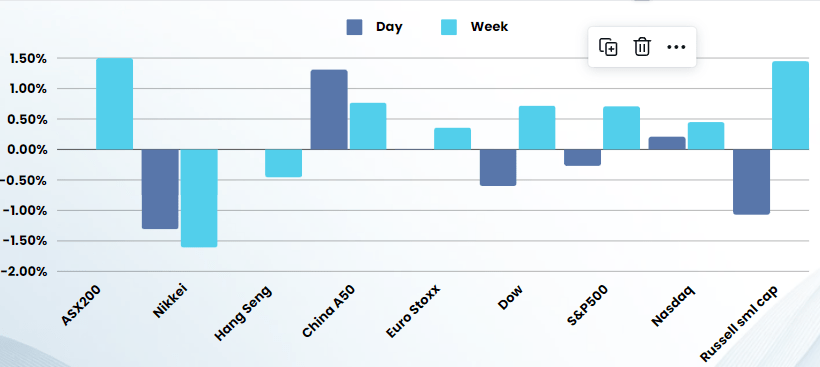

Last Night's Market Recap

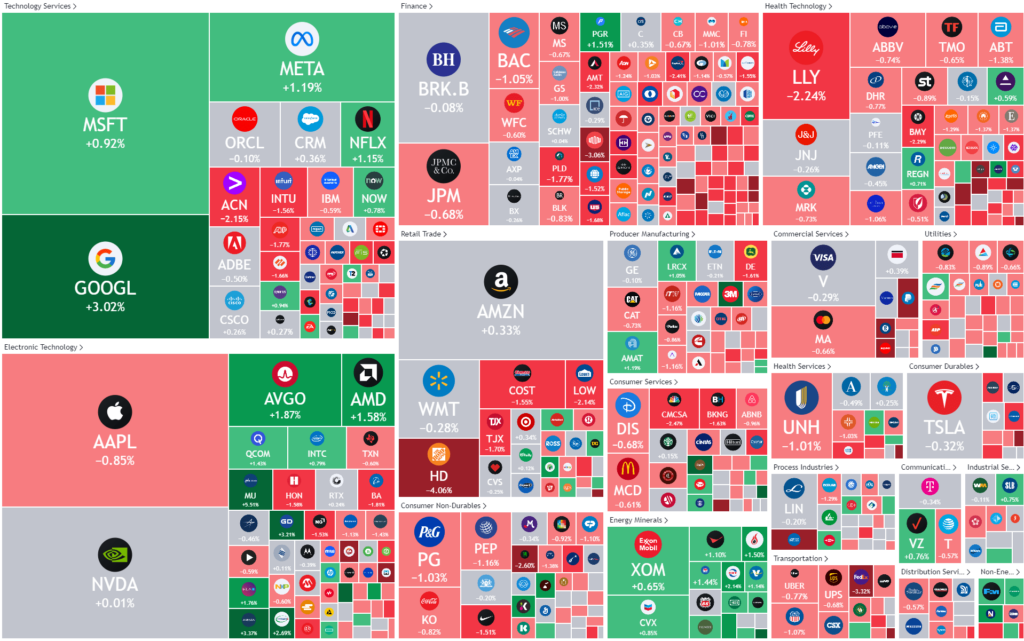

S&P 500 - Heatmap

Overnight – Rate cut hopes continue to fade as Inflation & Manufacturing data edge higher

Friday: Equities ground higher before the long weekend as PCE data came in higher than expected, Powell said the inflation number was “as expected” and Chinese Manufacturing data expanded for the first time in 6 months

Data on Friday showed the PCE price index increased at a 2.5% annual rate in February, up from 2.4% in the prior month. The number excluding volatile food and energy prices rose 0.3% on a month-to-month basis, slightly faster than Powell anticipated. Some details of the PCE data for February, economists noted, showed improvement in aspects of inflation that the Fed considers important, even as the headline numbers have shown little progress in the first two months of the year.

“We need to see more” progress on inflation before cutting rates, he said on Friday. “The decision to begin to reduce rates is a very, very important one … The economy is strong right now, and the labor market is strong right now. And inflation has been coming down. We can and we will be careful about this decision because we can be.”

China’s manufacturing activity expanded for the first time in six months in March, an official factory survey showed on Sunday, offering relief to policymakers even as a crisis in the property sector remains a drag on the economy and confidence. The official purchasing managers’ index (PMI) rose to 50.8 in March from 49.1 in February, above the 50-mark separating growth from contraction and topping a median forecast of 49.9 in a Reuters poll.

