Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Strong economic data & hawkish Fed speakers continue to erase rate cut hopes

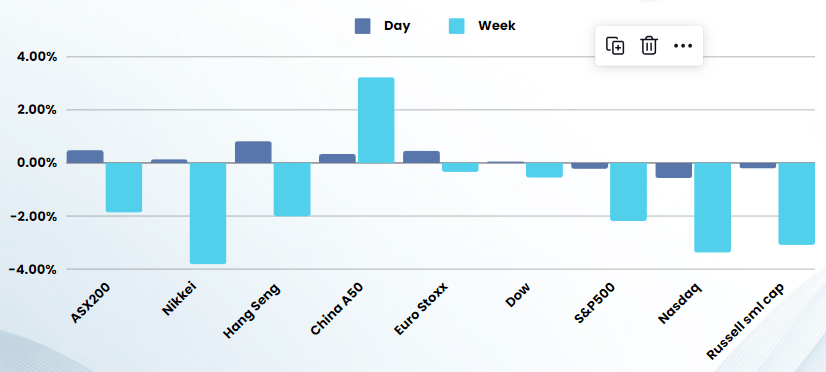

Equities notched their 5th straight day of losses, the longest losing streak since October, as hawkish Fed speak pushed treasury yields higher

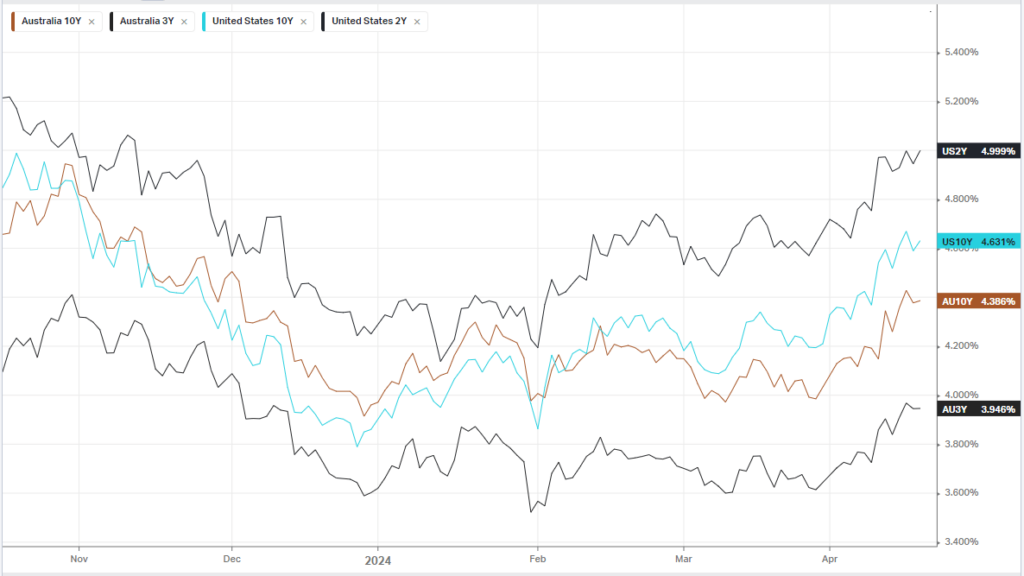

Treasury yields continued to trend higher rate-cut expectations continued to take knock following remarks from Fed speakers calling for patient on cuts, while others flagged the possible of resuming rate hikes should inflation pick up pace. Interest are in a “good place”, New York Federal Reserve President John Williams said Thursday, though cautioned that “if the data are telling us that we would need higher interest rates to achieve our goals, then we would obviously want to do that.” Atlanta Fed president Raphael Bostic reiterated that rate cuts aren’t likely to begin until the end of the year the path to the 2% inflation target would be slow and bumpy.

As well as hawkish Fed remarks, fewer than exepcted Initial jobless claims data, pointing to ongoing strength in the labor market and an unexpected increase in a key regional manufacturing report also dented hopes on rate cuts.

Micron Technology also weighed on chip stocks after falling more than 8% even as the memory chip maker is reportedly set to receive over $6 billion in government grants.

