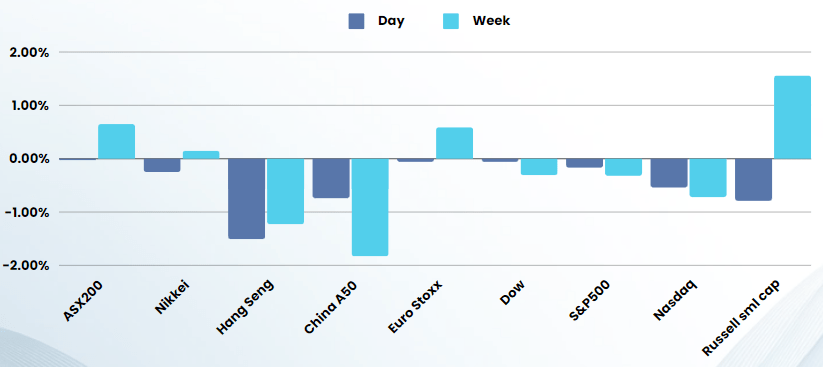

Last Night's Market Recap

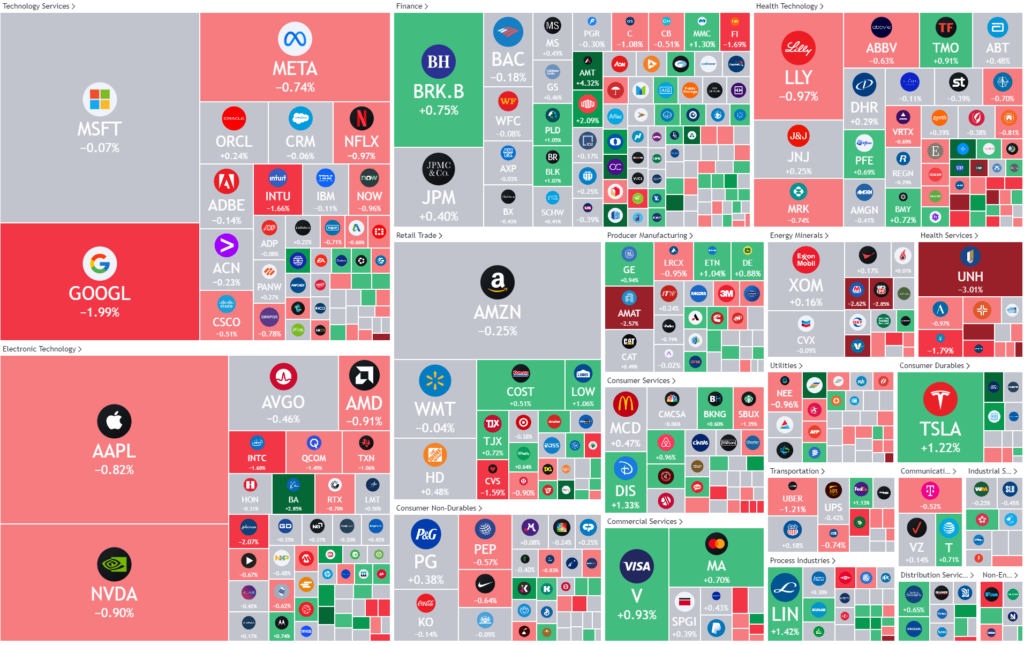

S&P 500 - Heatmap

Overnight – Stocks slip in quiet market as investors wait for Inflation data

Stocks ahead of a key inflation reading that could heavily shape expectations for the timing of an interest rate cut from the Federal Reserve.

The personal consumption expenditures (PCE) price index, the Fed’s preferred inflation gauge, is expected to show prices ticked 0.3% higher on a monthly basis in January. Stocks have struggled to retain upward momentum in recent days leading up to the data after a lengthy rally that peaked last week, fueled by enthusiasm around the potential for artificial intelligence (AI) after Nvidia reported quarterly earnings. Evidence of stubborn inflation in recent data on consumer and producer prices, a resilient U.S. economy, and commentary from some Fed officials have caused the market to dial back expectations for the Fed’s first cut to June from March.

