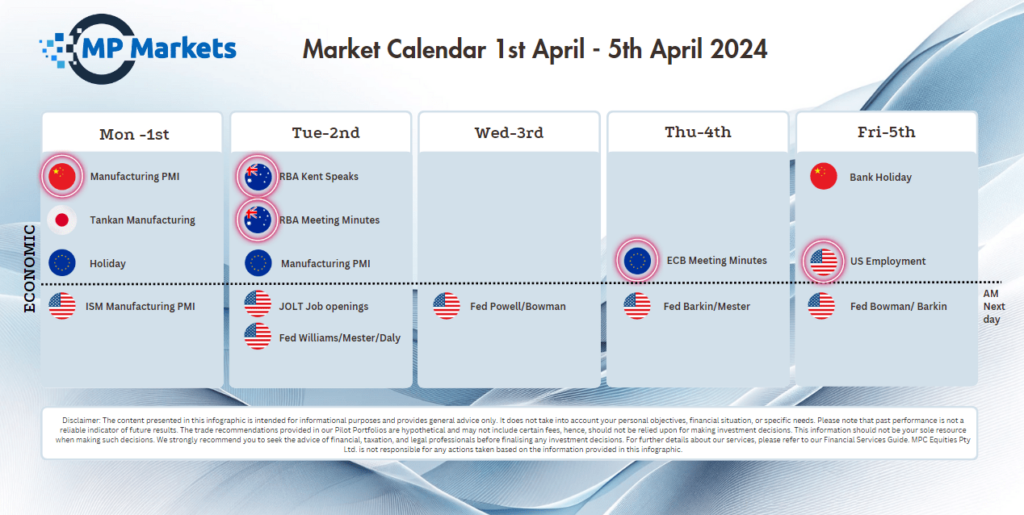

Last Night's Market Recap

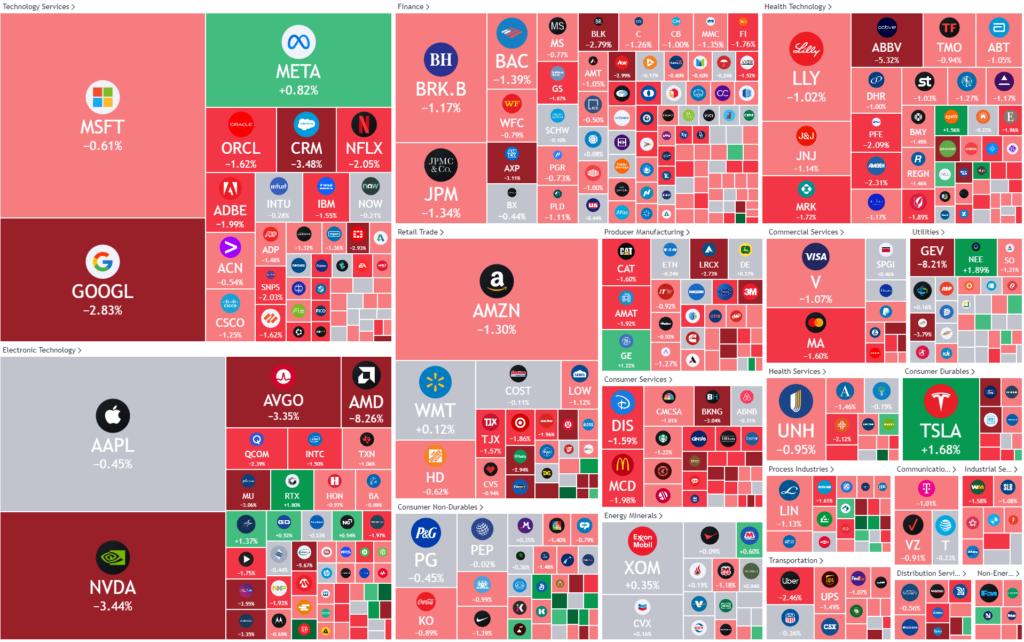

S&P 500 - Heatmap

Overnight – Rising geopolitical tensions rattle stock market bulls

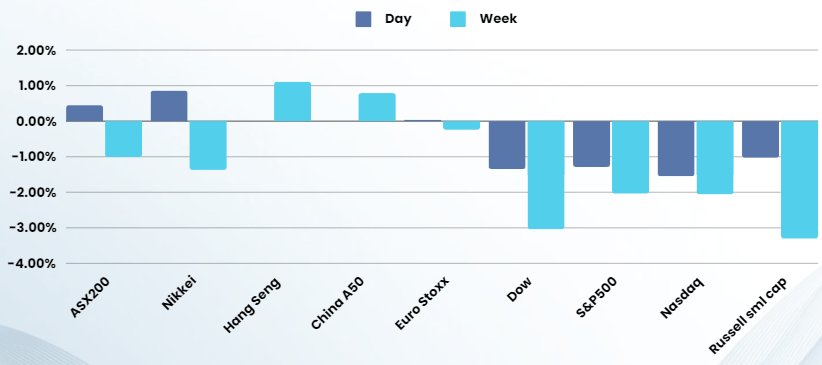

Equities gave up intraday gains on rising geopolitical tensions and hawkish remarks from Federal Reserve officials just ahead of the crucial monthly jobs report due Friday.

Geopolitical tensions ratcheted up amid fears skirmishes between Israel and Iran are set to escalate. Israeli Prime Minister Benjamin Netanyahu vowed to operate against Iran and its proxies in the face of imminent threat expected from Iran. The remarks come just days after Iran vowed to seek revenge for an alleged Israeli attack on its consulate in Syria.

As well as geopolitical tensions, further remarks from Fed officials calling for patient on rate cuts continued to dominate attention. Minneapolis Fed president Neel Kashkari saying no rate cuts would be needed this year should the trend of cooling inflation fade.

The number of Americans filing new claims for unemployment benefits increased more than expected last week, according to data released earlier Thursday, with claims rising 9,000 to a seasonally adjusted 221,000 for the week ended March 30. This was above the 