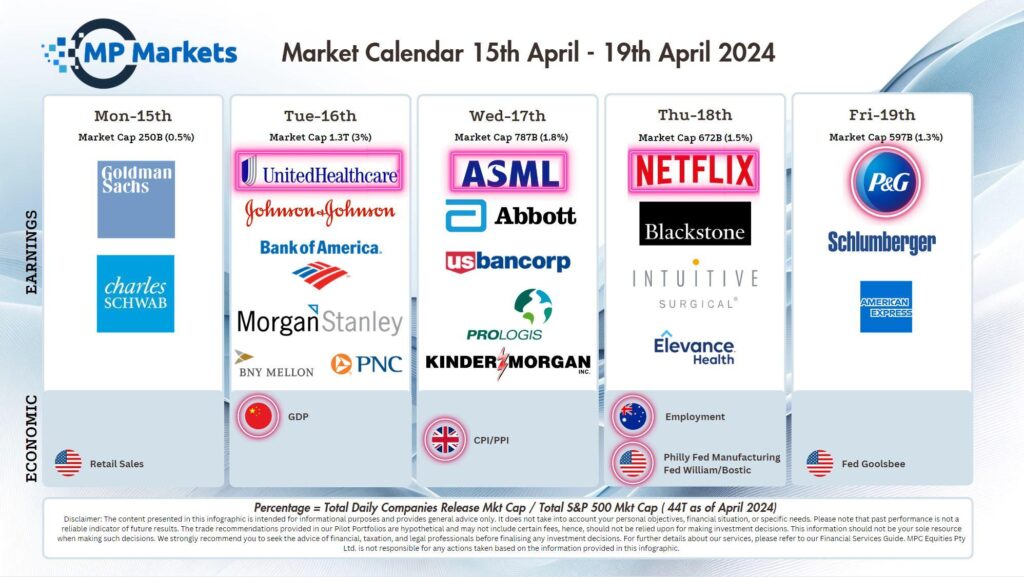

Last Night's Market Recap

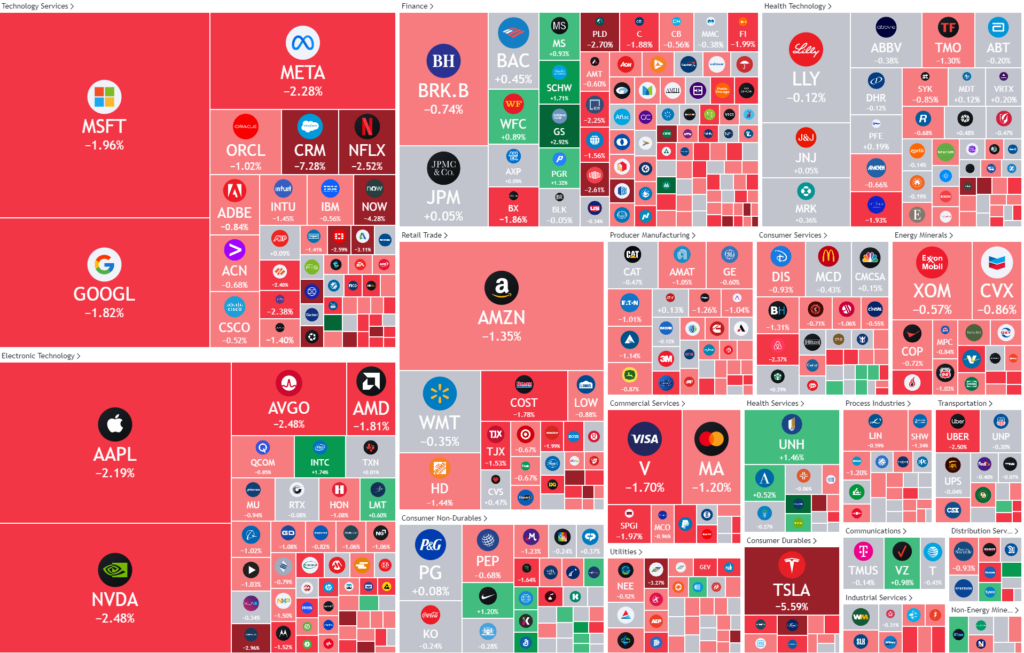

S&P 500 - Heatmap

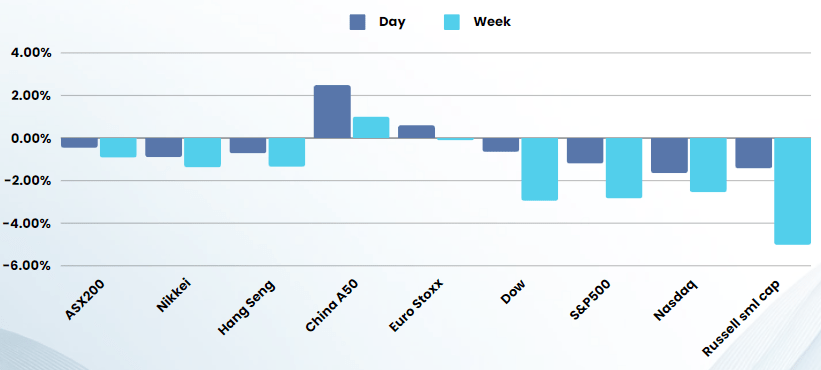

Equities heavily sold off, pressured by a spike in Treasury yields as geopolitical tensions and stronger-than-expected retail sales data dented expectations for interest rate cuts and overshadowed strong earnings from banking giant Goldman Sachs.

