Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Investors ignore hot inflation numbers and buy the dip in tech

Investors ignored a hotter-than-expected inflation and twisted the narrative to “the consumer is resilient“ and bought the dip in tech stocks.

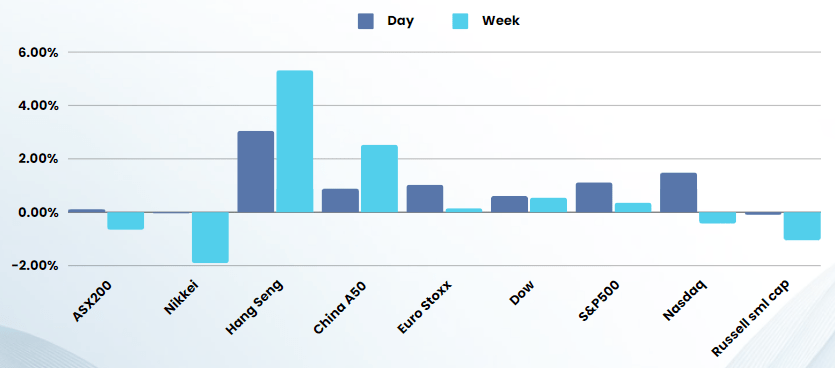

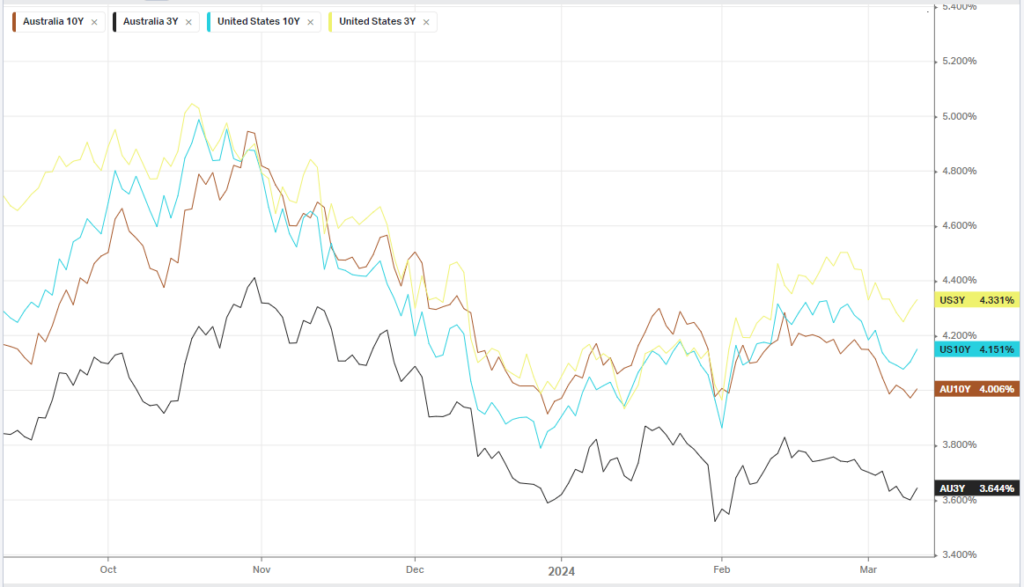

Inflation came in hot, again, with the core gauge 0.4%, which strips out volatile items like food and fuel, matching the prior month and marginally hotter than expectations of 0.3%, taking the year-on-year pace to 3.8% from 3.9%, but that was still slightly above projections of 3.7%. The hotter-than-expected pace of inflation will yet again push back speculated rate cuts from the Fed. A continuation of rising inflation in the coming months may force the cuts to be taken off the table completely. Treasury yields moved higher on the prospect of higher for longer interest rate path, but that did little to stem bullish bets on tech, led by Oracle and a rebound in Nvidia.

Oracle Corp surged nearly 12% after reporting stronger-than-expected quarterly earnings on increased demand for its AI offerings. The cloud computing firm said it will make a joint announcement with AI darling Nvidia this week, citing expectations of increased AI-led demand for cloud infrastructure. NVIDIA jumped more than 7%, lifting the broader chip sector more than 3% higher, while megacap tech including Google, Microsoft and Meta were also in the ascendency.

Industrials, however, lagged the broader market move higher, weighed down by slump in airline stocks and a more than 4% slump in Boeing after the aircraft maker reportedly failed 33 out of 89 audits during Federal Air Aviation examination. The whistleblower was then found dead from an apparent “suicide” due to the investigation that was launched after an air panel blew off an Alaska Airlines Boeing 737 Max plane mid-flight. Southwest Airlines, down nearly 15%, led the move in airline stocks lower after cutting its first-quarter guidance on capacity, and warning that it was reevaluating full-year outlook amid delays of aircraft delivery from Boeing. American Airlines fell more than 4% after warning of a bigger loss this year owing to higher fuel costs.

Bonds

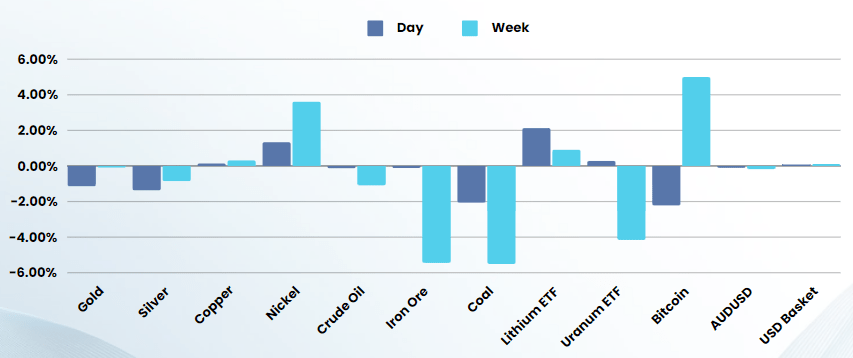

Commodities & FX

The Day Ahead

ASX SPI 7729 (+0.18%)

The ASX is likely to stabilize and edge higher on the offshore lead. Despite the rally in the US, the inflation data remains very high and the tech investors will not be able to ignore key economic data forever. We see the current market at a high risk of a sharp retracement in valuations for AI related stocks, which could trigger a broader move down

Company Specific:

- Shares of Brambles, Data#3, Downer EDI, Imdex, Pepper Money and Perpetual all trade ex-dividend on Wednesday.

- The CEO of Treasury Wines, Tim Ford, is “pleased” by the Chinese Ministry of Commerce’s draft intention to remove tariffs on Australian wines.