Last Night's Market Recap

S&P 500 - Heatmap

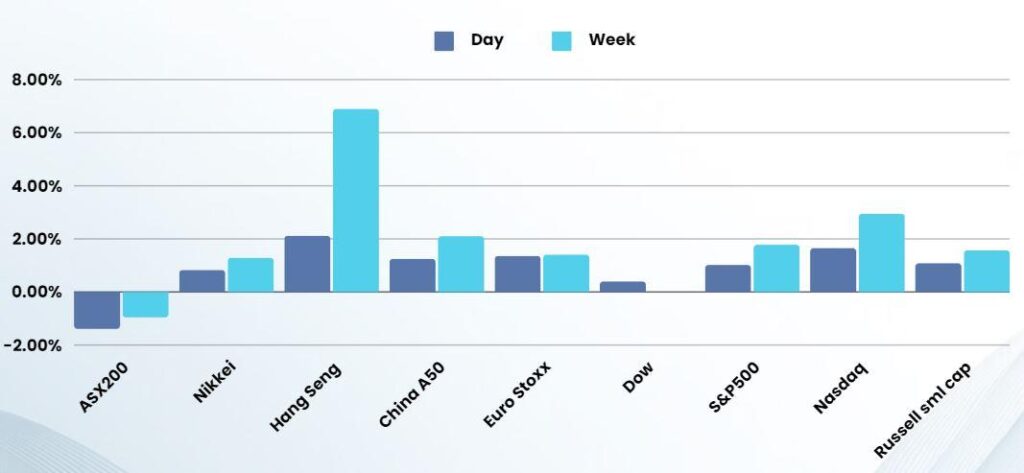

Overnight – Stocks have best week since November as Google and Microsoft do the heavy lifting

Equities rallied Friday, clinching its best week since November, as stronger-than-expected earnings from Microsoft and Alphabet revived investor optimism in the AI-led tech bull run.

Google-parent Alphabet gained 10%, hitting an indicated record high, after the tech giant reported stronger-than-expected first-quarter earnings on robust demand for its new AI offerings. Alphabet also declared its first ever dividend, of 20 cents per share. The quarterly results show that Google is “more than weathering the GenAI concerns, RBC said in a note, keeping the stock in the core holding bucket for investors. Microsoft shares rose 2%, as strong demand for AI products also helped the firm report stronger-than-expected first-quarter earnings. As each key growth driver – especially Azure and Gaming – continues to perform well, MSFT remains a top GenAI pick,

In chip stocks, Intel fell more than 9% after its weaker Q2 guidance stoked concerns that the chipmaker is set to fall further behind its rivals in the race to cash in on artificial intelligence.

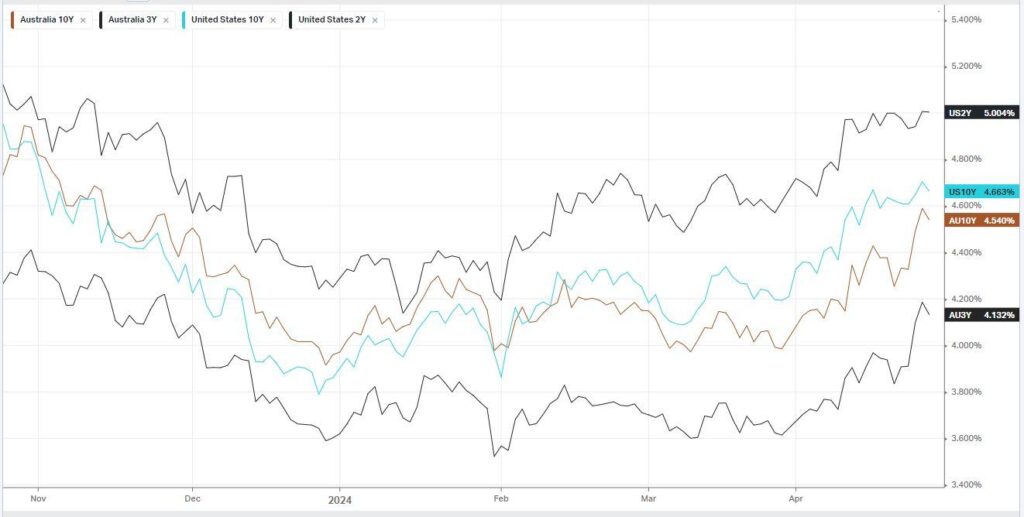

Data released earlier Friday showed that the personal consumption expenditures price index rose 0.3% in March, largely as expected. In the 12 months through March, PCE inflation advanced 2.7% against expectations of 2.6%. Excluding the volatile food and energy components, the PCE price index increased 0.3% last month, as expected, rising 2.8% on an annual basis versus forecasts of 2.7%. There had been fears, driven largely by hawkish comments from a number of Fed officials, that the Fed’s favourite gauge of inflation would come in way ahead of expectations, pushing back further the likelihood of rate cuts this year.

