Last Night's Market Recap

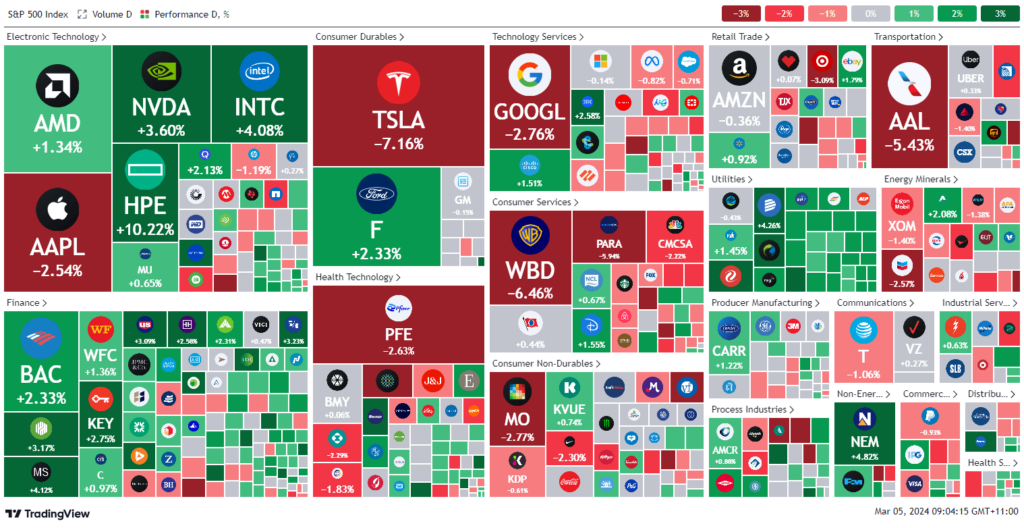

S&P 500 - Heatmap

Overnight – Stock rally stalls. Nasdaq falls despite NVDA rally

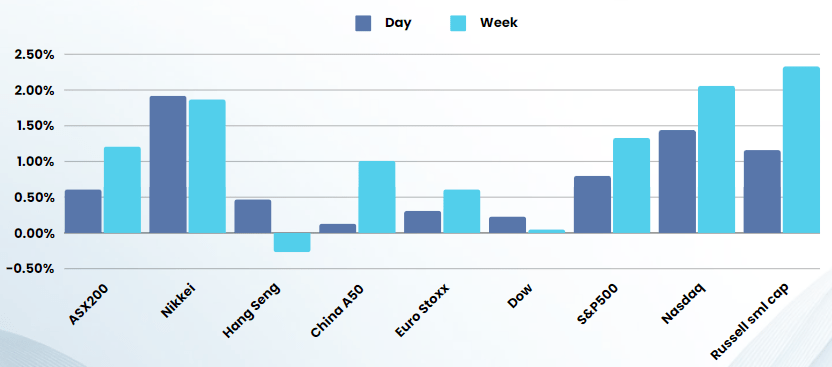

On Monday, U.S. stock indices retreated from their recent all-time highs, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average declining by 0.12%, 0.41%, and 0.25% respectively. Despite the overall market downturn, select technology stocks, especially those related to the artificial intelligence sector like Nvidia and Super Micro Computer, showcased strong performances. Nvidia gained over 3%, and Super Micro Computer surged 18% following its inclusion announcement in the S&P 500. Additionally, bitcoin-related stocks such as Microstrategy and Coinbase saw significant advances amid a cryptocurrency surge.

Conversely, setbacks in the technology sector, highlighted by Apple’s 2.5% drop due to a substantial EU antitrust fine and Tesla’s 7% fall after its discount announcement, weighed on the market. Meanwhile, non-technology sectors had their highlights, with Ford and Macy’s experiencing gains following strong sales data and increased acquisition offers, respectively. In the airline industry, JetBlue’s shares rose, whereas Spirit Airlines faced a sharp decline after their merger plans were canceled.

