Last Night's Market Recap

S&P 500 - Heatmap

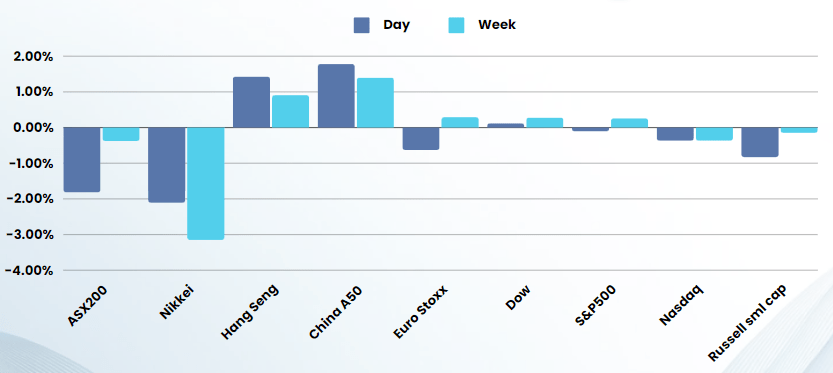

Overnight – Tech bulls continue to take profit ahead of Inflation data

Tech stocks drifted lower overnight as investors took some profits ahead of US CPI data Tuesday night which will be key in shaping the Federal Reserves next move on interest rates

The consumer price index data is due next session and will be watched closely for clues on the path of US interest rates and the economy. The reading is expected to show some easing in inflation after outsized CPI readings for the past two months, although the annual core figure is still expected to remain well above the Fed’s annual 2% target. The data comes in the wake of strong employment numbers that forced some analysts to ditch May rate hike predictions, with June now more favoured by analysts, MPC’s view is late Q3 this year

Fed Chair Jerome Powell, as well as several other central bank officials, had signaled last week that they were still seeking more signs that inflation was weakening, before the bank would consider cutting interest rates.

Meta fell more than 4% at the market open on Monday to $478.7, its lowest point in nearly a month, as former President Trump slammed TikTok and Facebook, calling them the “enemy of the people” and a report was released saying that Facebook Marketplace users are encountering numerous issues, including counterfeit listings, fraudulent payment schemes, or receiving products that don’t live up to their descriptions on the platform.

In the Healthcare sector, Moderna rallied 10% due to information on a government trial website, the drugmaker is beginning a mid-stage study to try its experimental cancer vaccine in patients with cutaneous squamous cell carcinoma, a form of skin cancer. The trial is in collaboration with Merck.

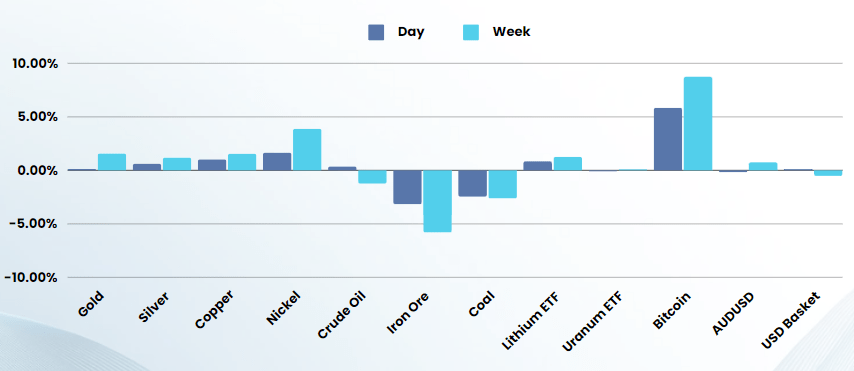

Bitcoin hit a record high on Monday above $72,000, as the biggest cryptocurrency’s surge showed no signs of slowing down. Bitcoin was last up 4.4% at $72,649 after reaching as high as $72,739. The world’s most valuable cryptocurrency has been boosted by a flood of cash into new spot bitcoin exchange-traded funds and hopes that the Federal Reserve will soon cut interest rates.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7719 (+0.06%)

The ASX is in for a quiet day ahead of key data in the US tonight. Shares in mining giants BHP, Rio Tinto and Fortescue may have a rough start after iron ore prices tumbled to their lowest in four months due to worries about the economic health of top consumer China. Iron ore futures skidded 6.8 per cent to $US107.35 a tonne in Singapore trading on Monday.

Shares of IGO, Lifestyle Communities and News Corp all trade ex-dividend on Tuesday.