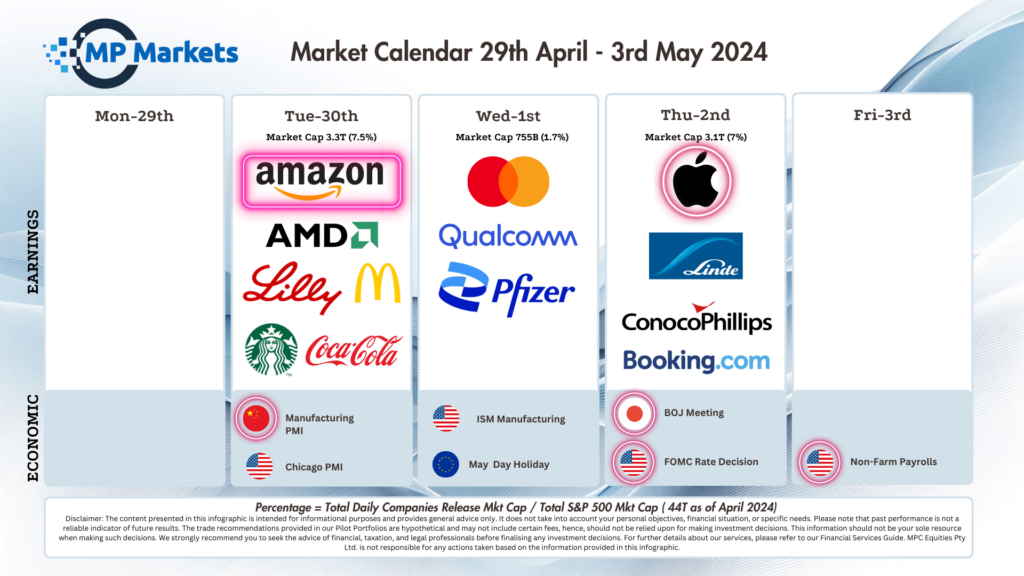

Earnings:

- Snap +27% – after the social media firm posted stronger-than-expected first-quarter earnings, while also offering an upbeat outlook.

- Roku -10% – after streaming device maker flagged “difficult year-over-year growth rate comparisons following past price hikes.

- Exxon Mobil +3% – after reporting Q1 results that fell short of estimates, pressured by a fall in refining margins and a slump in natural gas prices.

Bonds

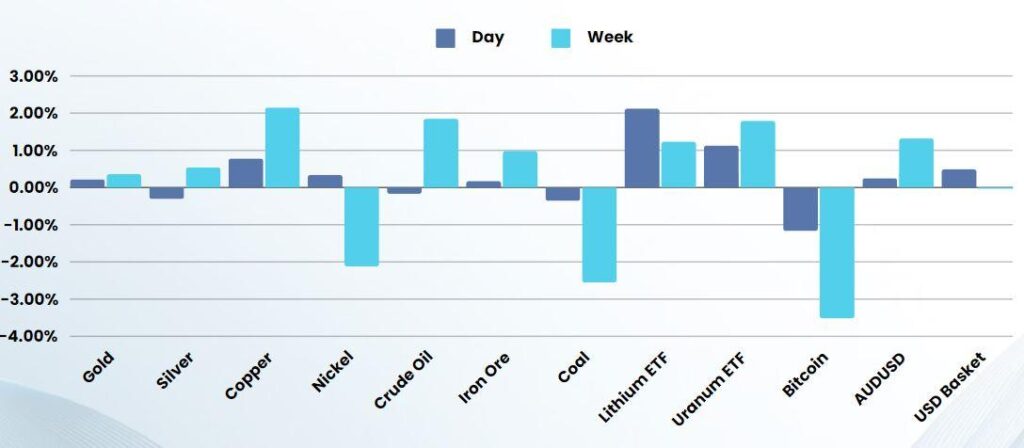

Commodities & FX

The Day Ahead

ASX SPI 7620 (+0.31%)

The ASX should have a decent start to the day with the materials and tech sectors leading the way, although the recent weekend papers overwhelming calls for more rate hikes is likely to see the consumer discretionary and REIT’s sectors hit a wall of selling.

Company Specific:

- BHP’s $59B bid for Anglo American has been knocked back and branded as opportunistic by analysts.