Last Night's Market Recap

S&P 500 - Heatmap

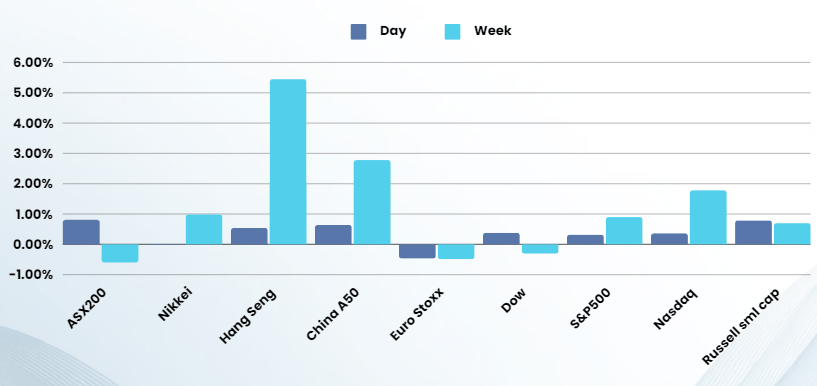

Overnight – Equities grind higher led by Tesla “Robo-taxi” approval in China

Equities clawed back losses as Tesla rallied 15% on tentative approval of Robo-Taxis in China and an upgrade for Apple, as quarterly earnings season continues to roll on just a day ahead of the latest Federal Reserve meeting.

Tesla stock soared 15% after the EV giant reportedly received tentative approval from Beijing to launch its driver assistance software in China, leveraging mapping and navigation technology from Chinese tech giant Baidu according to multiple media reports. The milestone marked further signs of the company’s efforts to increase adoption of its sticky self-driving software, which many on Wall Street believe forms a key part of the EV maker’s growth story. While demand challenges exist in China for Tesla, the Street is looking through this painful transition period for the long term growth story to emerge for Musk & Co. with FSD a key ingredient in that recipe for success

Apple rose more than 2% after Bernstein upgraded the tech giant to outperform from market perform, saying in China-led demand weakness was overdone.

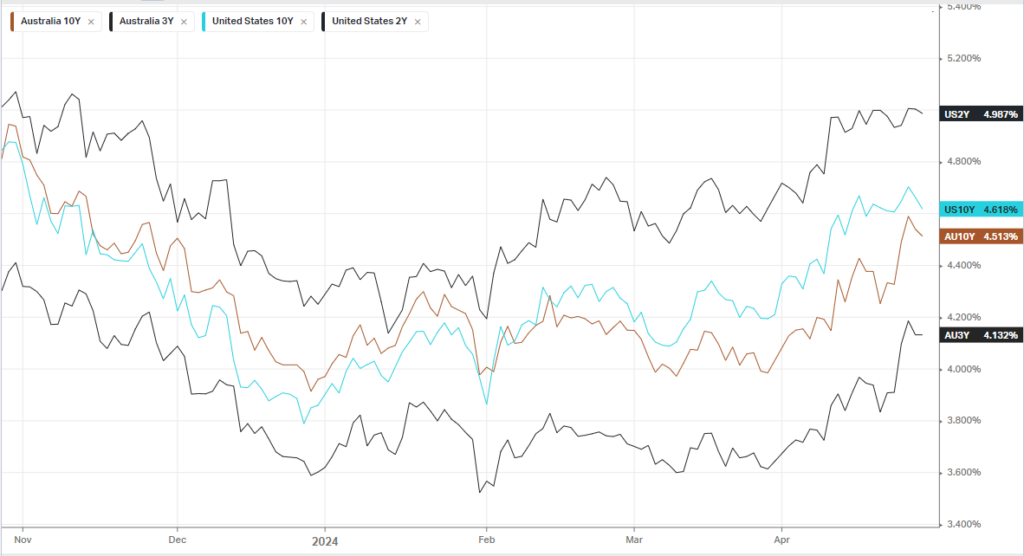

Treasury yields off lows as U.S. Treasury looks to borrow more than expected in April-June quarter as the Treasury Department raised its net borrowing estimate for the April through June quarter to $243 billion, up from the $202 billion amount it had forecast in late January, driven by lower cash receipts. The larger than expected funding requirements for the quarter, pointing to more bond sales than expected, pressured Treasuries and pushed yields up off the lows of the day.

