Last Night's Market Recap

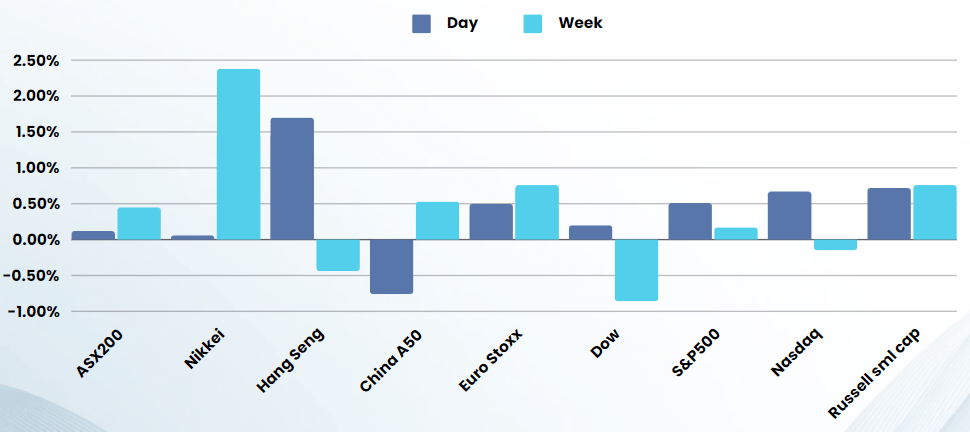

S&P 500 - Heatmap

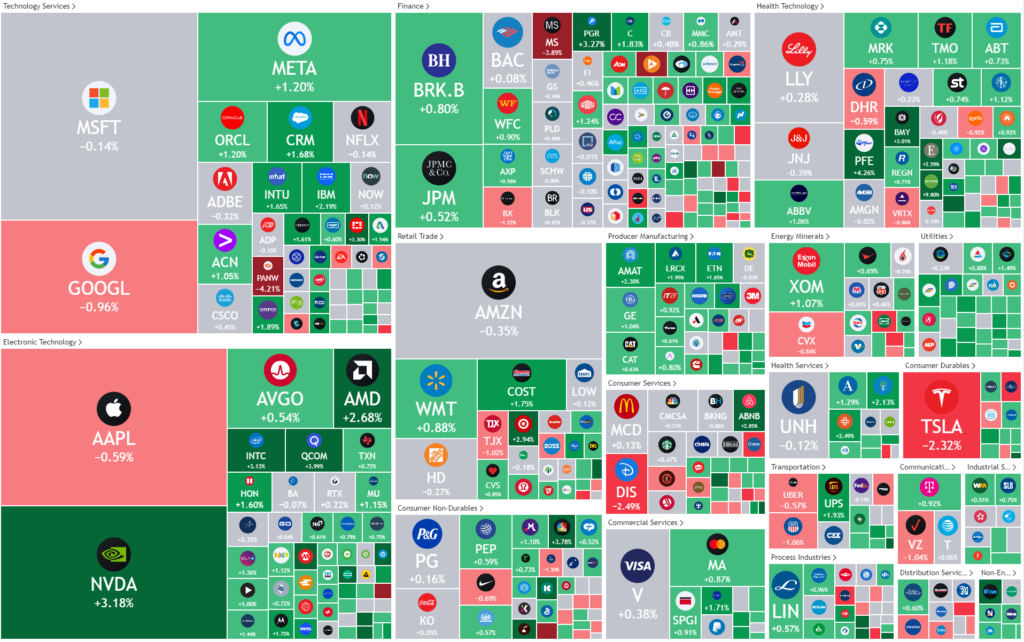

Overnight –Investors only hear what they want to hear as Powell delivers more of the same

The rally in tech returned after Federal Reserve Chair Jerome Powell reiterated that interest rate cuts were coming later in the year, a statement that has been repeated ad nauseum for over a month now, but investors treated as “new” news

Federal Reserve Chair Jerome Powell said in prepared remarks ahead of his testimony that the central bank expects to reduce its benchmark interest rate later this year. During the question-and-answer session with House Financial Services Committee members, the Fed chief said that the central bank could afford to approach rate cuts “carefully” because of the strength in the economy and labor market, but expects the Fed will reach confidence to cut “sometime this year.” The remarks come just as data continue to show a strong labor market a job openings rose more than expected in January, though the economy created fewer private jobs than expected. The Nonfarm payrolls data due on Friday is set to provide more cues on that front. Traders see around a 70% chance of the first rate cut this year in June, as per CME Group’s FedWatch tool.

Tech was back in the ascendency, pushing the broader market higher as recent dip in chip stocks attracted dip buyers, with NVIDIA, Intel, Taiwan Semiconductor Manufacturing, and Wolfspeed among the biggest gainers. Taiwan Semiconductor Manufacturing was up 5% after JPMorgan lifted its price target on the chipmaker to NT$850 from NT$770, citing optimism about AI-related chip demand.

Tesla extended losses for the third straight session, down 2%. Baird said the electric vehicle maker’s first-quarter earnings were at risk, suggesting delivery estimates still need to go lower.

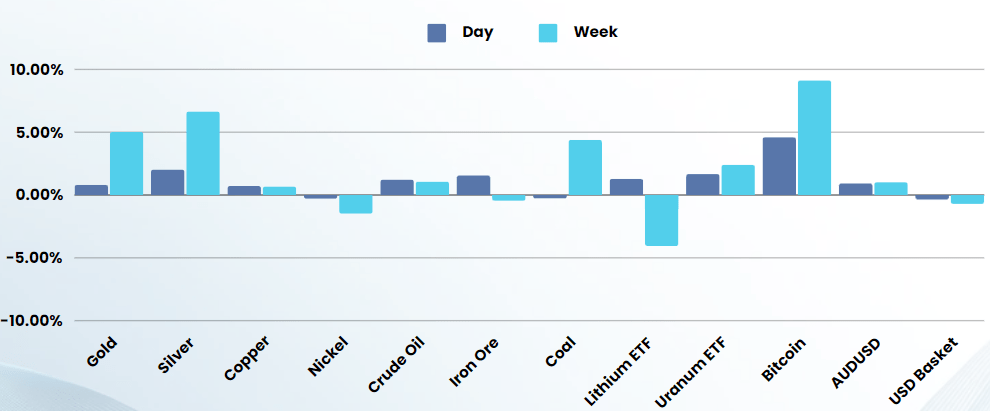

Oil rose as a smaller-than-expected increase in crude supplies pointed to improving demand just as Fed chief Jerome Powell reinforced expectations for rate cuts this year.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7750 (+0.48%)

The ASX is likely to head back to highs as the market continued its “any news is good news” sentiment. Gold, iron ore, and lithium will buoy the materials sector while tech should also provide support

BHP, Bapcor, G8 Education, IDP Education, Michael Hill, nib, Pinnacle Investments, Platinum Asset, Rio Tinto, South32, Viva Energy and Woodside Energy all trade ex-dividend on Thursday.