214,000 expected. Claims had bounced around between 212,000 and 210,000 for much of March, and this rise suggested that labour market conditions were weakening. Signs of cooling in the labor market, come just days before Friday’s closely-watched nonfarm payrolls release for March.

Apple, Amazon, Microsoft, Nvidia and Meta gave up the bulk of gains, and the latter eased from a record high despite positive remarks from brokers.

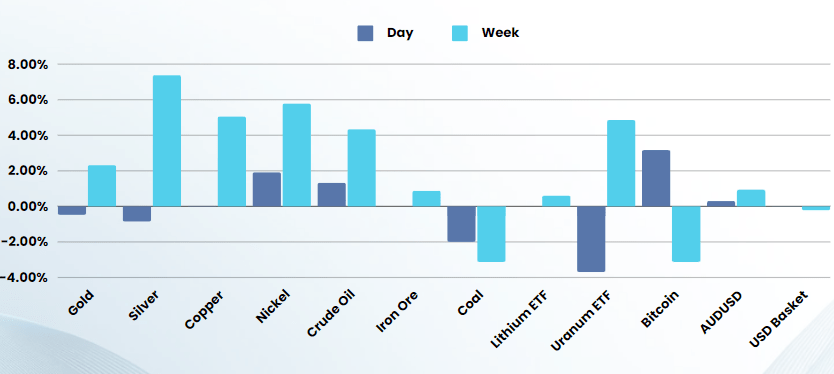

Oil rose to another 5-month high on the geopolitical tensions, however gold and silver both had a breather as rising yields finally started to restrict the rally

US Jobs data tonight are expected to rise another 220k, which would bring 2024’s total jobs added to the economy to over 1 million. The strength in the jobs market is currently at its highest 3-month average in over 15-months, making it very unlikely that the Fed will be forced to cut rates anytime soon

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7803 (-0.80%)

The ASX is in for a soft day leading into the weekend with key US economic data and a high chance of geopolitical escalation in the Middle East. Given we are close to record highs, it seems logical that some profit taking will emerge which will drive down prices over the course of the day