Last Night's Market Recap

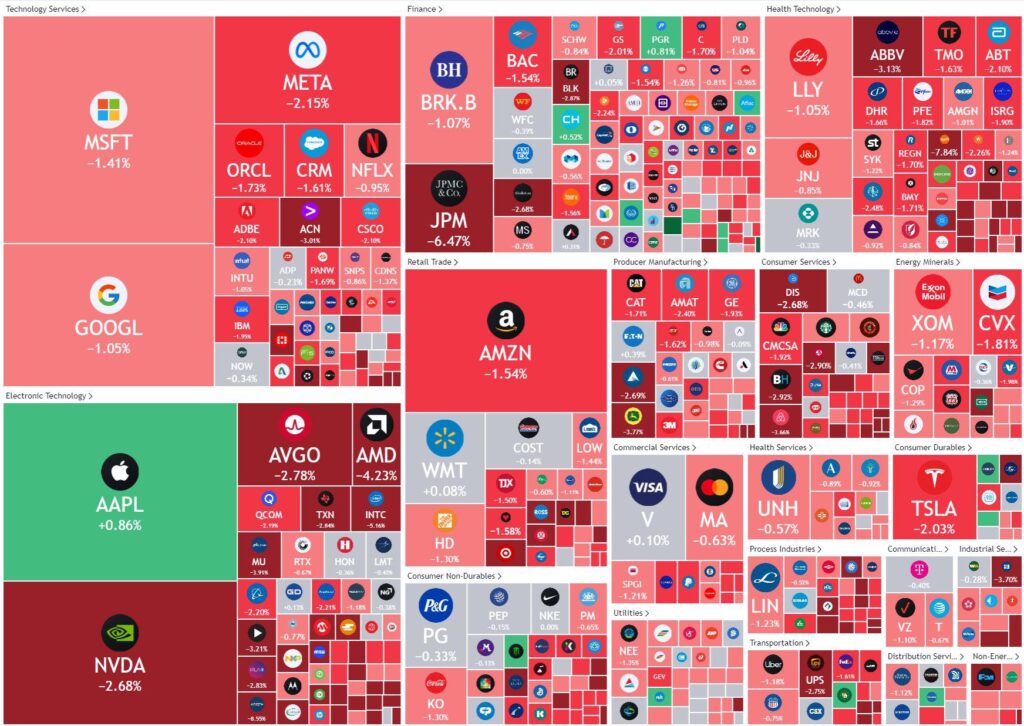

S&P 500 - Heatmap

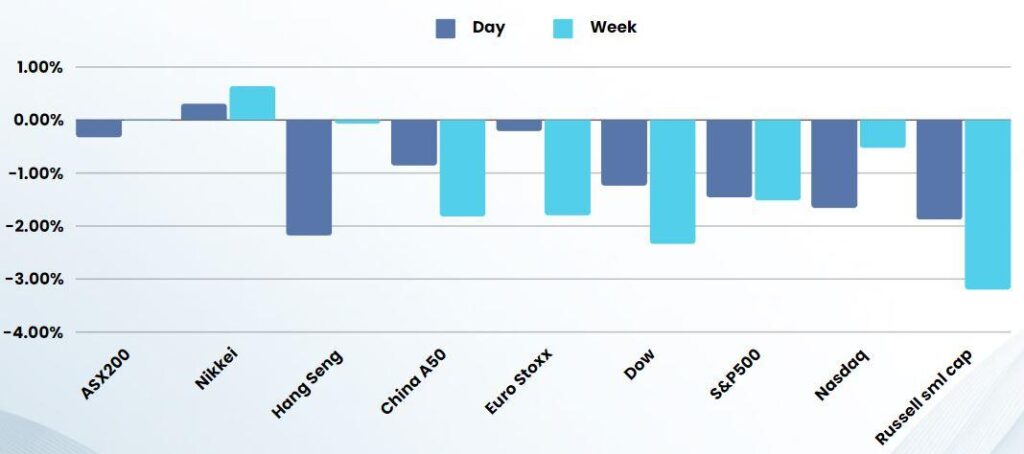

Overnight – Stocks tank on disappointing bank earnings and Inflation concerns

Equities were sold off Friday as major Wall Street banks kicked off the earnings season with disappointing results, stoking worries about the strength of the upcoming earnings season at a time when inflation jitters remain front and center.

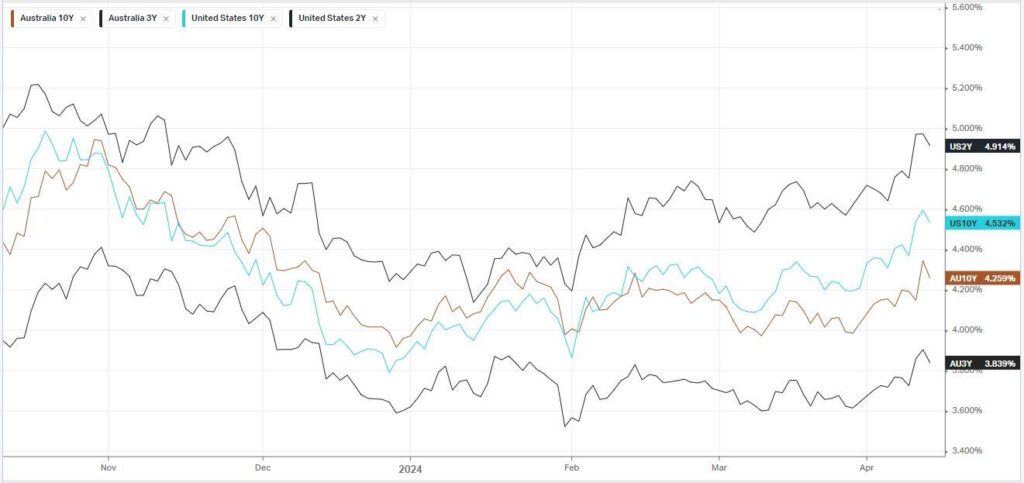

The Michigan consumer sentiment index fell to 77.9 in April from 79.4 a month earlier, missing forecasts of 79.0 and the data also showed that the 1-year inflation expectations and 5-year expectations rose to 3.1% and 4% respectively, piling on worries about higher for longer interest rates.

