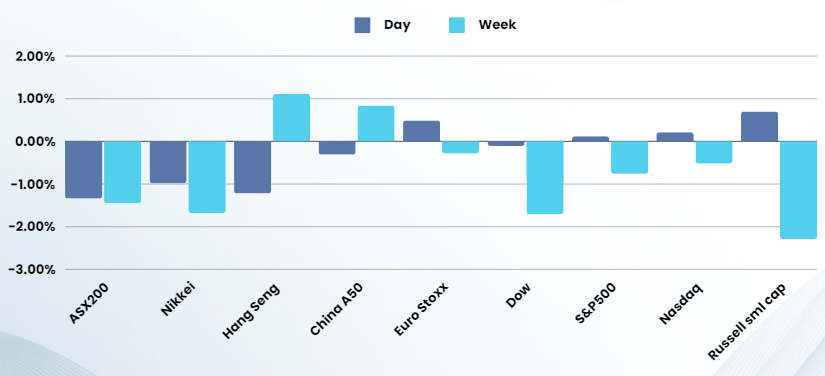

Last Night's Market Recap

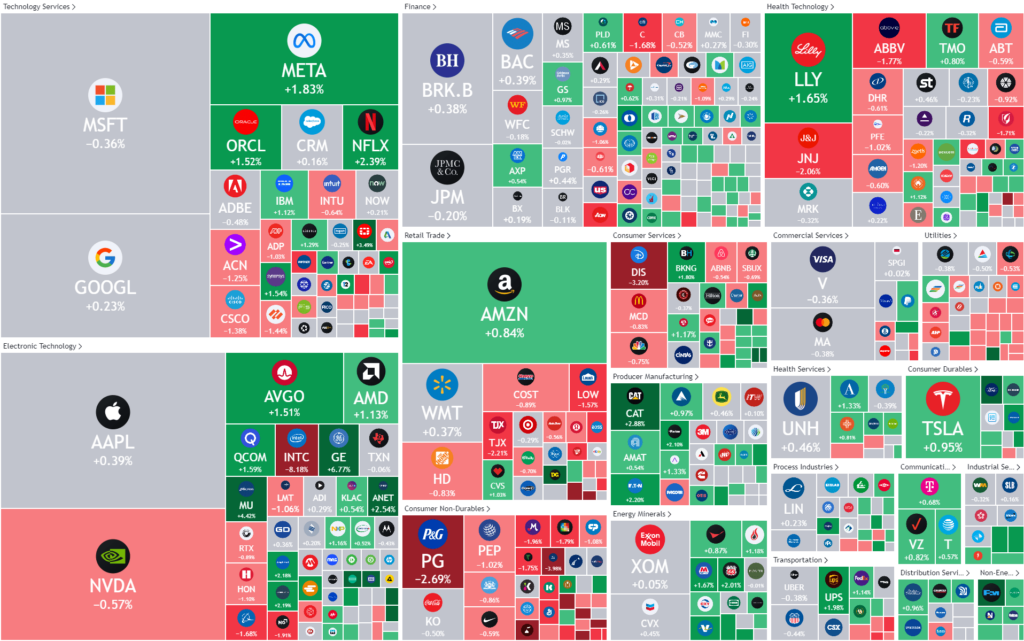

S&P 500 - Heatmap

Overnight – Gold, Silver and equities rally as Powell says rate cuts “still a chance”

Equities had a relief rally as Fed chair Powell said rate cuts remain on the table for this year, easing some investor fears that the recent strength of the economy would persuade the Fed chief to turn more hawkish.

