Last Night's Market Recap

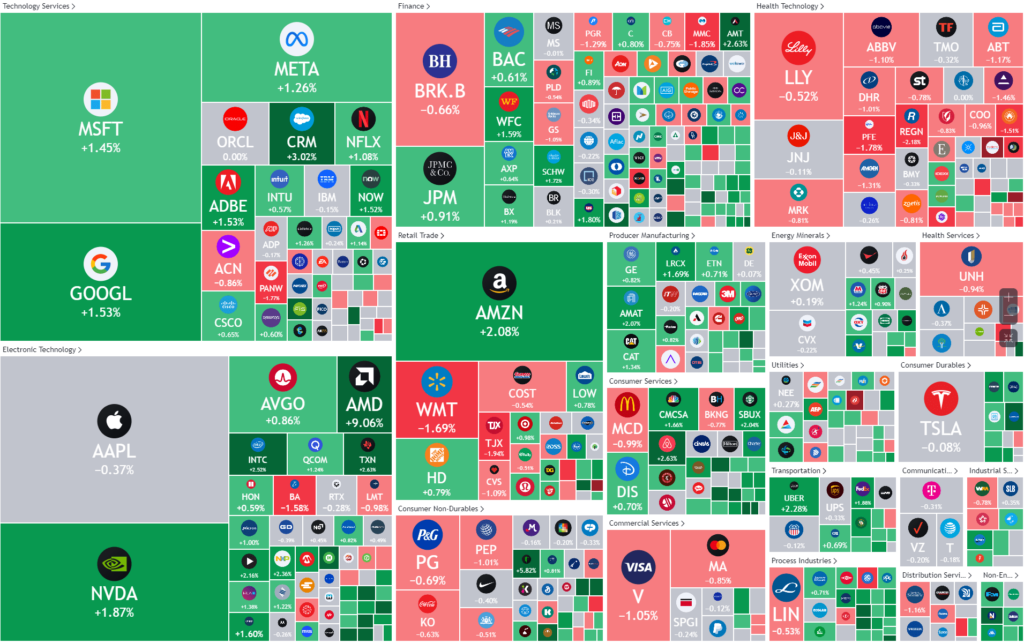

S&P 500 - Heatmap

Overnight – Tech stocks rejoice as Inflation data in-line with expectations

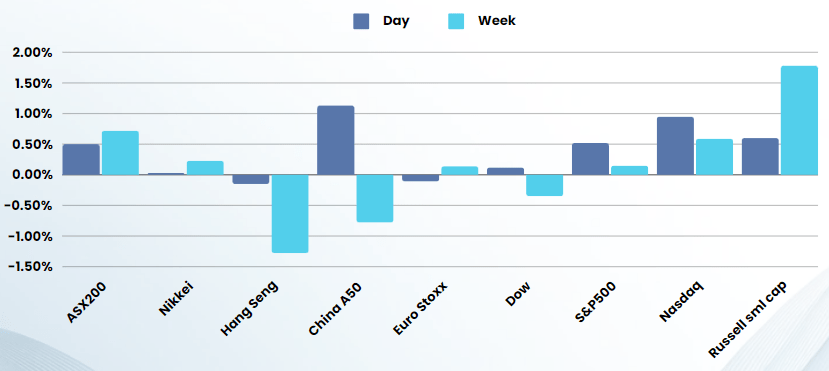

Stocks The Nasdaq on Thursday closed at record highs for the first time since 2021, as the artificial-intelligence-led rally continued and an in-line inflation report boosted hopes of a summer interest rate cut.

The personal consumption expenditures (PCE) price index rose 0.3% last month, and 2.4% in the 12 months through January. That was the smallest year-on-year increase since February 2021 and followed a 2.6% advance in December, easing investor concerns that sticky inflation will see the Fed keep interest rates at elevated levels for longer.

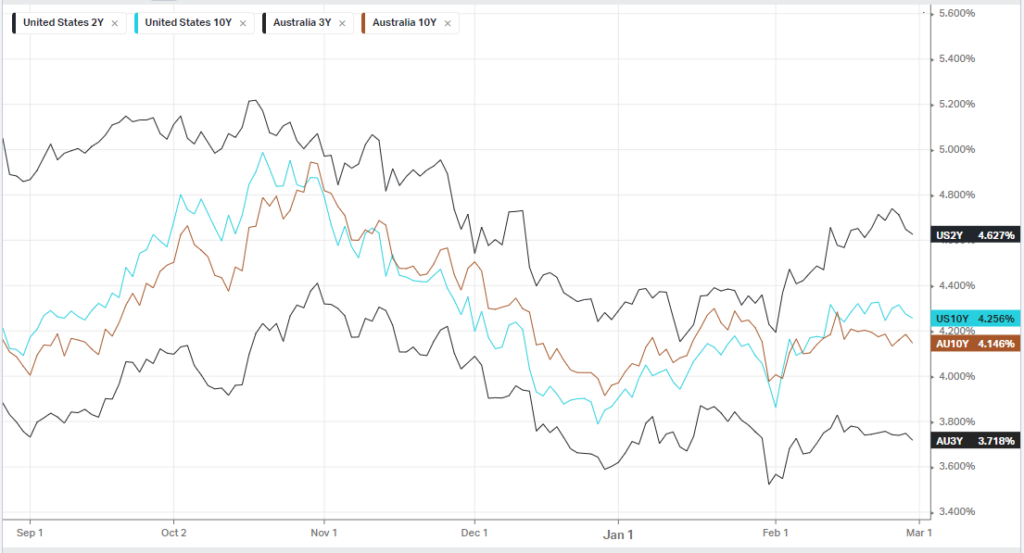

Treasury yields fell on the news, though losses were kept in check by data showing personal income, which includes earnings, property income as well as other benefits, jumped 1% on the month in January, suggesting the consumer spending is likely to continue. In another positive development for rate-cut hopes, jobless claims rose 13,000 in the week ended Feb. 17, above economists estimates for an 8,000 increase.

