Last Night's Market Recap

S&P 500 - Heatmap

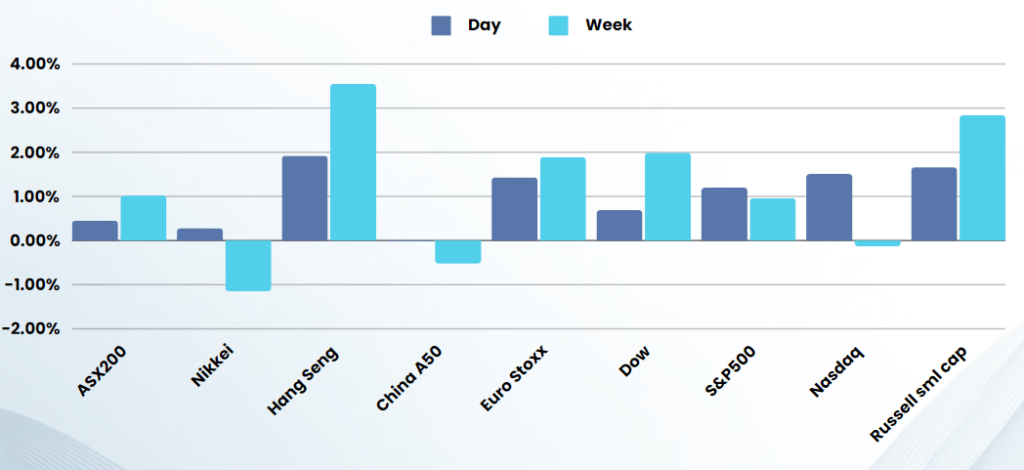

Overnight – Tech leads gains ahead of Magnificent 7 earnings

Equities rallied on tech strength, notching a second-straight daily gain underpinned by mostly better-than-expected quarterly earnings just ahead of the start of earnings from the Magnificent 7, with Tesla rocketing 8% after releasing results after the close.

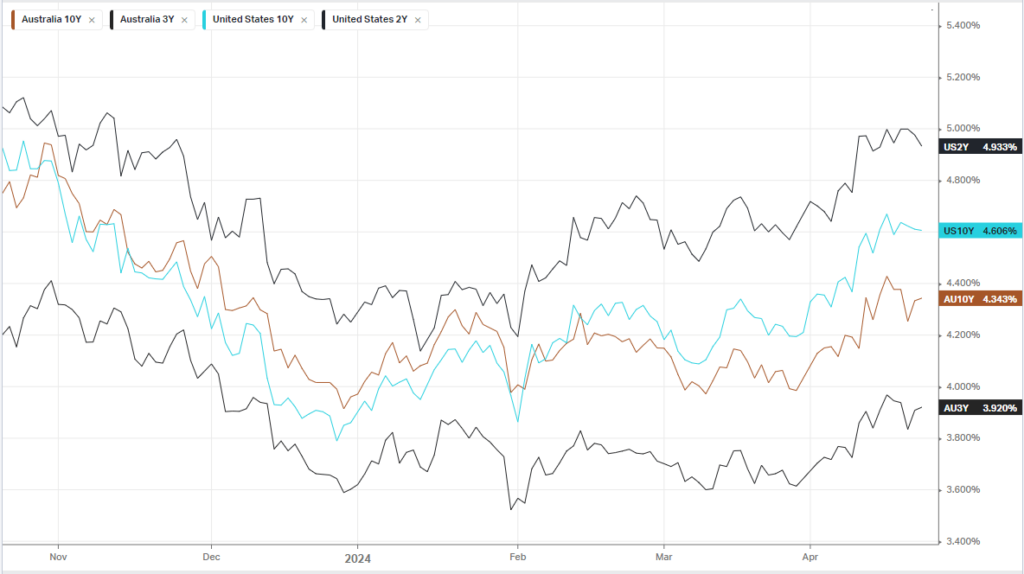

Treasury yields fell from the recent highs as data showing manufacturing and services activity unexpectedly weaken in April. The data come ahead of gross domestic product and the PCE price index data – the Fed’s preferred inflation gauge – due Friday, which is set to offer more cues on interest rates.

