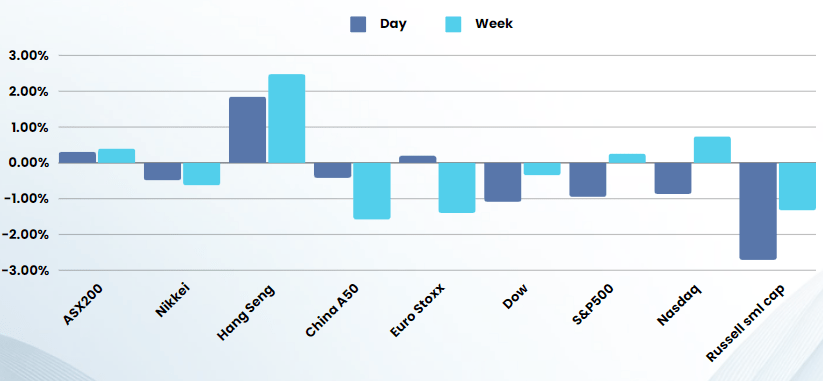

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – High inflation numbers throw cold water on rate cuts calls

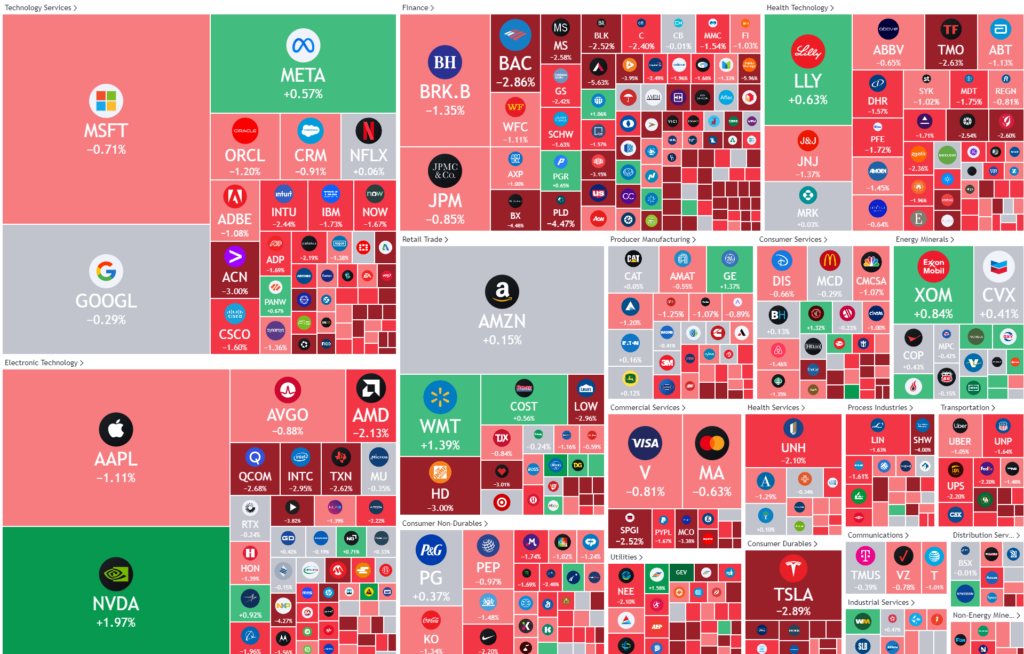

Equities pared back steep early losses to only finish down 1% after hotter-than-expected inflation data threw cold water on hopes that the Federal Reserve would begin cutting interest rates as early as June.

Headline U.S. consumer price growth accelerated in March, but growth in the underlying measure remained unchanged, which could further increase the uncertainty surrounding the timing of potential Federal Reserve interest rate cuts this year. The annualized reading of the closely-watched consumer price index increased by 3.5% last month, above the pace of 3.2% notched in February, and more than the 3.4% expected. The year-on-year core figure, which strips out volatile items like food and fuel, stayed at 3.8%.

Minutes from the Fed’s March policy meeting also reflected concerns that inflation’s progress toward that target might have stalled, and restrictive monetary policy may need to be maintained for longer than anticipated.

All three major U.S. stock indexes veered sharply lower at the opening bell after the Labor Department’s Consumer Price Index (CPI) report landed north of consensus, a reminder that inflation’s road back down to the Fed’s 2% target will remain a long and meandering one.

