Last Night's Market Recap

S&P 500 - Heatmap

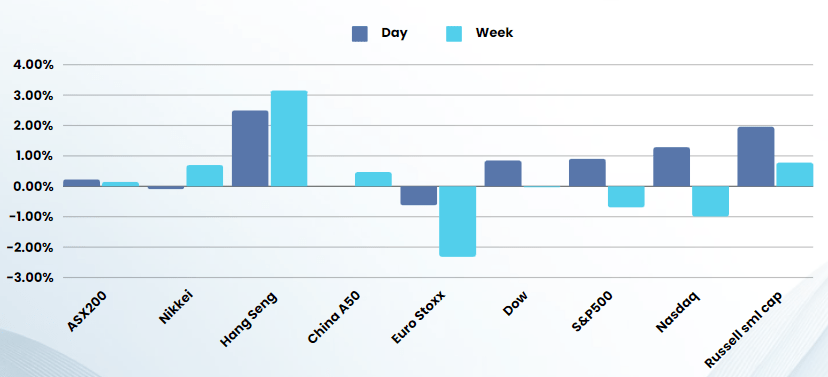

Overnight –Stocks higher as Investors regain selective hearing skills

Equities traded higher overnight led by tech as investors continued to digest a slew of corporate earnings ahead of the crucial monthly jobs report due Friday.

The number of Americans filing new claims for unemployment benefits held steady at lower levels last week, data showed earlier Thursday, as the labour market remains fairly tight. The economic focus now turns towards Friday’s closely watched April jobs report, which is expected to show that nonfarm payrolls likely increased by 243,000 jobs in April after advancing by 303,000 in March. The fresh labour market data come a day after the Federal Reserve kept interest rates unchanged at the conclusion of its latest policy meeting on Wednesday, and Powell signaled that the next rate move was still likely to be an interest rate cut.

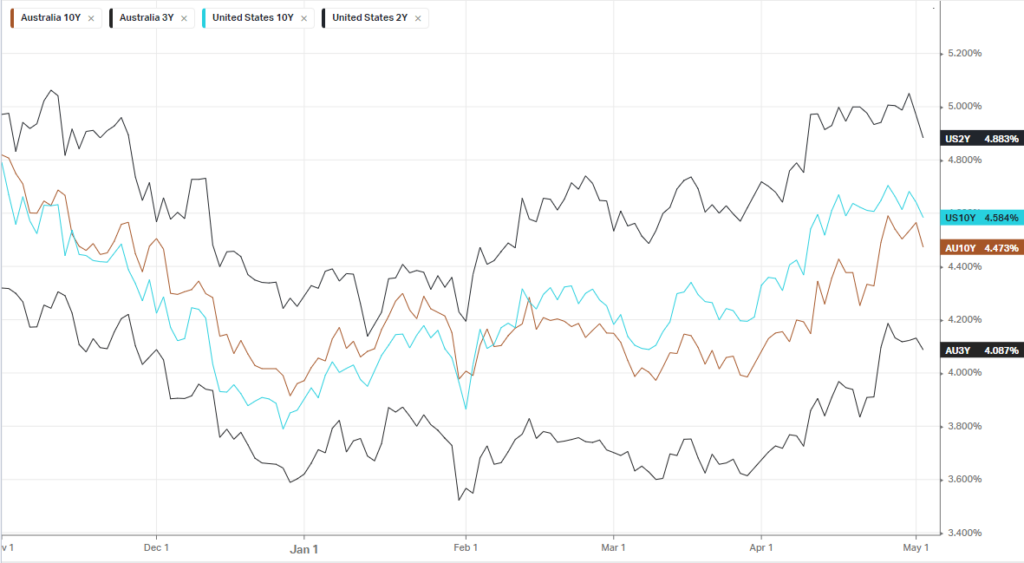

Treasury yields came off their recent highs, providing some relief for growth stocks. The MAG7, led by Apple helped the market higher with Apple beating market expectations on earnings, despite poor iPhone sales as the company announced a $100B buyback

All eyes are now on the US employment numbers tonight which is very likely to dictate the trend for the coming weeks

