Last Night's Market Recap

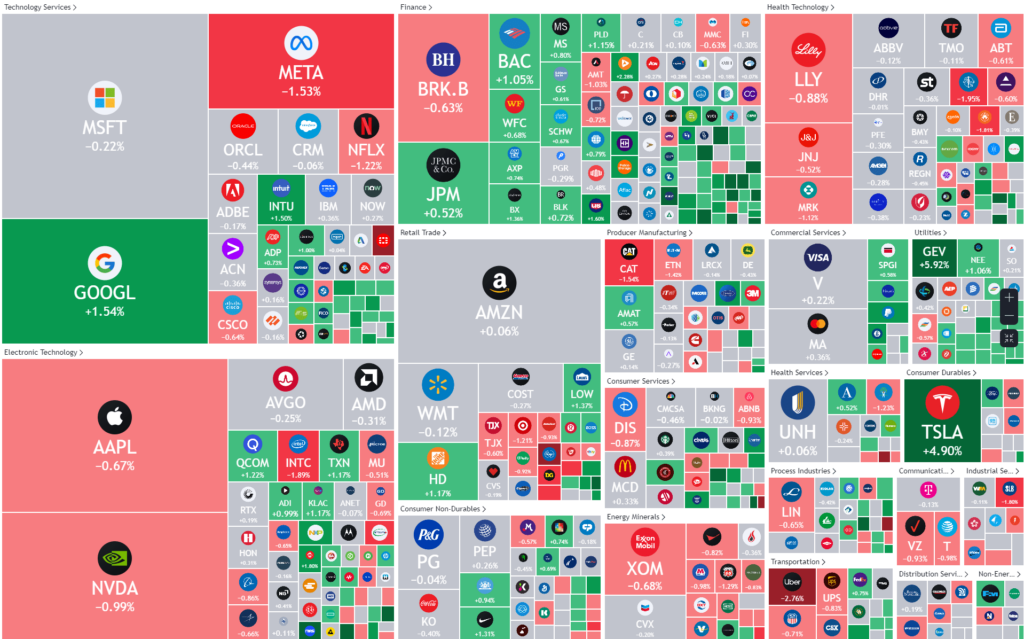

S&P 500 - Heatmap

Overnight – Stocks finish flat as investors are wary into key inflation data

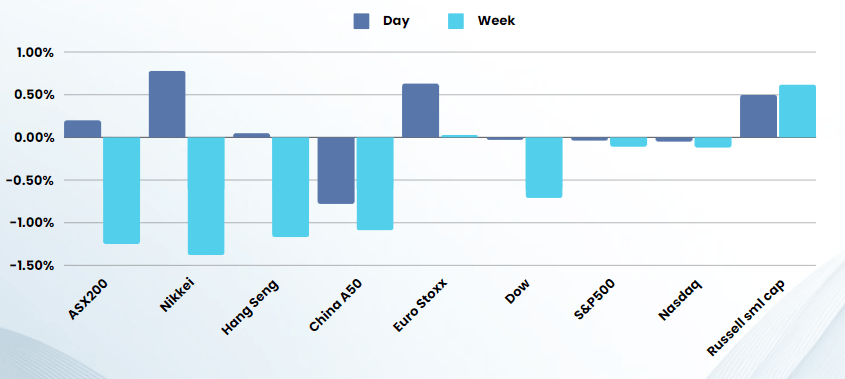

Equities closed flat overnight amid cautious trading ahead of the latest inflation reading as well as the start of the first-quarter earnings season later this week.

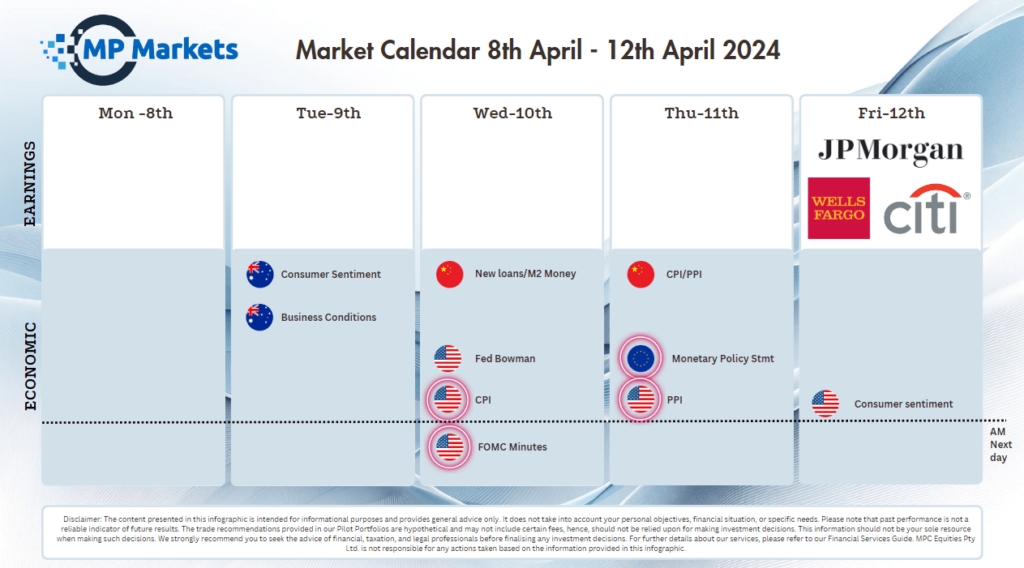

The consumer price index and the core inflation, which strips out volatile food and fuel costs, for March due Wednesday, are expected to show a cooling to a 3.7% pace in the 12 months through March from from 3.8% the prior month. As well as U.S. inflation, the Bank of Canada decision, FOMC minutes and Chinese inflation are also slated for Wednesday. The upcoming FOMC minutes from its March minutes will provide more cues on potential rate cuts as well as plans for the central bank to rein in its quantitative tightening program. “The March FOMC meeting minutes could reveal more details of the discussion surrounding the balance sheet. We also expect to see some discussion of the supply side improvement,” UBS said in a note. Traders now see a roughly 51% chance for a 25 basis point cut in June, according to the CME Fedwatch tool.