With a lack of data and Fed speakers tonight, we expect the major catalyst to be a test of the 5% level in the US2Y treasuries, currently sitting at 4.99%

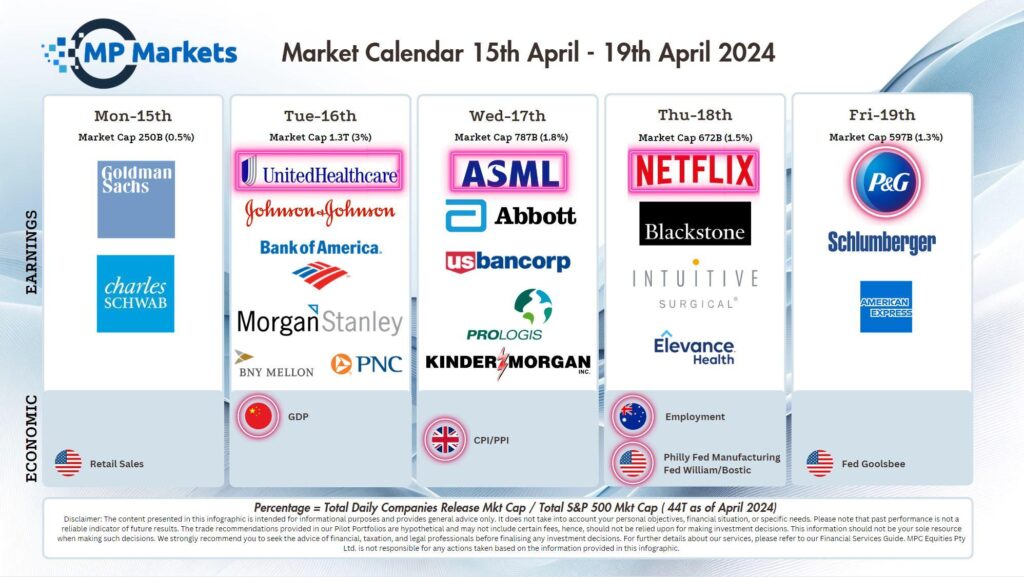

Earnings:

- Netflix -5.11% – reported Thursday better-than-expected first-quarter results after blowout subscriber growth, but the streaming giant forecast weaker-than-expected revenue for the current quarter amid expectations for slower net additions in Q2

- TSMC -4.86% – the world’s largest contract chipmaker, fell 5% as its lowered forecast for overall semiconductor growth offset first-quarter results that topped Wall Street estimates, driven by strong demand for all things AI. Some on Wall Street remain sanguine on the chipmaker on expectations for an ongoing boost from AI-led demand.

- Alaska Air +4.03% – was flat after the carrier forecast current-quarter profit above estimates as the hit to capacity from the grounding of its Boeing 737 Max 9 fleet was offset by a surge in corporate travel demand.

- Aloca -0.20% Aluminum producer Alcoa was trading below the flatline after its earnings topped estimates, and it flagged steady production in 2024.

Bonds

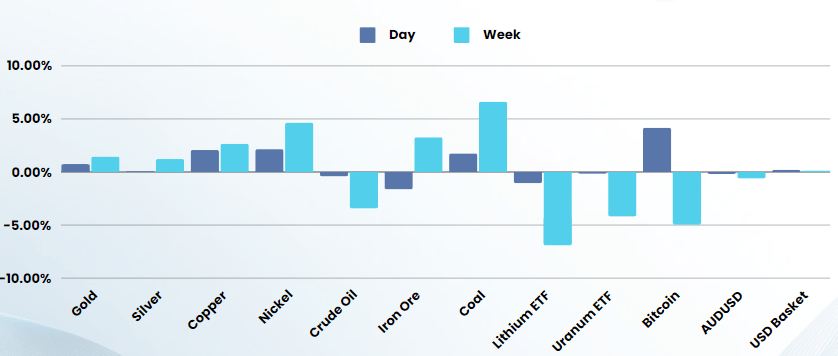

Commodities & FX

The Day Ahead

ASX SPI 7612 (-0.72%)

The ASX will perform better than its US counterparts with Iron ore jumping 6% overnight, pushing BHP and RIO higher in the London session. Copper and Aluminum also rallied on the London Metals Exchange (LME) on accepting Russian metals for delivery.

AU employment will be in focus at 1130am with 7k jobs expected to be added and 3.9% unemployment rate

Company Specific:

- RMD was heavily sold off due to an advance in drug development for sleep apnea patients from Eli Lily

- Challenger gives guidance – Annuities provider and funds management group Challenger says its total assets under management climbed 6 per cent to $124 billion in the March quarter. It also upgraded its guidance for normalised net profit before tax to finish at the upper end of a range between $555 million to $605 million in financial 2024.