Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks bounce on earnings hopes

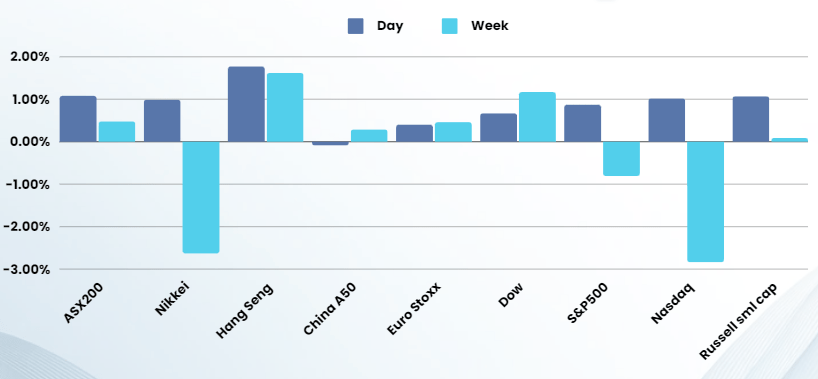

Equities rallied on tech strength Monday, rebounding from its biggest weekly loss since March last year as investors looked ahead to quarterly earnings from big tech.

Tech led the broader market rebound following a recent rout as investors looked as investors looked to slew of quarterly earnings from four of the ‘Magnificent 7’ stocks set to report earnings this week. Tesla on Tuesday, Facebook-owner Meta on Wednesday, followed by Microsoft and Google-owner Alphabet on Thursday.

Ahead of its earnings, Tesla fell over 3% after the EV manufacturer announced fresh price cuts in several key markets, including China and Germany, days after similar reductions in the United States, risking a fresh electric vehicle price war.

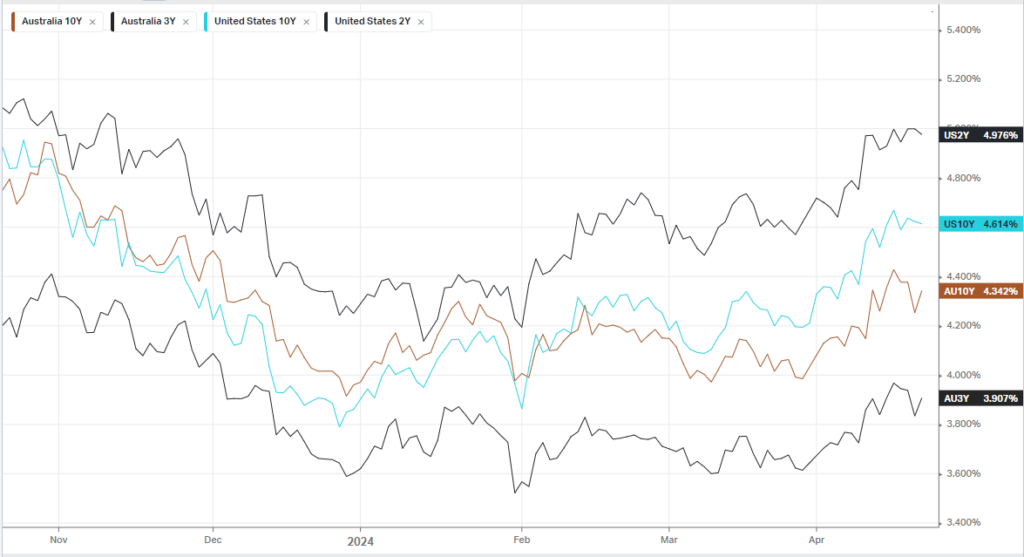

The yield on the 2-year Treasury briefly topped 5%, adding to recent gains as investors looked ahead to slew of key data including manufacturing data, preliminary economic growth data for Q1, and the Fed’s PCE price index data, the Fed’s preferred inflation gauge, later this week.

The slew of data come as bets on rate cuts have tumbled, with just two cuts now expected, which is below the Fed’s projection for two cuts. The Fed is widely expected to deliver an unchanged rate decision on May. 1, but focus will be Chairman Jerome Powell’s commentary for further clues on the rate outlook.

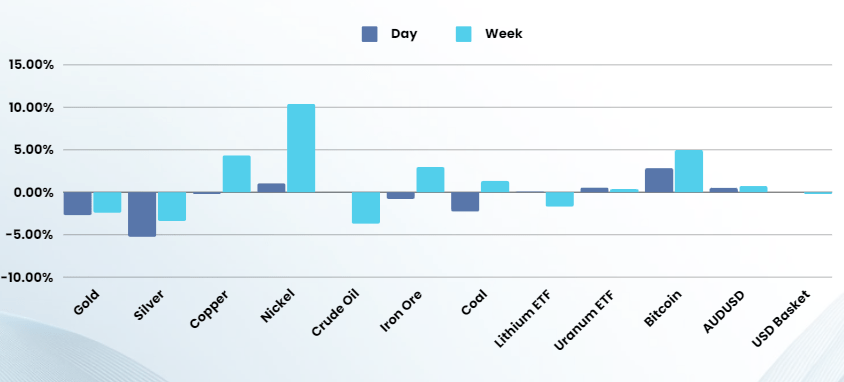

The last 24 hours has seen the market unwind safe haven bets due to the escalating geopolitical situation in the middle east, the focus now turns to Tesla tonight and Meta, Google and Microsoft over the next few days, then advance GDP numbers Thursday and Inflation data Friday

Earnings:

- Verizon Communications -4% – stock fell more than 4% even after the telecoms giant said it lost fewer-than-expected wireless subscribers in the first quarter, though that was overshadowed by weaker than expected cash flow of $2.7B in the quarter.

- Zions Bancorporation +3.5% – after reporting quarterly results that beat on the both the top and bottom lines, driven by lower credit provisions.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7693 (+0.24%)

The local market is likely to be fairly quiet today with the calendar full from Wednesday with AU inflation numbers due tomorrow and US earnings/data. Gold and materials stocks will soften further with the “safe-haven” trade being unwound.