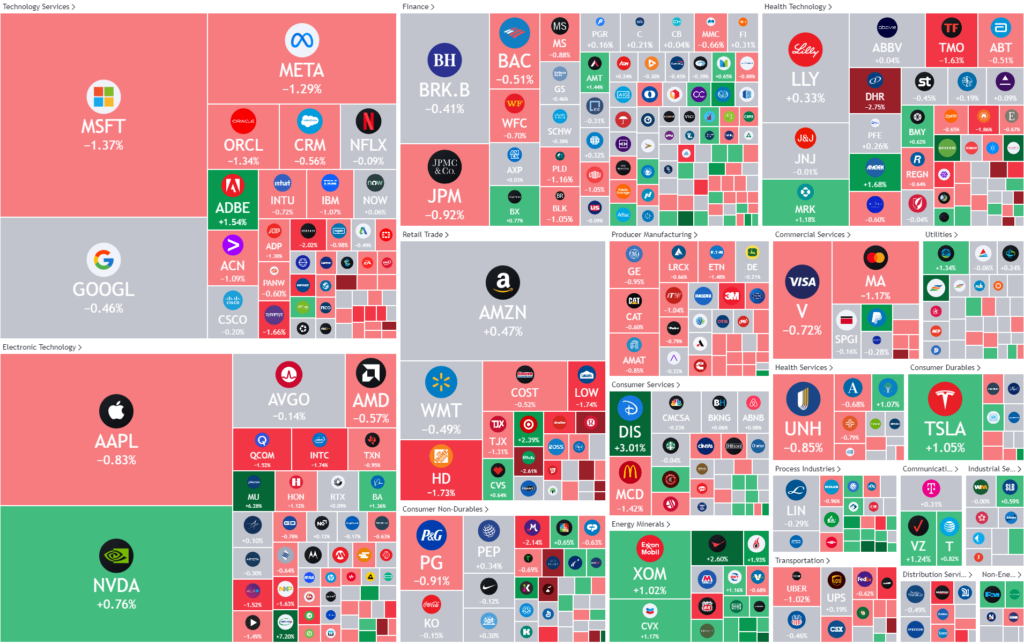

Last Night's Market Recap

S&P 500 - Heatmap

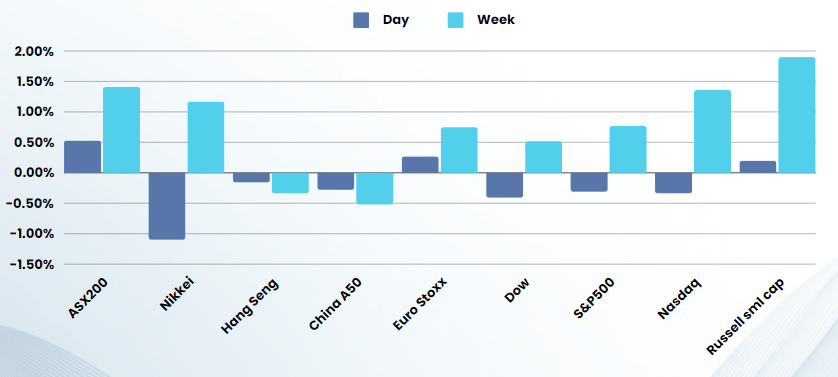

Overnight – Equities drift lower as Tech bulls take a day off

Equities closed lower Monday as big tech took breather ahead of key market-moving events this week including an update on inflation and remarks from Federal Reserve officials.

Atlanta Federal Reserve Bank President Raphael Bostic reiterated Monday that he sees the need for just one rate this week, adding that the strong economy allows the central bank to continues with its cautious approach. Fed governor Lisa Cook also reiterated the need for the bank or proceed carefully on rate cuts. The somewhat less dovish remarks were in contrast to Fed chairman Powell’s speech last week following the central bank’s signal that three rate cuts remain on the table for 2024. Further Fed speak will follow later this week, with remarks from Fed governor Christopher Waller and chairman Jerome Powell likely to garner the bulk of investor attention. Personal consumption expenditures data, which is the Fed’s preferred inflation gauge, is due this Friday, when the market is on holiday for Good Friday. Traders now see a 75% chance of the Fed bringing in the first cut in June, according to the CME FedWatch tool, up from around 55% at the start of last week.

Super Micro Computer jumped more than 7% after JPMorgan started coverage on the company at overweight with a $1,150 amid optimism about an acceleration in server demand to support the AI revolution. Still, sentiment on chips were soured after China blocked the use of Intel and AMD chips in government computers. In other tech news, Apple, Meta Platforms and Alphabet stocks were in the red after EU antitrust regulators launched investigations into the tech giants for potential breaches of the Digital Markets Act, potentially leading to hefty fines for the companies.

Oil prices settled higher Monday, driven by growing bets on tighter global crude supplies as Russia is reportedly set to cut oil output at a time when Ukraine continues to target the country’s refineries.

A de-escalation in the Israel-Hamas conflict would likely soothe concerns over geopolitical instability in the oil-rich Middle East region. APA Corporation, Copper Futures, Coterra Energy were among the biggest gainers.

