Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Tech bulls nervous before next weeks Fed meeting

Equities sold off again on Friday as tech was pressured by rising Treasury yields on jitters the Federal Reserve is likely to stress the need for interest rates to remain higher for longer following data showing inflation continues to run hot.

Major indexes registered slight declines for the week. The Dow was down 0.02%, the S&P 500 was down 0.1% and the Nasdaq was down 0.7%. The small-cap Russell 2000 index fell 2.1% for the week.

Friday also marked the simultaneous expiry of quarterly derivatives contracts tied to stocks, index options and futures, also known as “triple witching,” which can boost volume. Friday’s volume was the year’s highest by far on U.S. exchanges, with 18.76 billion shares traded. The average volume for a full session over the last 20 trading days was about 12.4 billion.

Treasury yields in the US10Y and the US2Y neared 4 month highs, as bets on sooner Fed rate cuts suffered a blow from recent data showing a faster-than-expected pace of inflation at time when the consumer strength appears to be waning. The University of Michigan’s consumer sentiment index fell to a reading of 76.5 from 76.9 in February, according to preliminary results, missing economists estimates of 77.4. About 55% of traders expect a June rate cut, slightly down from 58% last week.

Big tech was in the firing line, dragging the broader market lower, as rising Treasury yields weighed on growth sectors of the market. As well as a stumble in big tech, a nearly 14% slump in Adobe also weighed on sentiment after the software maker reported weaker-than-expected second quarter revenue guidance on higher competition and weak demand for its AI offerings. Micron Technology however, shrugged off the broader market selloff after Citi named Micron one of its top picks and hiked its price target on the stock by $150 from $95 as the memory chip maker increased exposure to artificial intelligence is expected to boost growth.

Crypto rediscovered gravity, performing a sharp U-turn from record highs, falling more than 10% early in the session before it moved off session lows. The dip-buying in bitcoin comes just ahead of its eagerly awaited halving event that will cut rate of new bitcoin generated in half, likely increasing the scarcity premium in the popular crypto.

Bonds

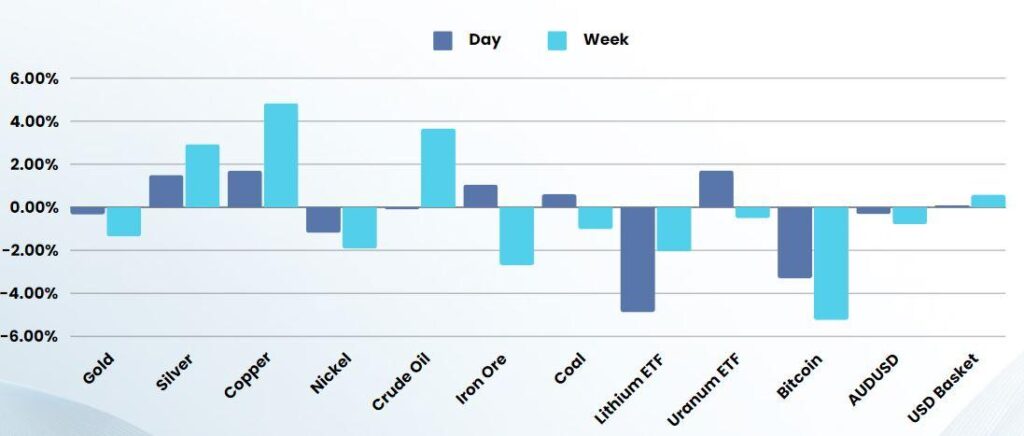

Commodities & FX

The Day Ahead

ASX SPI 7659 (-0.01%)

We are likely in for a relatively quiet day with the Fed meeting mid-week the main focus for markets this week. Iron ore and lithium having a small rally after days of selling may stabilize the materials sector, along with the rise in Copper and Silver. The energy sector should also remain buoyant as oil held its ground and Uranium bounced from its recent lows. Tech will be the laggard, but merely a retracement in the scheme of things