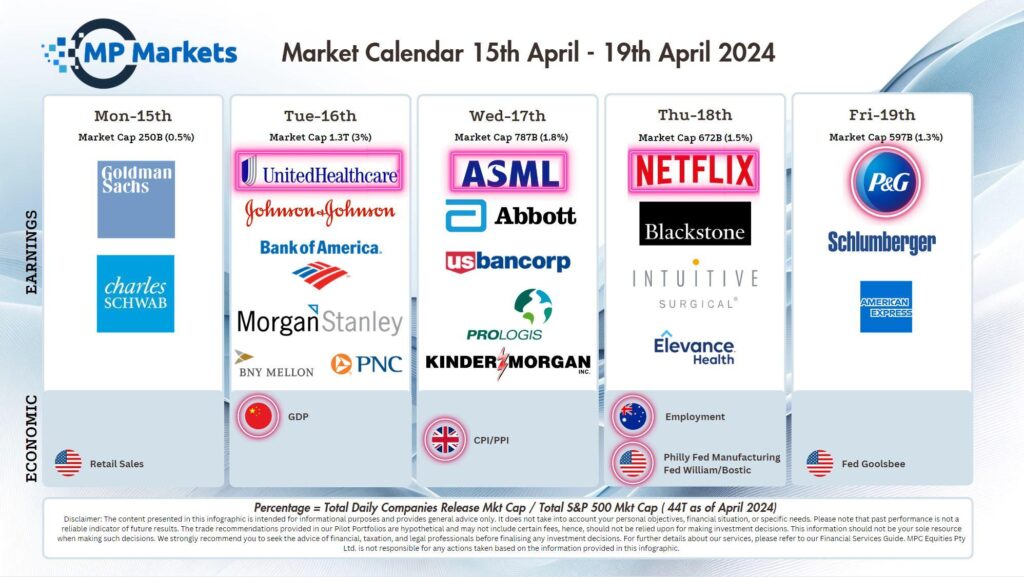

Last Night's Market Recap

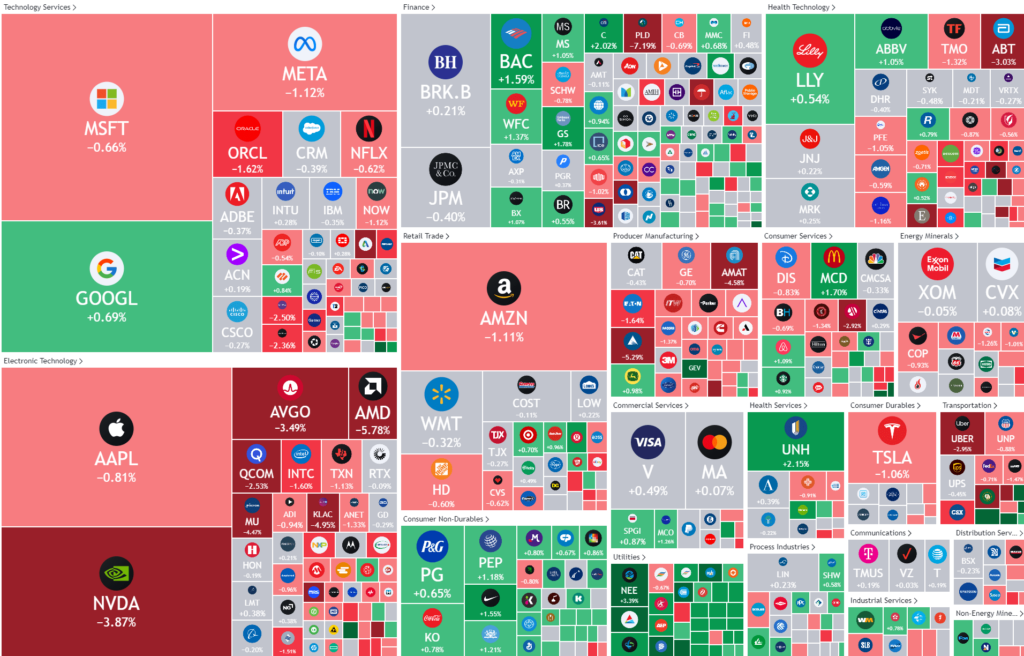

S&P 500 - Heatmap

Overnight – Equities led lower by Nvidia as “Higher for Longer” sinks in

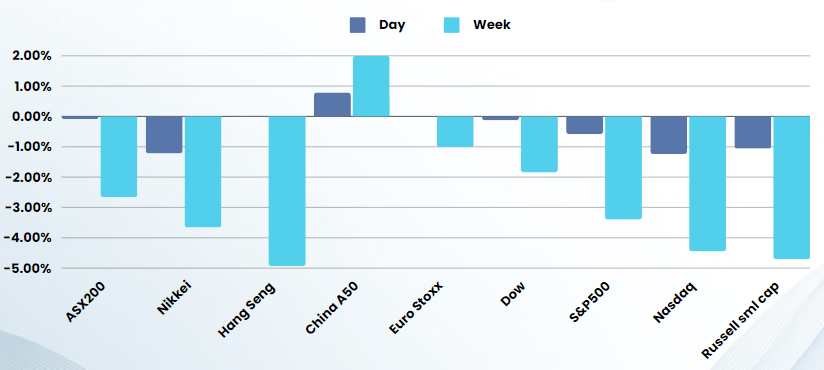

Equities continued to slide led by an Nvidia-led slide in tech just as fears of higher-for-longer Federal Reserve interest rates persist.