Major Wall Street banks will kick off the earnings season in earnest later this week, with many eager for evidence on whether the upcoming earnings can justify recent run-up in stocks. Major U.S. lenders JPMorgan Chase, Citigroup, and Wells Fargo will report earnings on Friday. Delta Air Lines and top asset manager BlackRock will also provide quarterly updates during the week. This reporting season, investors will be focused on the breadth of corporate profits vs. strength in the largest TECH+ stocks

Boeing stock fell 0.8% after an engine cover on a Southwest Airlines aircraft – a Boeing 737-800 – fell off during take off in Denver and struck the wing flap, adding to the aircraft manufacturer’s recent malfunction issues. Tesla rebounded 5% following its recent malaise after the electric vehicle maker said late Friday that it would unveil its robotaxi design on Aug. 8. Taiwan Semiconductor Manufacturing’s Arizona unit stuck an agreement with the Commerce Department, securing up to $6.6 billion in funding from the CHIPS and Science Act that looks to bolster domestic chipmaking activity.

Energy stocks were flat, pressured by falling oil prices as rising hopes for a possible ceasefire in the Israel-Hamas conflict eased concerns of supply disruption from the oil-rich Middle East. Teams from Israel and Hamas met in Egypt for renewed ceasefire talks, just days before the Eid holidays this week, while Israel pulled out some troops from southern Gaza. APA Corporation, Phillips 66, Schlumberger NV were the among the biggest losers in the energy sector.

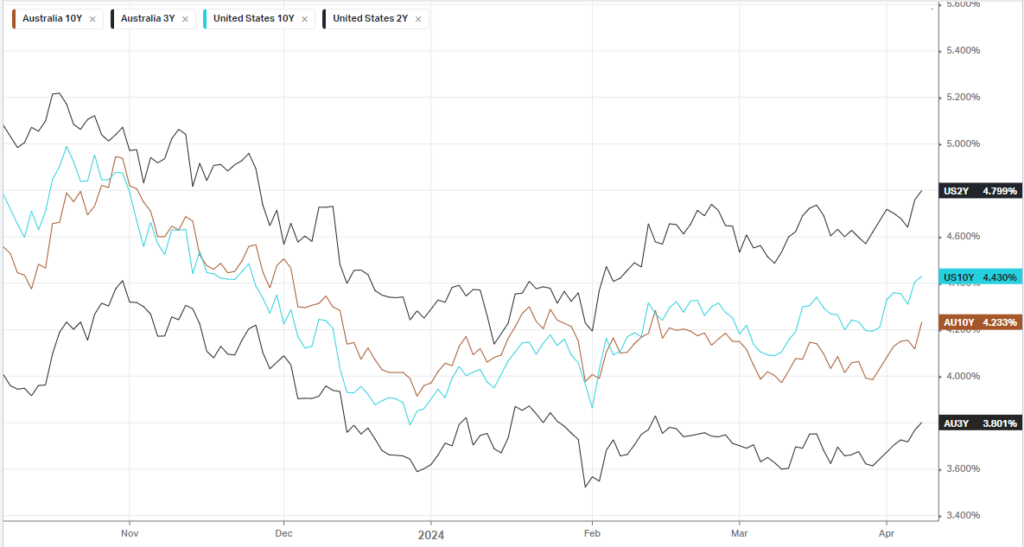

Bonds

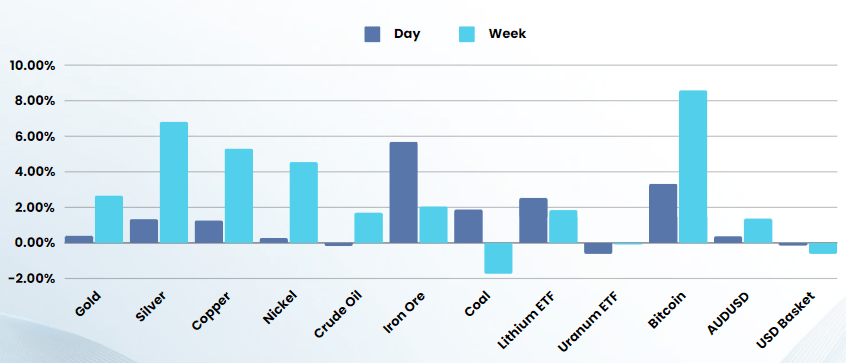

Commodities & FX

The Day Ahead

ASX SPI 7866 (+0.45%)

The continued run in commodity stocks should see the ASX perform well today, held up by the materials sector. These gains are likely to be capped by higher yields, which are at their highest point since November last year.

Company Specific:

- New Zealand’s Synlait Milk has appointed Charles Fergusson as acting chief financial officer. He will retain his role in OnFarm Excellence, Business Sustainability, and Corporate Affairs.

- Woolworths, Coles, Wesfarmers Bunnings slammed a push by Woolworths for the code governing supplier relationships to be expanded to cover rivals Amazon, Costco and Chemist Warehouse, saying it would do little to lower prices and imposed a one-size-fits-all approach on unrelated business operations.

- IAG, QBE The Albanese government will push insurers to cut costs for households that take steps to reduce their risks amid soaring double-digit premium growth that is expected to continue in 2024.

- Rio Tinto, BHP Rio Tinto’s shares will grow at more than twice the rate of its major rival BHP, according to investment bank brokers, who say the miner is best placed for a boom in base metals.