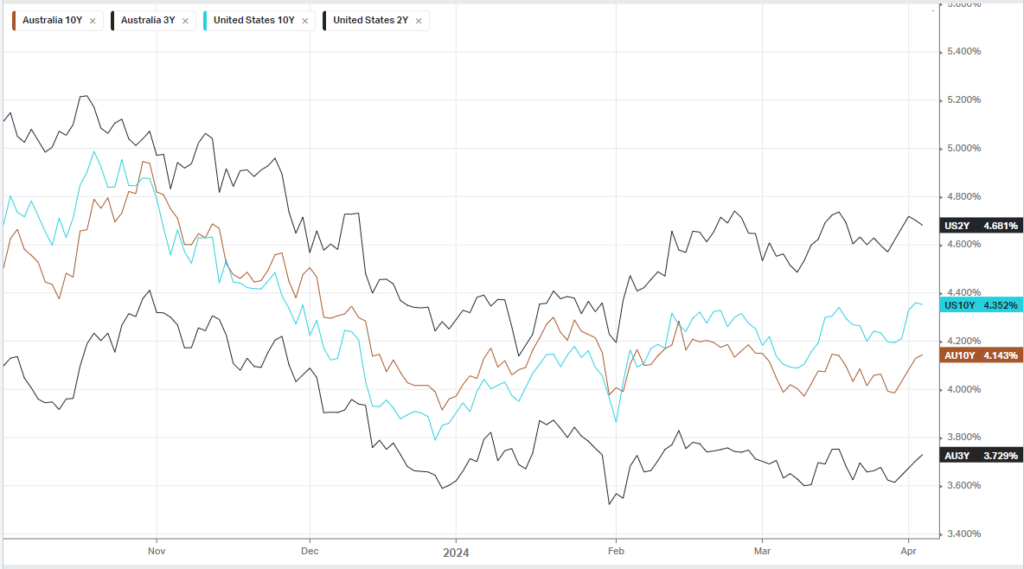

Powell said Wednesday most voting Fed participants support lowering interest rates at some point this year, but not until the central bank has greater confidence from incoming data that inflation is on a sustainable move lower. In a sign that the Fed chief continues to believe a soft landing for the economy remains intact, Powell said recent data pointing to strong economic growth and hotter inflation haven’t materially changed the Fed’s outlook, which continues “to be one of solid growth, a strong but rebalancing labour market, and inflation moving down toward 2 percent on a sometimes bumpy path.” Treasury yields were lower, but above the lows of the day, with the yield on US2Y dropping 2.7 basis points to 4.674%, while the US10Y 1.1 basis points to 4.352%.

The remarks arrived hours after data showed the U.S. private sector added far more jobs than expected in March, as private sector employment increased by 184,000 jobs last month, according to payrolls processor ADP. This was the largest increase in hiring since July, above the 148,000 expected, with job gains strong across industries with the exception of professional services.

Intel fell more than 8% after it disclosed $7 billion in operating losses for its foundry business through 2023, as it lost out more business to Asian rivals including TSMC and Samsung. The update comes ahead of the chipmaker’s earnings slated for Apr. 25, which would likely reflect the headwinds including a loss of server market share to AMD

Taiwan Semiconductor Manufacturing stock rose 1.4% after a severe earthquake on the island prompted the chip maker to halt production at some of its facilities.

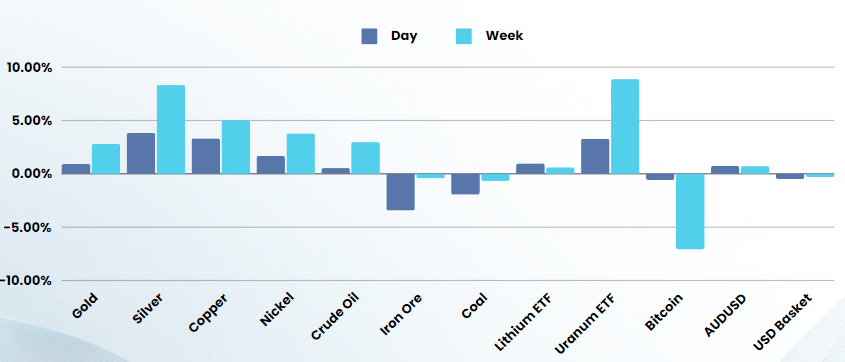

The less hawkish message from the Fed drove gold higher, however the move was eclipsed by Silver, jumping another 4% to be up 8.5% in 2-days at 52-week highs.

Oil, Copper and Uranium also had a solid rally as investors remained deluded that rate cuts and a strong economic numbers are not mutually exclusive

Bonds

Commodities & FX

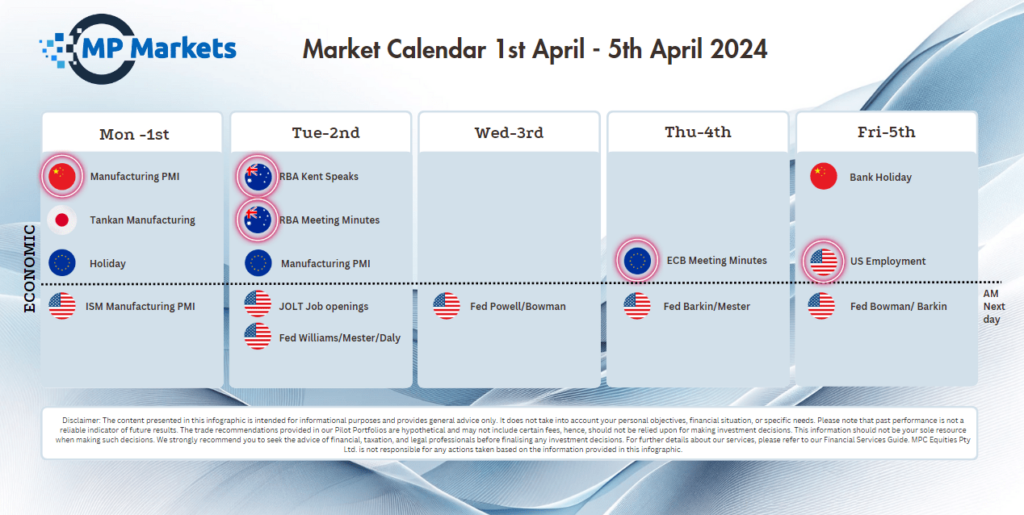

The Day Ahead

ASX SPI 7855 (+0.33%)

The ASX should bounce back today led by Gold and energy. We don’t expect a significant rally, with likely pockets of weakness in the tech and consumer discretionary sectors. We may see some profit taking in the backs as Investors get nervous at currently over inflated prices as a recent string of developer defaults is signaling the property market could be topping out due to over-leverage

Company Specific:

- Scentre Group hosts an AGM. ARB Corp shares trade ex-dividend on Thursday.

- Windsome Resources announced a plan to purchase a diamond processing plant for repurpose to lithium refining in Canada