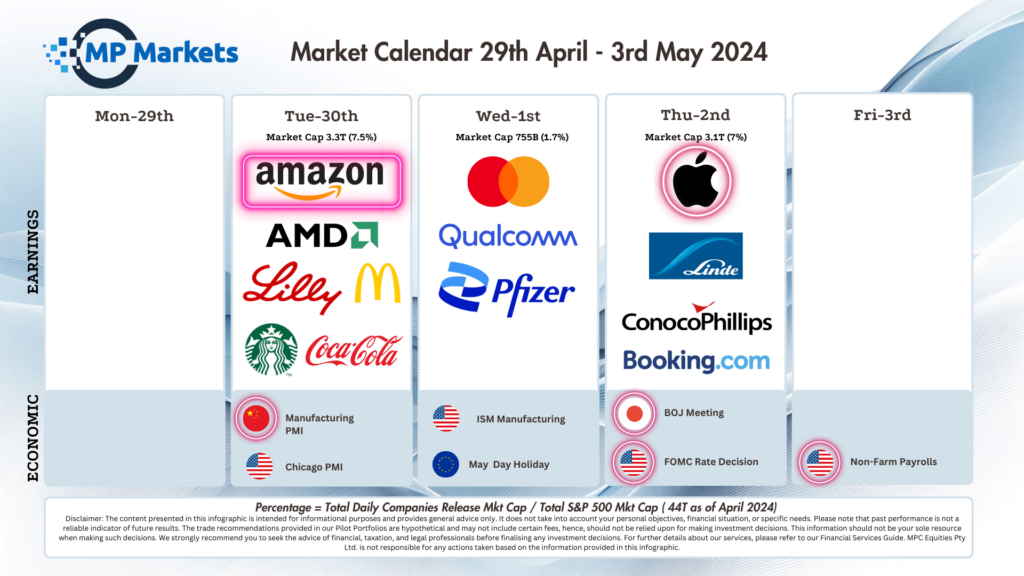

Earnings:

- Apple +2.29% (+7.05% after-market) – topped Wall Street estimates amid better-than-feared performance in its key China market and the tech giant unveiled its largest ever stock buyback. iPhone revenue, which makes up about half of total revenue, fell to $45.96B from $51.33B a year earlier, but that just missed estimates of $46B. The weaker than expected iPhone revenue, and pressured margins show that the revenue growth plateau is more than a regional problem and should keep on deepening without new, more innovative products

- eBay -3% – the e-commerce giant delivered revenue guidance for the current quarter that fell just shy of expectations amid a weakening consumer.

- Moderna +12% – the drugmaker posted a narrower-than-expected loss for the first quarter as its cost-cutting efforts took hold and sales of its Covid vaccine topped estimates.

- Carvana +34% – the used car dealer clocked a surprise first-quarter profit and offered a positive forecast.

- DoorDash -10% – stock slumped 10% after the food delivery service flagged a disappointing outlook for annual profit.

- Block +3.46% (+7.44% after-market) – the company reported earnings and revenue for the fiscal Q1 that topped analyst expectations. Following this robust print, Block is raising its full-year financial outlook. The company now projects a minimum gross profit of $8.78 billion for the year, reflecting a 17% increase from the previous year.

Bonds

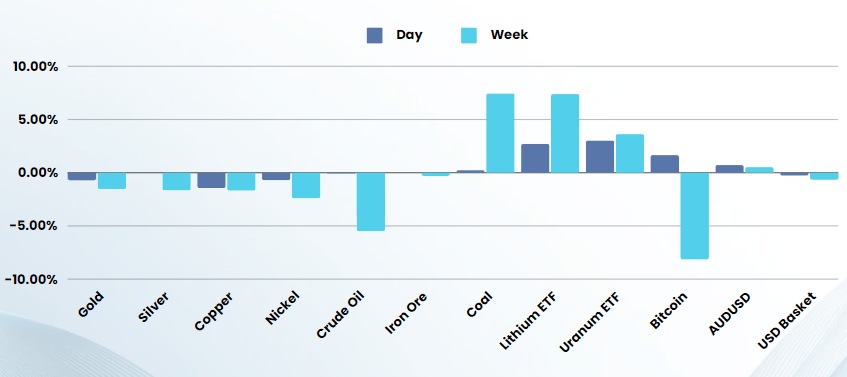

Commodities & FX

The Day Ahead

ASX SPI 7636 (+0.45%)

We are likely to see some optimism in the AM from the strong US lead which is likely to turn to profit taking in the afternoon with the key US jobs data due out tonight. The materials sector will remain quiet with China on holiday this week.

Uranium stocks will see a continued rally on the US ban on Russian Uranium from earlier in the week as spot prices rallied another 2%

Company Specific:

- Block (SQ2) results overnight should see the stock rally over 10% on a significant earnings beat and lift in guidance

- Macquarie (MQG) will report earnings this morning

- TPG will hold its AGM