UBS on Monday downgraded its rating on the mega-cap companies, warning that profit growth momentum of the so-called Big Six technology stocks could “collapse” over the next few quarters.

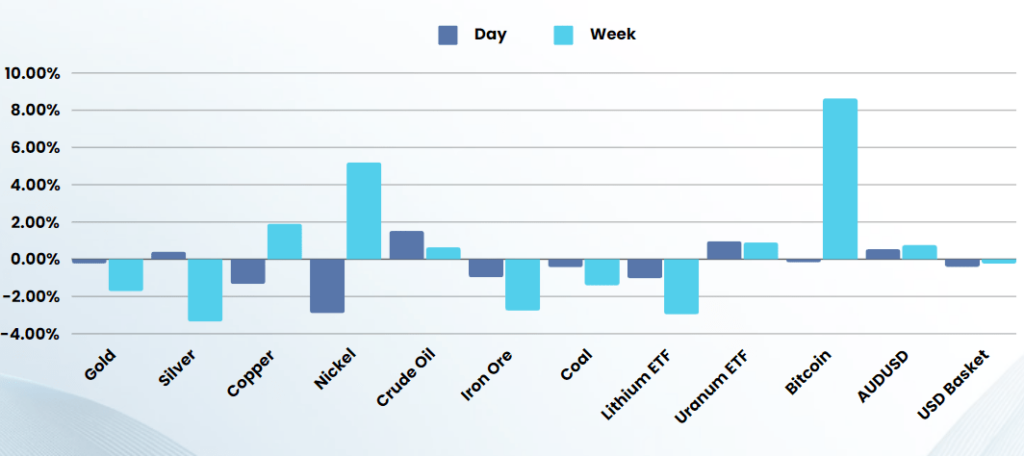

In commodities, spot gold reversed earlier losses, up 0.08% to $2,328.14 an ounce. U.S. gold futures fell 0.3% to $2,325.30 an ounce. Oil prices were up as investors continued to assess the situation in the Middle East. U.S. crude gained 1.76% to $83.34 a barrel and Brent rose to $88.39 per barrel, up 1.6% on the day.

Earnings:

- Tesla +.1.8% (+7.6% after hours) – the electric vehicle maker’s announcement that it was accelerating the launch of new EVs including affordable models overshadowed fiscal first-quarter results that fell short of estimates amid waning EV demand. Tesla delivered 386,810 EVs during the quarter, down from 433,371 in the three-month period a year earlier. “We have updated our future vehicle line-up to accelerate the launch of new models, with production set to start in the second half of 2025,” the company said.

- Visa +3% – the payment processor posted earnings and revenue that topped Wall Street expectations for the fiscal Q2 2024. Payment volume grew 8% during the period, while cross-border volume excluding intra-Europe popped by 16%. For the fiscal third quarter, Visa anticipates revenue growth in the low double-digits, with similar expectations for the full year.

- General Motors +4% – the auto giant raised its annual forecast after strong quarterly results, while GE Aerospace jumped more than 8% after the aerospace giant raised its full-year profit forecast.

- JetBlue -19% – as the low-cost airline trimmed its annual revenue forecast after reporting lukewarm first-quarter revenue.

- PepsiCo -3% – the soft drinks behemoth witnessed a slowdown in the United States.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7725 (+0.35%)

The Australian market will be firmly focused on domestic CPI numbers at 1130 today, with a 0.8% rise expected for the quarter and 3.4% for the year.

Most of the gains overnight were driven by tech, which is unlikely to feed through to the ASX. With a public holiday tomorrow for ANZAC day, we would normally expect some afternoon selling to de-risk into key earnings reports from Meta, Microsoft and Google, although it seems the glow has returned to the US market after 2 days