Monday: The Institute for Supply Management (ISM) said its manufacturing PMI increased to 50.3 last month, the highest and first reading above 50 since September 2022, from 47.8 in February. It suggested the manufacturing sector, which has been battered by higher interest rates, was recovering.

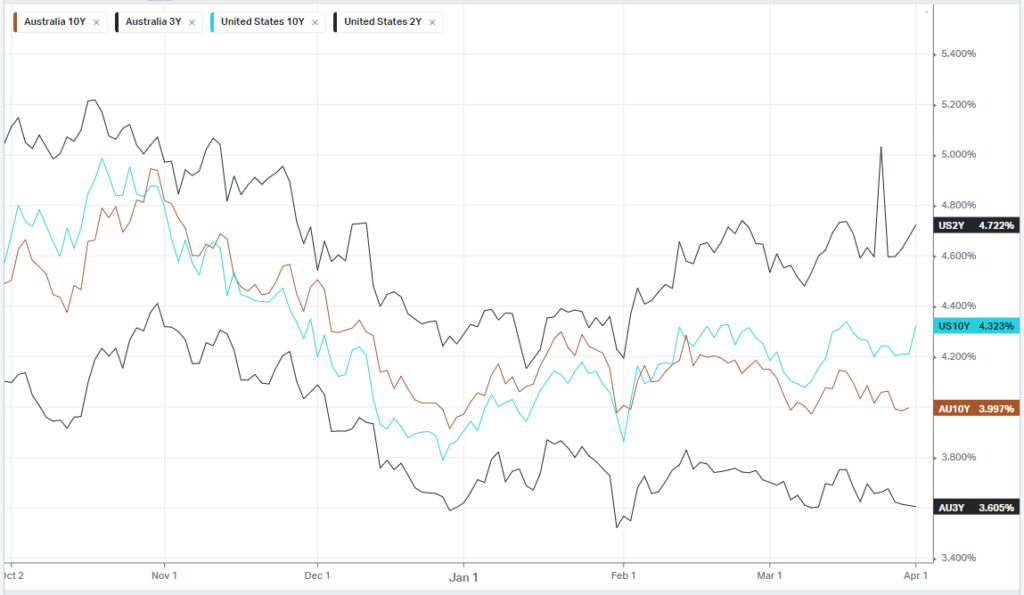

Bond yields jumped to 4-month highs, putting pressure on the “Goldilocks scenario” that has fueled 2 consecutive quarters of double digit gains in the US equity market.

Bonds

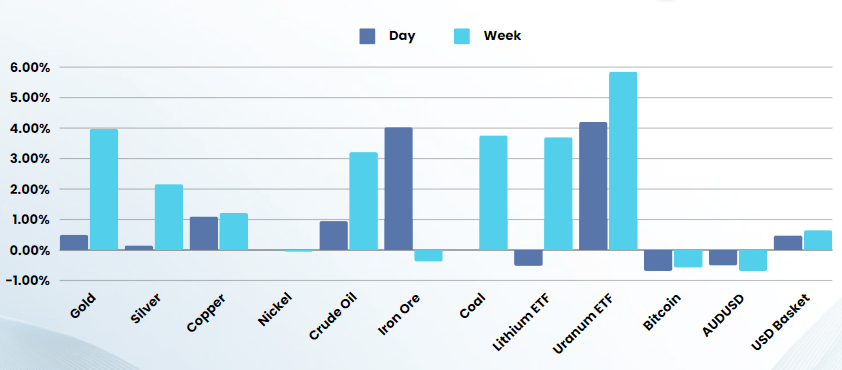

Commodities & FX

The Day Ahead

ASX SPI 7924 (+0.02%)

With the rally in Iron ore, Oil, Gold and lithium, the ASX should have a pretty positive day, despite the US falling away into the close due to higher bond yields. Christopher Kent from the RBA speaks mid-morning.

The rate cut bulls will be tested globally with a string of stronger than expected economic numbers recently. The strength not only gives space for central banks to be patient, but further persistence will start to bring any rate cuts into question

Company Specific:

- Treasury wines has lifted the prices of Penfolds with the Chinese government officially lifting Australian wine tariffs

- Nickel miners will be watched closely this morning after the Indonesian government forecast that nickel exports would quadruple by 2030, despite a supply glut that has already prompted several Australian operations to curb production and close mines.