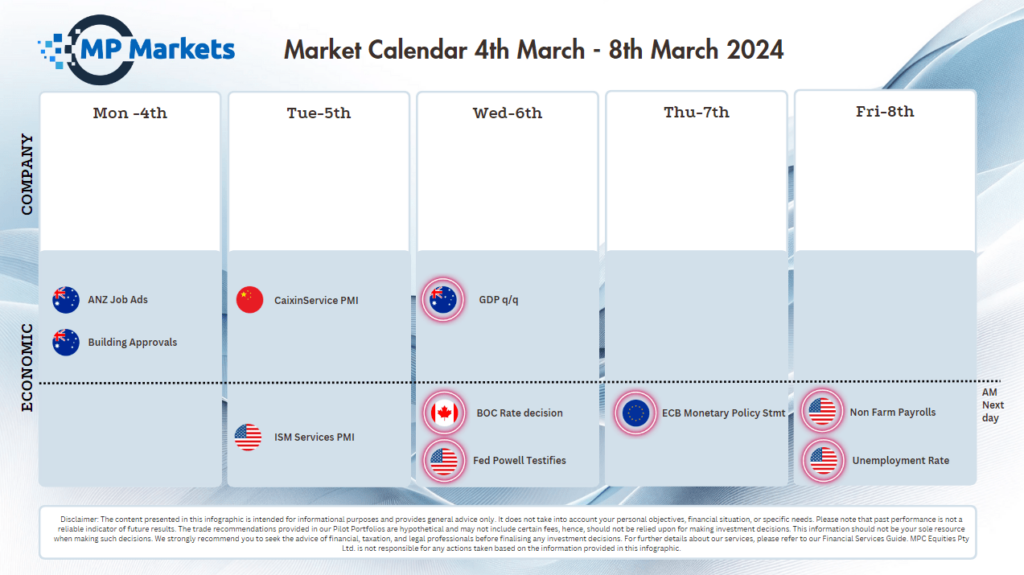

Investors remain cautious, awaiting guidance from Federal Reserve Chair Jerome Powell’s upcoming monetary policy updates and key economic data releases, including the ADP Employment Survey, job openings, and nonfarm payrolls, to gauge the market’s future trajectory amidst current uncertainties.

Bonds

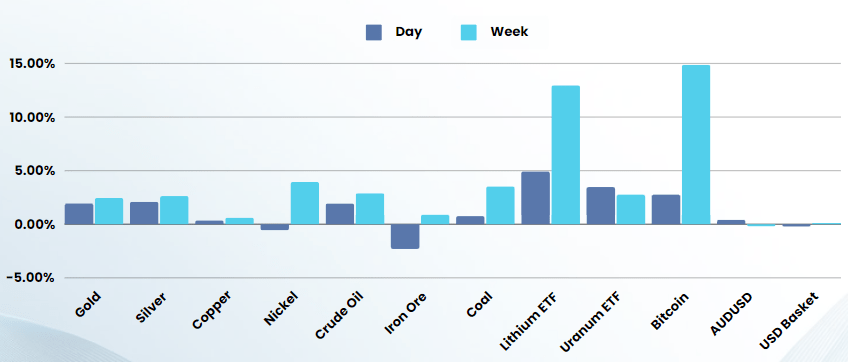

Commodities & FX

The Day Ahead

ASX SPI 7711 (-0.15%)

Australian stocks are set to open with minimal movement, following a downturn on Wall Street as market participants adopt a cautious stance ahead of forthcoming economic indicators and a scheduled testimony by Federal Reserve Chairman Jerome Powell. ASX futures have marginally declined by 12 points to 7,711, hinting at a subdued opening for the market. This comes after the local market experienced a slight decrease of 0.1% on Monday, despite achieving an intraday record high earlier in the session.

Investors will closely monitor the release of balance of payments data, expected at 11:30 AM, which is anticipated to show a shift to a surplus of $5.6 billion in the December quarter. This marks a significant turnaround from the $200 million deficit recorded in the preceding quarter, highlighting the fluctuating dynamics of Australia’s financial interactions with the rest of the world.