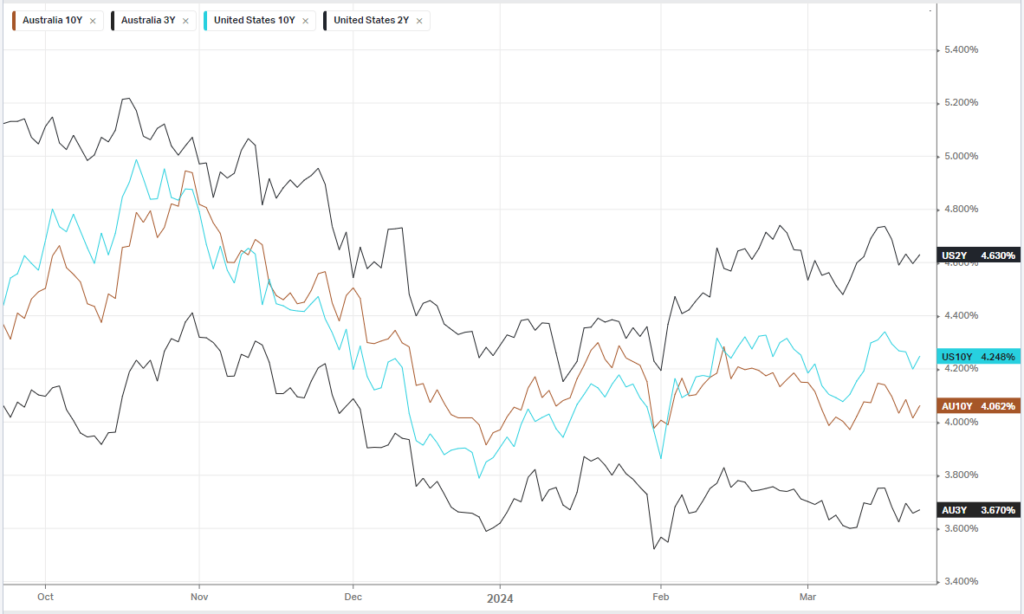

Bonds

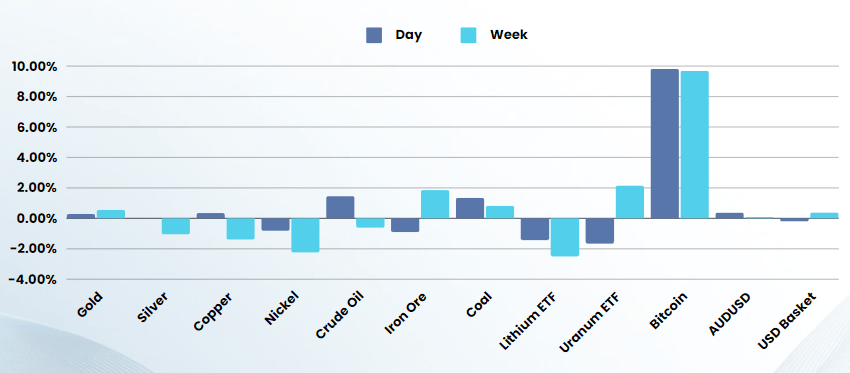

Commodities & FX

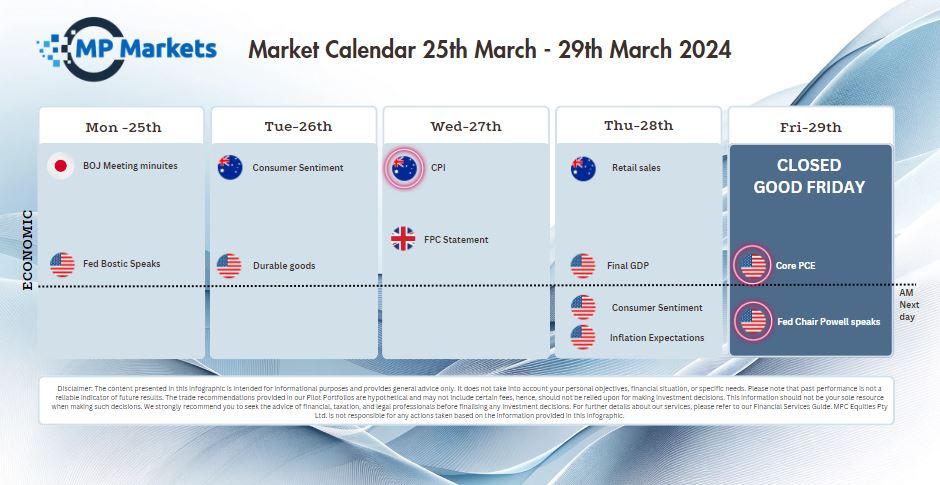

The Day Ahead

ASX SPI 7836 (-0.04%)

The AU market will drift off today on a weak US lead and nerves into tomorrows CPI data. It is likely to be a low volume day as the combination of a shortened week and inflation data being released give little reason for investors

Company Specific:

- Goodman Grouphosts an investor meeting on Tuesday. Atlas Arteria and Flight Centre shares trade ex-dividend.

- Kerry Stokes’ Seven Group has hit back at the independent review that recommended Boral shareholders reject its takeover offer brought forward earlier this year.