The Federal Reserve is set to kick off its two-day meeting on Tuesday that is widely expected to culminate in an unchanged decision on interest rates. Many on Wall Street will be focus on remarks from Fed chairman Jerome Powell amid fears of a more hawkish Fed chief. The statement language is likely to be altered in a hawkish direction, reflecting economic developments in recent weeks, particularly the strong inflation readings for March

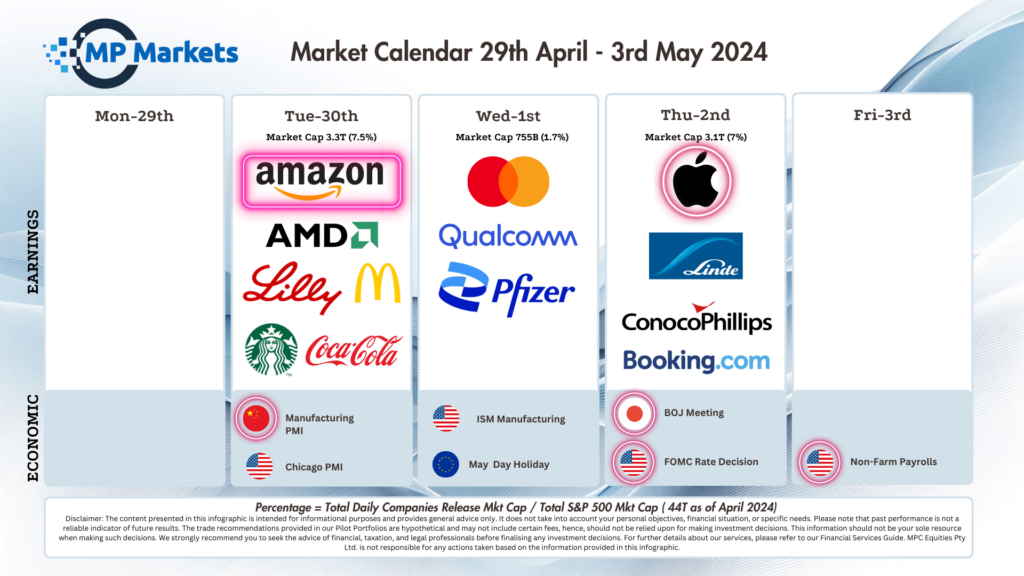

Amazon, Coca-Cola, Advanced Micro Devices (AMD) and Eli Lilly will report earnings on Tuesday.

Earnings:

- Domino’s Pizza +5% – lifted consumer stocks after the pizza chain reported better-than-expected first-quarter sales estimates, driven by a 6% increase in same store sales as customers made use of the company’s loyalty programs.

- SoFi Technologies -10% – the personal finance company issued a disappointing second-quarter forecast, even after posting better-than-expected revenue and income last quarter, fueled largely by its financial-services and technology platform segments.

Bonds

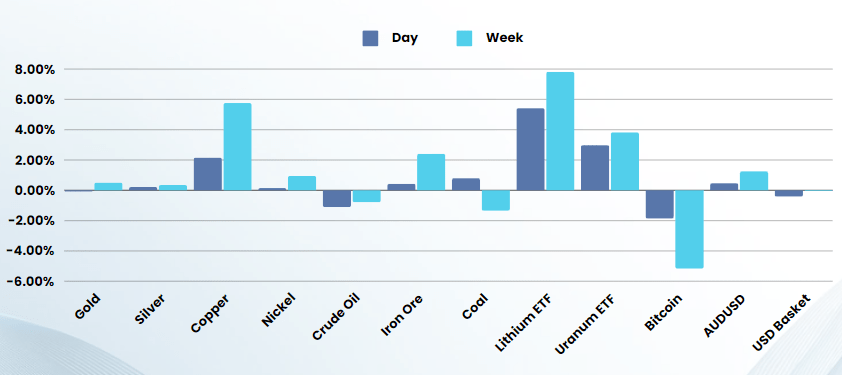

Commodities & FX

The Day Ahead

ASX SPI 7671 (+0.31%)

The ASX is likely to have a fairly quiet morning with Australian Retail Sales figures at 1130am and Chinese Manufacturing PMI numbers at midday to be in focus. Lithium, uranium and copper all headed higher with big gains in the global ETF’s.

Company Specific:

- Fuel supplier Ampolreported a 21 per cent drop to $US11.80 per barrel in Lytton Refiner Margin in the three months to March, from a year ago, as Singapore refined product cracks were lowered.

- Worley Limited’s largest shareholder, Dubai-based infrastructure group Sidara (née Dar Group), locked in $14.35 a share for its sale of 19 per cent a stake.