The U.S. House of representatives backed a bill to avert a partial government shutdown, sending the legislative measure to a vote the Senate. Should the stopgap funding bill, which aims to extend government funding for one week, clear the upper chamber, it will be sent to President Joe Biden’s desk to sign into law ahead of the midnight Friday deadline.

Earnings

- Salesforce, up 3%, rolled out its first-ever quarterly dividend and boosted it buyback program offsetting full-year guidance that fell short of analyst estimates. Some on Wall Street believe customer relationship software maker is poised to take advantage of the artificial-intelligence boom, paving the way for increased market share.

- Snowflake fell 18% after announcing that its CEO Frank Slootman had retired and the cloud data analytics company forecast first-quarter product revenue below Wall Street estimates, pressured by rising competition. Still, Macquaries said the sell off represent buying opportunity, upgrading Snowflake to outperform amid AI-led optimism

Bonds

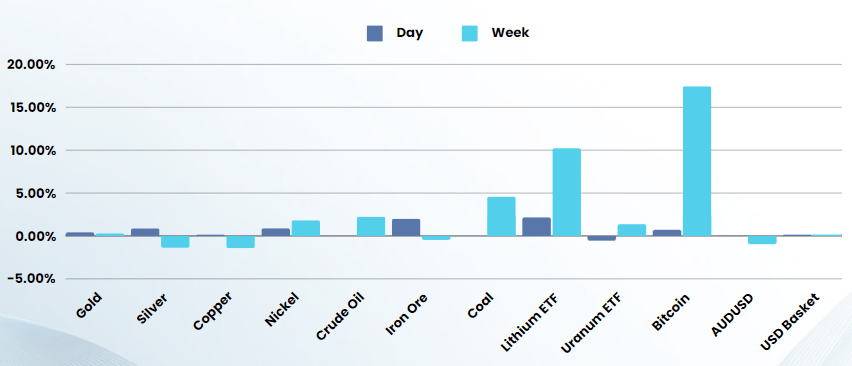

Commodities & FX

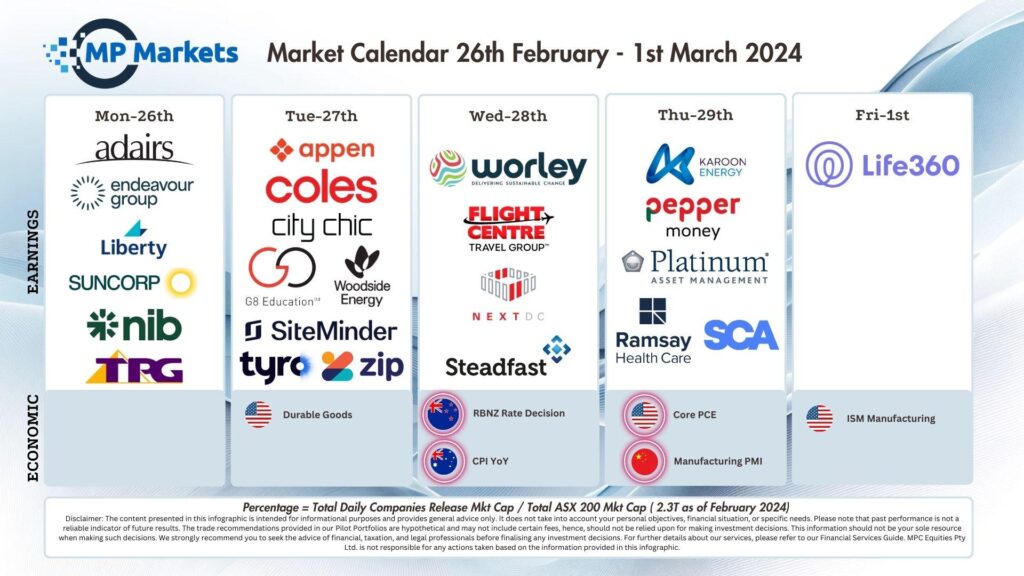

The Day Ahead

ASX SPI 7680 (+0.26%)

The ASX is set to consolidate yesterdays month-end gains with inflation fears somewhat dampened in the US overnight. Iron ore bounced which will help the materials sector while healthcare may weigh on the index as the sector remained soggy on global exchanges as analysts start to question valuations.

Lithium will be the star of the day with Chinese futures prices rebounding 9.5% yesterday, 5.5% of the move, after the closing bell in AU. That was the 7th day straight of gains, a feat not seen in a year, totaling 28.5% bounce from the lows

Shares of AMP, ASX, Ampol, Cleanaway Waste Management, Johns Lyng, Mineral Resources, Sonic Healthcare and Stanmore Resources trade ex-dividend on Friday.