JPMorgan Chase stock fell more than 6% after the banking giant forecast full-year income from interest payments below expectations as the industry prepares for widely expected Federal Reserve rate cuts. Wells Fargo dropped 0.3% despite beating revenue expectations, as the lender reported softer-than-expected net interest income numbers. Citigroup, meanwhile, fell more than 2% despite reporting quarterly results that beat on both the top and bottom lines amid signs that turnaround efforts are bearing fruit. The health of the banking sector is often be used as a measure of the strength of the economy as a whole, and uncertainty over the Fed’s interest rate outlook is set to hang over the first-quarter earnings season as a whole. Analysts expect S&P 500 companies in aggregate to report earnings increased 5% in the first quarter from a year earlier, according to LSEG data, a sharp drop from the 10.1% growth seen in the fourth quarter of 2023.

Crude prices rose Friday as geopolitical risks, particularly in the oil-rich Middle East, remained elevated, but are set for weekly losses on concerns over U.S. monetary policy. U.S. officials have predicted an attack by Iran against Israel shortly, in retaliation for a suspected Israeli air strike against a top Iranian military commander in Damascus earlier this week. Iran, however, said that it will retaliate in a “calibrated” manner against Israel, signaling the Islamic Republic’s intention to avoid sparking a wider war in the Middle East tensions.

Bonds

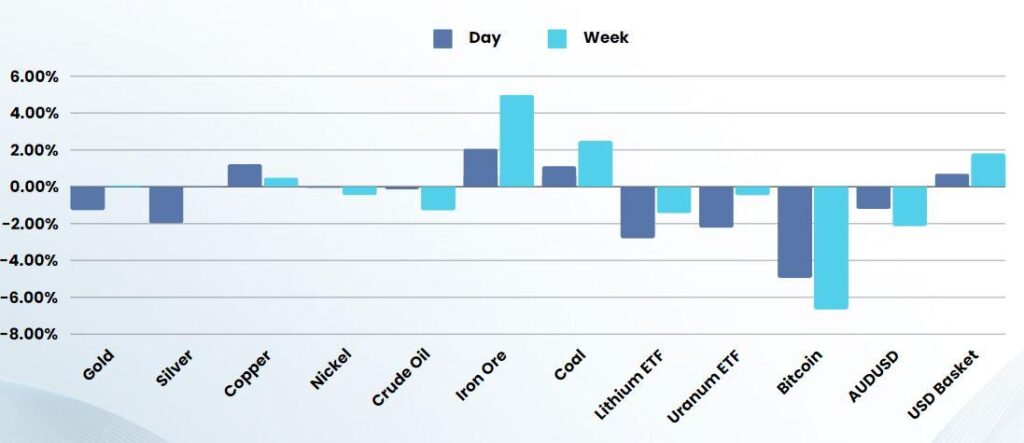

Commodities & FX

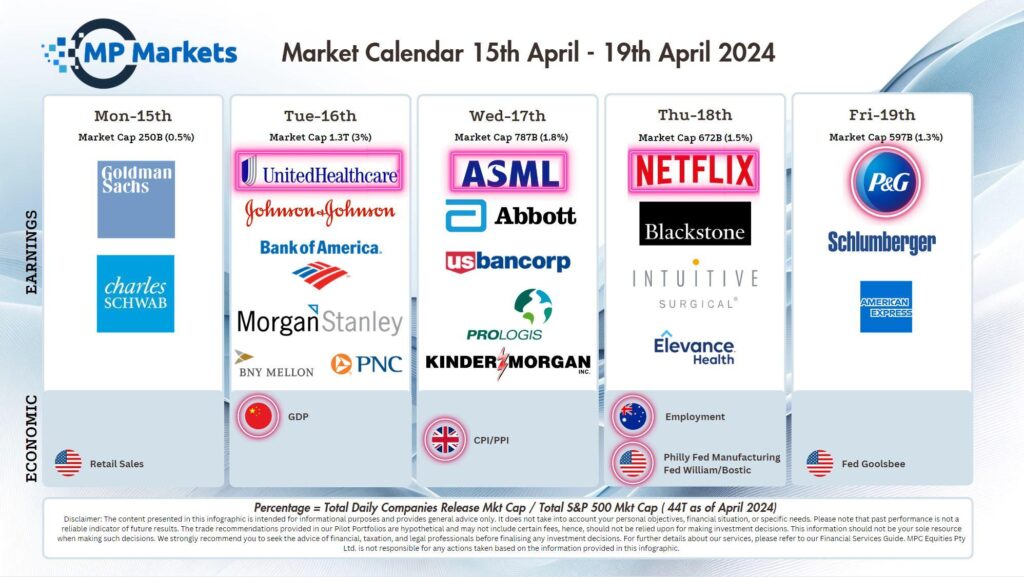

The Day Ahead

ASX SPI 7772 (-0.63%)

The ASX is in for a rough day with a very weak lead from US banks and commodity prices all taking a tumble on Friday, both huge contributors to the ASX index

We see significant downside risk for the Big 4, sitting at very over inflated prices which could weigh heavy on the index