected, while the unemployment rate ticked higher and wage growth unexpectedly cooled. The report likely hit the sweet spot for the Fed, offering signs the labor market is softening, which Powell has deemed necessary to put inflation on a sustainable downward path. The report also provided assurances on U.S. economic health. The report prompted investors to raise bets the Fed would implement its first rate reduction in September.

Fed officials weighed in on the data.

Fed Governor Michelle Bowman reiterated her willingness to hike rates if inflation progress reverses, and Chicago Fed President Austan Goolsbee said the employment report boosted confidence the economy is not overheating.

First-quarter earnings season is approaching the final stretch, with 397 of the companies in the S&P 500 having reported as of Friday morning. Of those, 77% have posted consensus-beating results, according to LSEG data.

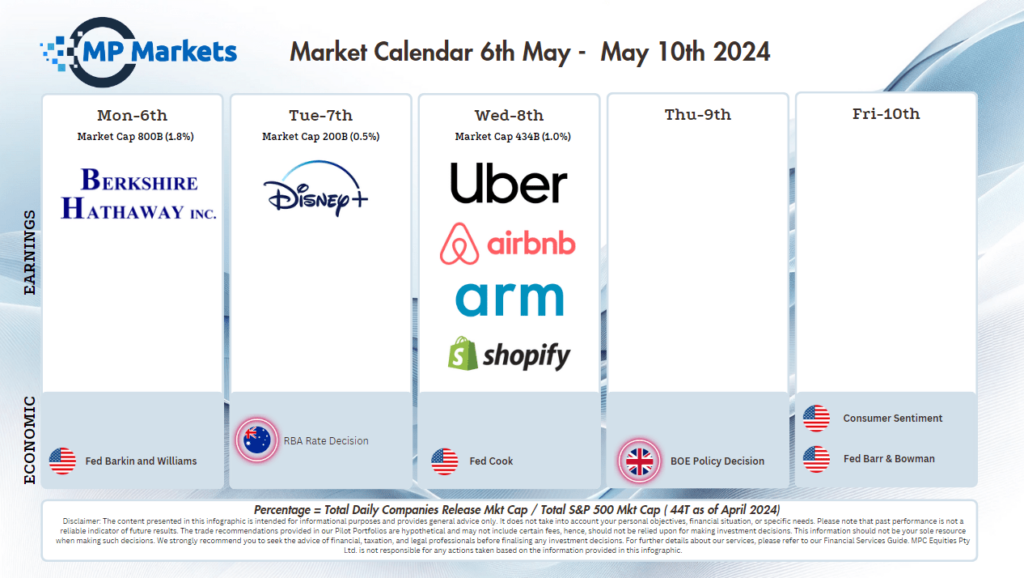

Earnings:

- Amgen +11.8% – after encouraging interim data on its experimental weight-loss drug MariTide and first-quarter earnings.

- Expedia -15.3% – The travel platform cut its full-year revenue growth forecast, sending its shares sliding 15.3%.

Bonds

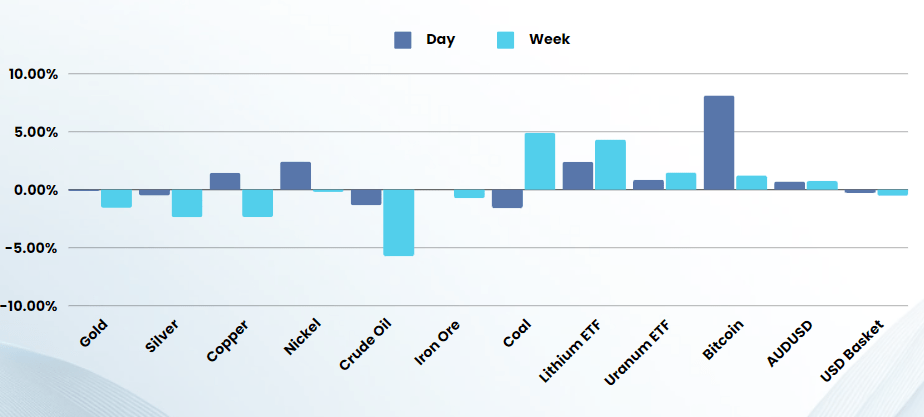

Commodities & FX

The Day Ahead

ASX SPI 7666 (+0.28%)

The ASX should follow the offshore lead and rally this morning on the eve of the RBA rate announcement tomorrow. There is increasing pressure from the market to raise rates, while ex RBA head Philip Lowe that the RBA could raise again. Adding to this pressure is the cheap populist policy from the Labor government who are looking to deliver an expansionary budget.

China comes back online today which could see some moves in commodity prices

Company Specific:

- Westpac has announced a $1 billion share buyback and special dividend. Chief executive Peter King said in statement to the ASX that Westpac’s balance sheet was in “good shape” and supported a special dividend of 15¢ per share fully franked and an increase in the buyback program of $1 billion to $2.5 billion. The interim dividend is 75¢ per share fully franked, up 7 per cent on the 2023 interim dividend.

- One of Australia’s big industry superannuation funds, HESTA, has endorsed BHP chief executive Mike Henry’s vision of a global copper giant, as BHPevaluates reviving the $60 billion Anglo American deal.