NVIDIA fell almost 4% to add pressure on the broader tech sector just as other big tech stocks including Netflix, Apple, Meta and Microsoft were also under pressure. ASML, meanwhile, weighed on chip stocks after falling over 7% following quarterly results that showed weaker than expected first-quarter new bookings. Sentiment on the growth sector of the market including tech has soured following an ongoing climb in Treasury yields on fears that higher for longer rates are likely to persist. Federal Reserve Chairman Jerome Powell on Tuesday “was clear, the Fed intends to stay on the sidelines for longer than previously expected, given the unexpected increase in recent inflation data,” Stifel said in a Wednesday note.

Crude prices retreated 3% Wednesday as a rise in U.S. commercial stockpiles created concerns about future demand. The official U.S. inventory data, from the Energy Information Administration, showed weekly crude stockpiles rose by 2.7M, well above the 1.6M economists had forecast.

Earnings:

- United Airlines +17% after the carrier forecast stronger-than-expected earnings in the current quarter, as well as reporting a narrower-than-expected loss in the first quarter, on robust demand for travel.

- Travelers -7% after the insurer announced a sharp rise in catastrophe losses, net of reinsurance, up to $712 million from $535 million a year earlier, due to severe wind and hail storms in the central and eastern regions of the United States.

- JB Hunt Transport -8% after the trucking firm missed estimates for first-quarter results, hurt by a decline in revenue in its biggest segment and pricing pressures at its brokerage business.

- Abbott Labs -3% despite the medical devices maker beat Wall Street estimates for quarterly profit and raised the lower end of its full-year forecast on strong sales of its products.

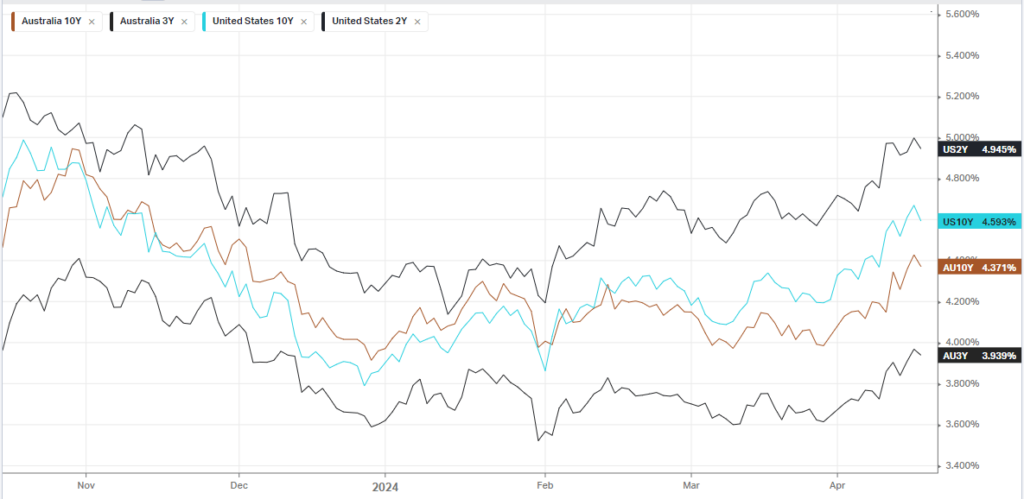

Bonds

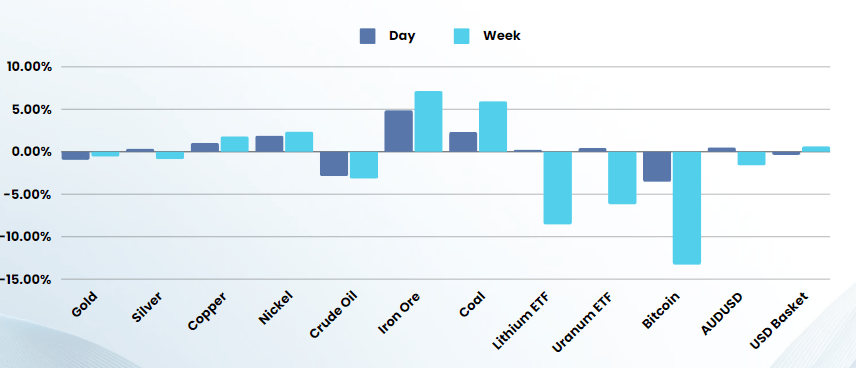

Commodities & FX

The Day Ahead

ASX SPI 7665 (+0.26%)

The ASX will perform better than its US counterparts with Iron ore jumping 6% overnight, pushing BHP and RIO higher in the London session. Copper and Aluminum also rallied on the London Metals Exchange (LME) on accepting Russian metals for delivery.

AU employment will be in focus at 1130am with 7k jobs expected to be added and 3.9% unemployment rate

Company Specific:

- RMD was heavily sold off due to an advance in drug development for sleep apnea patients from Eli Lily

- Challenger gives guidance – Annuities provider and funds management group Challenger says its total assets under management climbed 6 per cent to $124 billion in the March quarter. It also upgraded its guidance for normalised net profit before tax to finish at the upper end of a range between $555 million to $605 million in financial 2024.