Last Night's Market Recap

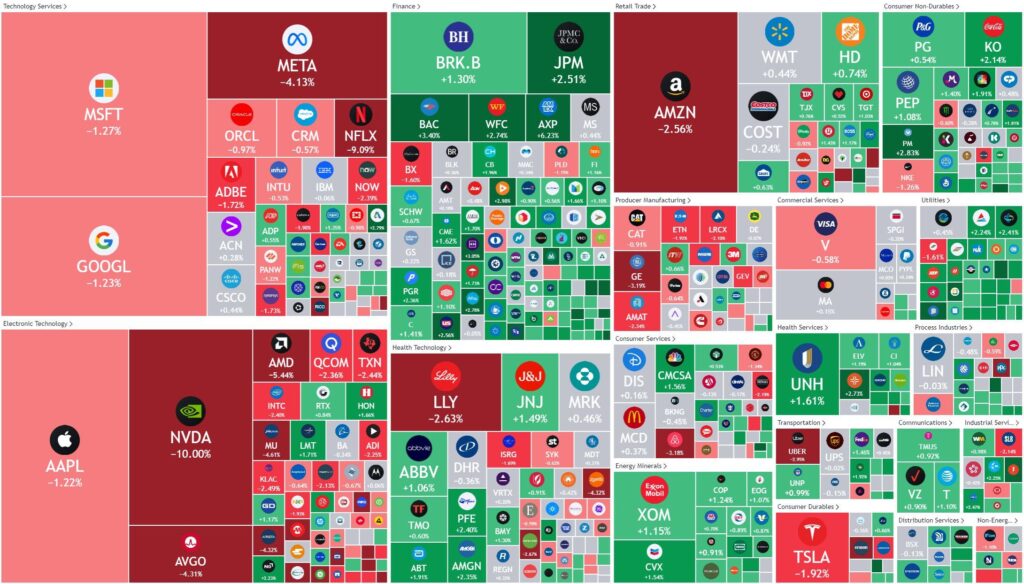

S&P 500 - Heatmap

Overnight – Equities fall for 6th straight day on Tech rout

Equities notched their 6th straight day of losses to round off the week led by a Netflix and Nvidia rout.

Netflix said it would stop reporting quarterly membership numbers and average revenue per membership starting next year with its Q1 2025. The announcement overshadowed the video streaming giant’s better-than-expected first-quarter results, sending Netflix shares more than 9% lower.

As well as slump in Netflix, other tech titans including Amazon, Microsoft, Alphabet, Apple and Meta were in the red, with the latter down 4% after Apple said it would pull Meta’s Instagram and thread apps from its App Store in China following pressure from Beijing’s internet regulator.

NVIDIA fell 10%, adding to its recent losses as investors appear to continue taking profit on the stock ahead of its earnings next month.

Mounting tensions in the Middle East appeared to plateau after Tehran downplayed Israel’s retaliatory drone strike against Iran, a move that seemed geared toward averting regional escalation.

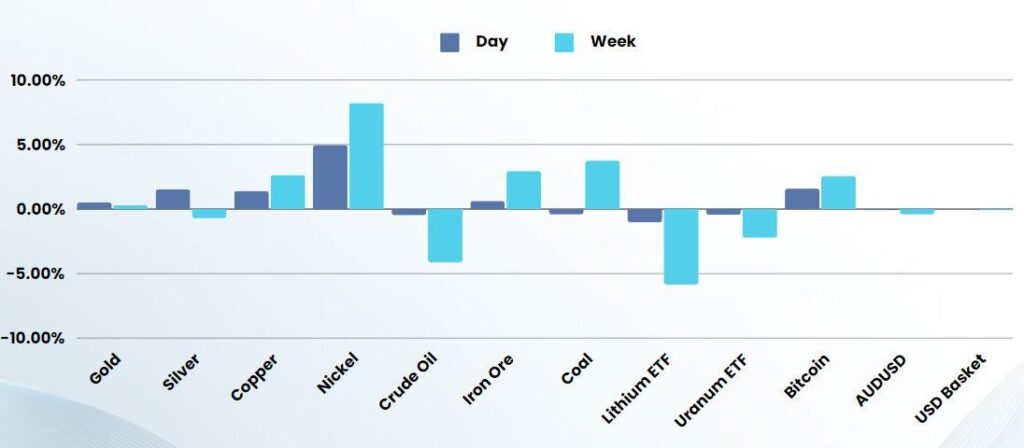

Crude oil prices dipped earlier as supply concerns eased in the wake of Iran’s subdued response, reversed course and settled modestly higher amid lingering uncertainties arising from geopolitical instability.

Gold advanced, putting the safe-haven metal on track for its fifth straight weekly gain. Spot gold added 0.4% to $2,386.49 an ounce.

Earnings:

- Procter & Gamble +0.5% – stock gained 0.5% after the customer goods giant’s third-quarter net sales fell short of expectations even as raised its annual profit forecast as commodity costs fall.

- American Express +6% – stock rose 6% after the financial services giant’s first-quarter profit vaulted past estimates, driven by an affluent customer base that increased spending as recession fears ebbed on Friday.

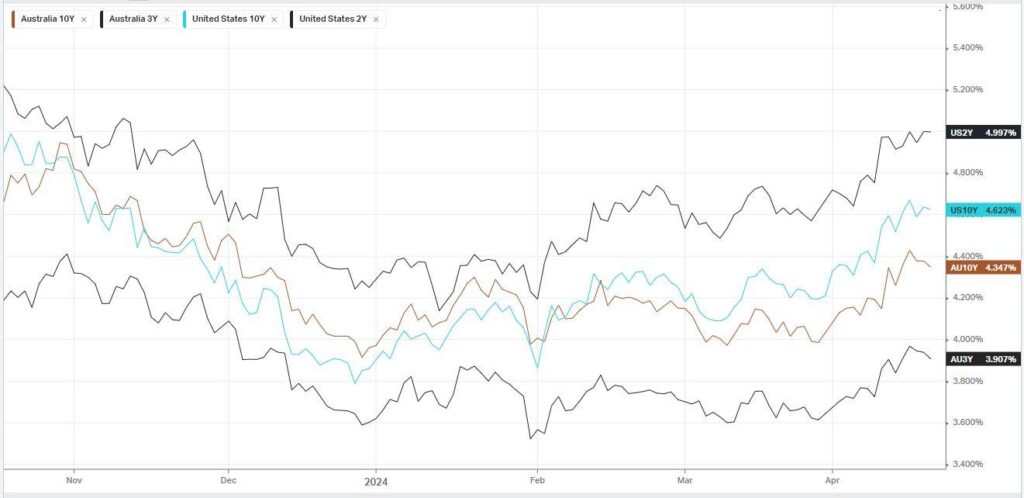

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7621 (+0.35%)

The local market is likely to bounce a little as retaliation from Fridays attacks didn’t eventuate. The banks and materials sectors were all positive on Friday night in the US however the tech sector is still in for a rough day with heavy profit taking in the US for the Mag 7 was clear