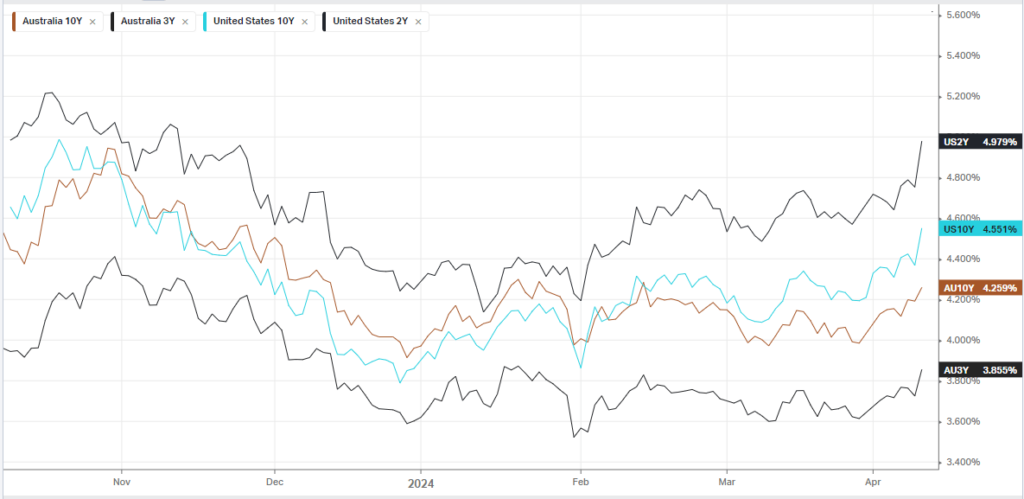

Equity prices were further pressured by benchmark Treasury yields, which breached 4.5% to touch the highest level since November. Interest rate-sensitive stocks were hardest hit, with real estate primed for its biggest one-day percentage drop since June 2022. Housing stocks registered their biggest daily decline since Jan. 23 and the Russell 2000 notched its steepest one-day slide since Feb. 13.

Oil reversed earlier losses and quickly moved higher after it was reported that the US and its allies believe major missile or drone strikes by Iran or its proxies against military and government targets in Israel are imminent.

Investors will now focus on tonight’s PPI (producer prices) for a clearer picture of March inflation, a definite risk with the recent rise in commodity prices. Friday also sees the unofficial kick-off of first quarter earnings season with a trio of big banks – JPMorgan Chase, Citigroup and Wells Fargo

The US2Y yield is now sitting just under 5% and any significant breach above the 5% level is likely to be significant for equity markets, particularly leading into the seasonally weak month of May

Bonds

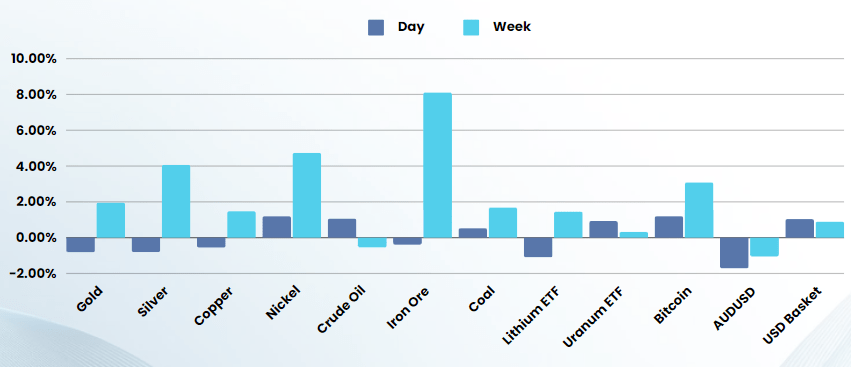

Commodities & FX

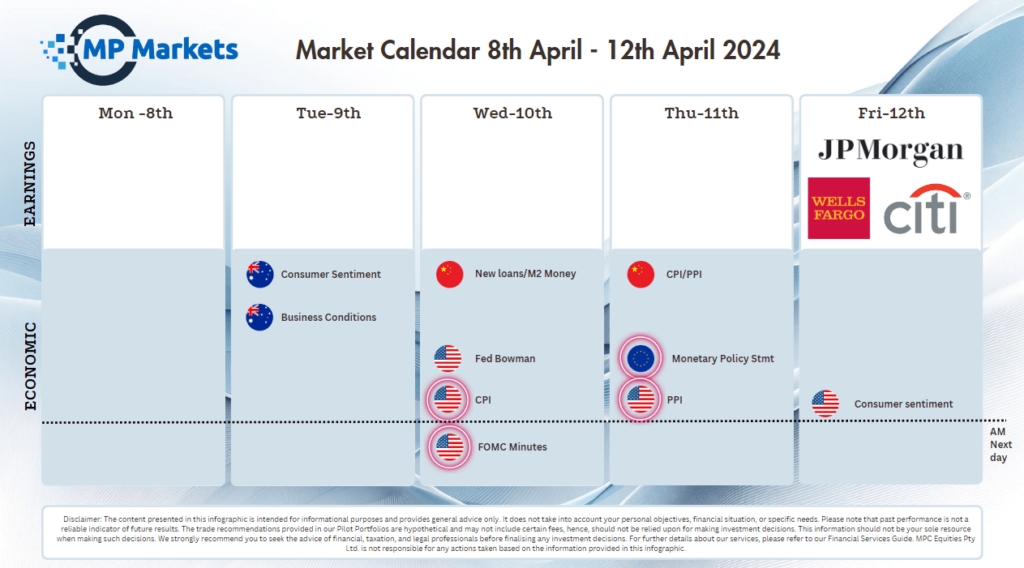

The Day Ahead

ASX SPI 7828 (-0.82%)

The surprise inflation data in the US will see broad weakness in the AU market today, with the REITs sector the most likely to bear the brunt of the down move due to the large spike in global yields.

Locally, traders will look to Chinese inflation data due out in the late morning for an update on the state of the world’s second-biggest economy. This may save the local index if there is an uptick in the Chinese economy