Last Night's Market Recap

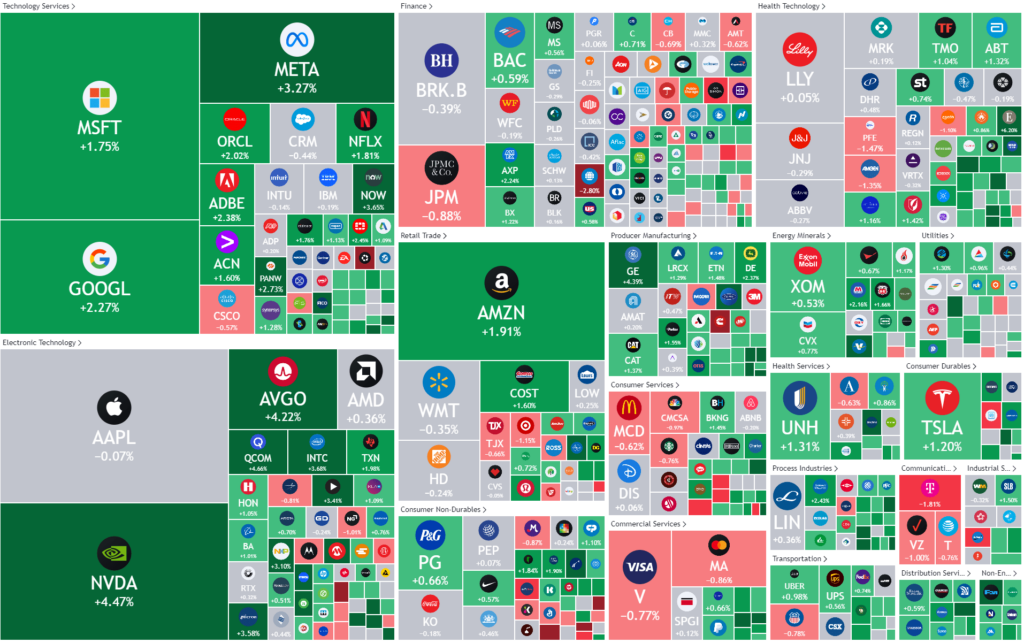

S&P 500 - Heatmap

Overnight – Nasdaq index Market Cap Exceeds value of US Economy Amid Tech Rally

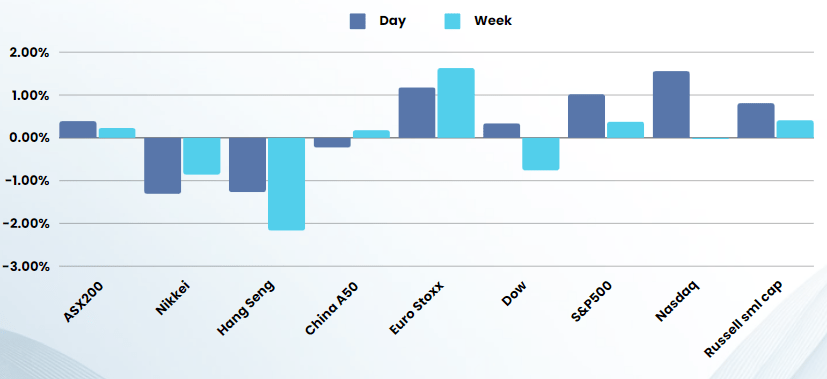

Stocks (once again) moved higher overnight, with the S&P 500 and Nasdaq both hitting intraday record highs with support from technology and growth stocks.

Fed Chair Jerome Powell said the U.S. central bank is “not far” from being confident that inflation is declining toward the 2% target, which would make rate cuts possible. His comments reinforced investor hopes for a first rate cut in June, boosting equity indexes that had faltered in the days leading up to the testimony. Fed Governor Michelle Bowman said the U.S. economy is not at the point where the central bank should reduce interest rates. The ECB also flagged rate cuts are in the pipeline, sending European yields lower.

The optimism this week around central banks signaling rate cuts is surprising given it is old news. If anything rate cut timing has actually been pushed back, which leads us to believe the central banks are more an excuse than a genuine catalyst

In particular, the Philadelphia Semiconductor index outperformed the broader market and hit a record high. The top percentage gainer was ON Semiconductor, up 7.8%. Nine the 11 major S&P 500 sectors rose, with communications services and information technology stocks jostling for position as the biggest gainer. Tech last had the lead with a 2% gain while communications services was up 1.9%.

Megacap stocks were the major contributors to gains, with current market darlings Meta & Nvidia up 3.5%-4% in a seemingly unstoppable rally where valuation seems to be irrelevant to the technical momentum. The Nasdaq index has now a combined market cap larger than the value of the entire US economy, a feat that should raise concerns about the extent of the recent rally.

All eyes will be on US employment data tonight, a strong number could derail the rally, although investors have been very good at finding the positive in anything released

Bonds

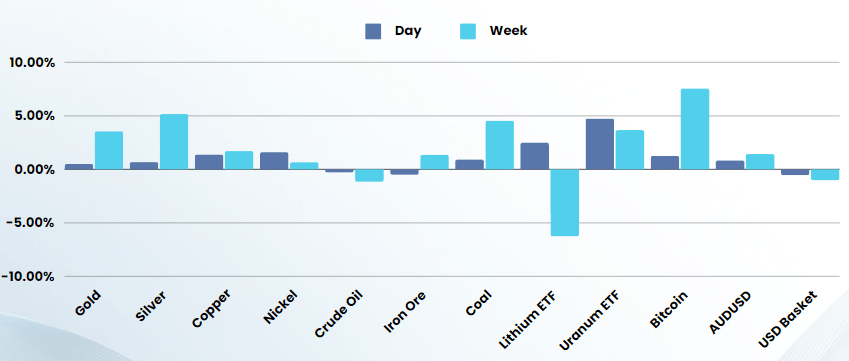

Commodities & FX

The Day Ahead

ASX SPI 7814 (+0.57%)

The ASX is in for a record close to end the week as US tech fuels the global equity rally. Gold, silver and copper continued their rally which will help the materials sector, while a 4% jump in global uranium stocks should help the energy sector higher.

To put Nvidia’s overnight rally of 4% in context, it rose more than the value of National Australia Bank (NAB) in a single session. We remain of the stance that caution is warranted as this rally has alarmingly similar qualities to the 2001 tech bubble. This does not mean the market will not continue to rally for the short term and trying to call a top in the market is a fools errand. We are focused on short to medium term trades with a catalyst, we feel there is far too much risk in buying long-term holdings at these highs

Stocks to watch: Shares of Insignia Financial, Nine Entertainment and WiseTech Global all trade ex-dividend. IPD Group hosts an investor meeting. Virgin Money gets $5.7b privatisation offer Britain’s sixth-largest bank, dual-listed on the ASX and in London, would be taken over by the mutually owned Nationwide Building Society.