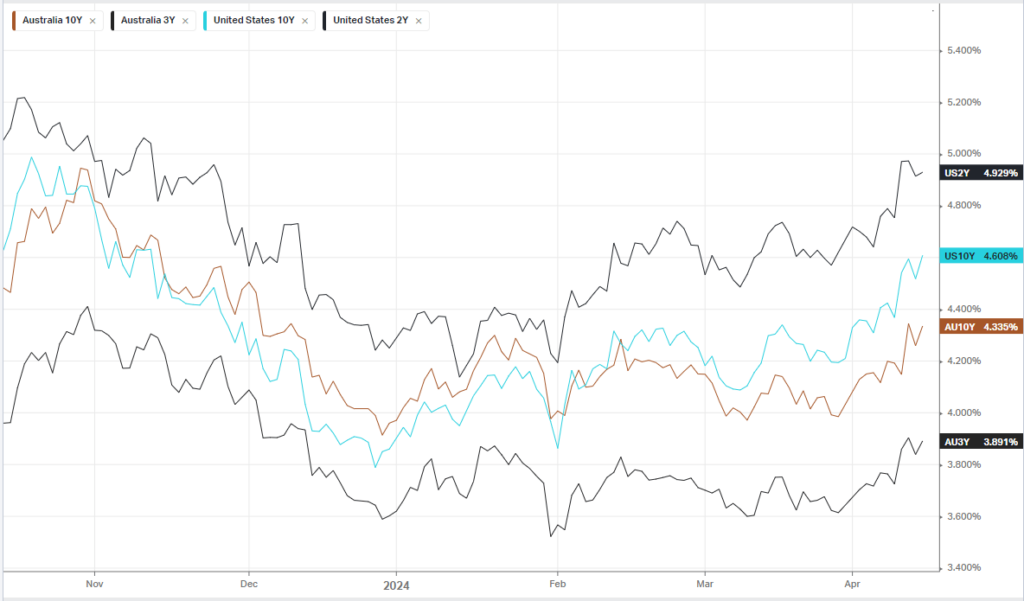

Treasury yields continued to add to recent gains after retail sales grew faster than expected last month, indicating strength in the consumer, which drives the bulk of U.S. economic growth, and cooling expectations for Federal Reserve rate cuts this year. The yield on the United States 10-Year Treasury jumped 11 basis points to 4.61%. The Commerce Department said Monday that retail sales rose 0.7% last month, topping economists’ forecast for a 0.4% rise. The retail sales control group – which has a larger impact on U.S. GDP – rose 1.1% above expectations for a 0.4% rise.

Investment bank Goldman Sachs was one of the few bright spots on the day, closing nearly 3% higher after reporting a jump in Q1 profit, fuelled by a recovery in underwriting, deals and bond trading in the first quarter that lifted its earnings per share to the highest since late 2021. Charles Schwab stock rose 2%, after brokerage reported first-quarter earnings that topped Wall Street estimates, driven by a surge in asset management fees in Q1.

Elsewhere, Apple stock fell 2% after data from research firm IDC indicated that the iPhone maker has lost its crown as the world’s No.1 phone maker, with Samsung regaining that spot in the wake of Apple’s weak first quarter. Apple’s smartphone shipments dropped about 10% in the first quarter of 2024, a period when global smartphone shipments increased 7.8% to 289.4 million units. Tesla stock fell more than 5% following reports that the EV manufacturer may be about to announce large scale redundancies as it grapples with worsening sales.

Geopolitical tensions also gripped markets as Israel is reportedly weighing up an imminent response to an attack from Iran over the weekend, NBC reported Monday, citing an unnamed Israeli official. The potential for the tit for tat skirmishes to break out into a wider war in the Middle East has stoked fresh geopolitical tensions, forcing investors into safe-havens including gold.

Bonds

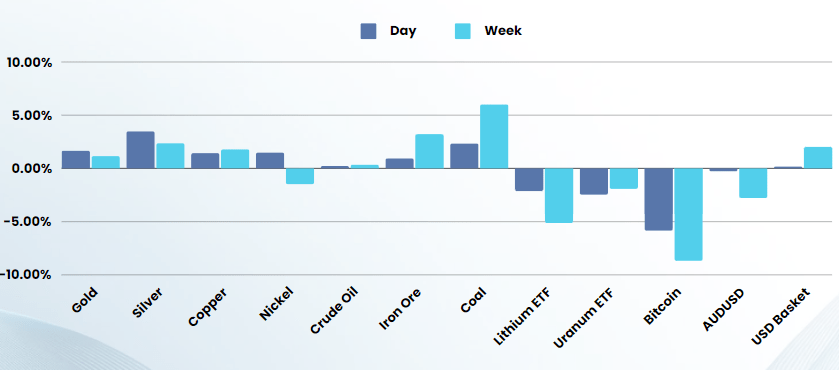

Commodities & FX

The Day Ahead

ASX SPI 7725 (-0.80%)

The local market is in for another rough day outside the materials sector. Gold, Silver, Iron ore and Copper were all higher overnight as Chinese intervention was seen yesterday. Chinese markets were saved yesterday by Major Government-backed state funds were also seen buying shares of heavyweight Chinese banks, which was a key point of support for China’s stock indexes.

The tech sector, high PE stocks and REITs are likely to feel the brunt of the selling today

Company Specific:

- Rio Tinto will reveal its operational performance in its first quarter production report at 8.30am.