In addition to the PCE data, reports for weekly initial jobless claims and manufacturing activity are due this week and will also help gauge the strength of the economy and path of interest rates.

Boston Fed Bank President Susan Collins said on Wednesday the Fed should be “taking time” to assess data before making any change to policy in order to be sure to deliver on both of the central bank’s mandates of maximum employment and price stability. In addition, New York Federal Reserve President John Williams said that even as there is still some distance to cover in achieving the Fed’s 2% inflation target, the door is opening to rate cuts this year depending on how the data come in.

Healthcare giant, UnitedHealth fell 4.93% as the biggest drag on the Dow and second largest on the S&P 500 after a report on Tuesday said the U.S. Department of Justice has launched an antitrust investigation into the healthcare conglomerate.

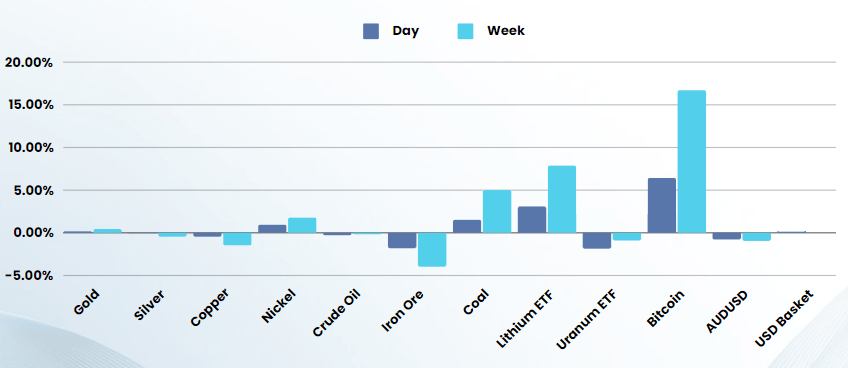

Bitcoin continued its white hot run breaching $60,000USD for the first time since late 2021 as a surge of capital into bitcoin ETFs is providing consistent capital flow.

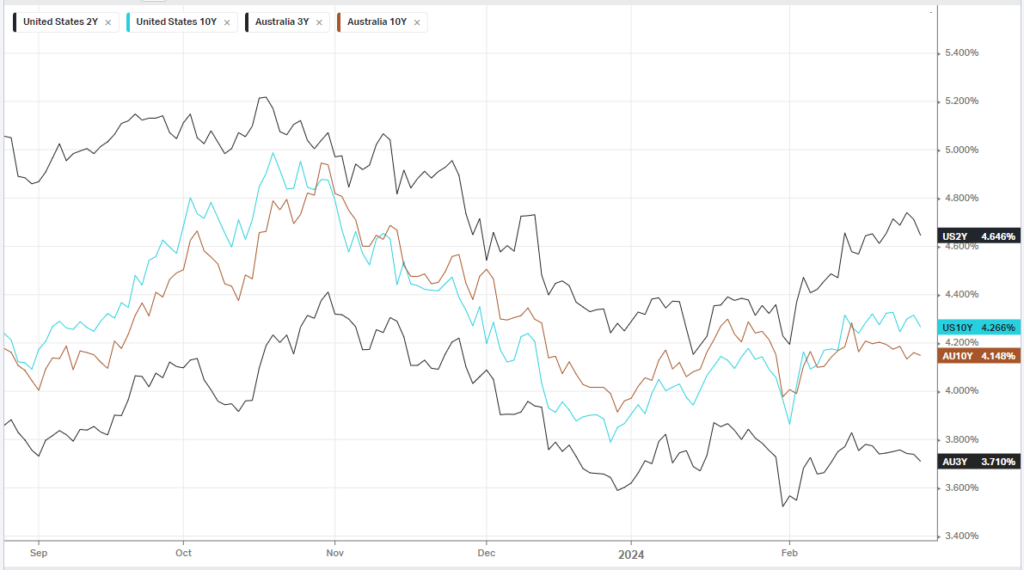

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7618 (-0.01%)

The ASX is in for a quiet day with global markets waiting on key US inflation data. The materials sector will be helped once again by the bounce lithium. Healthcare will be a drag with Resmed falling 4% in the US session and broad healthcare selling in global equity markets

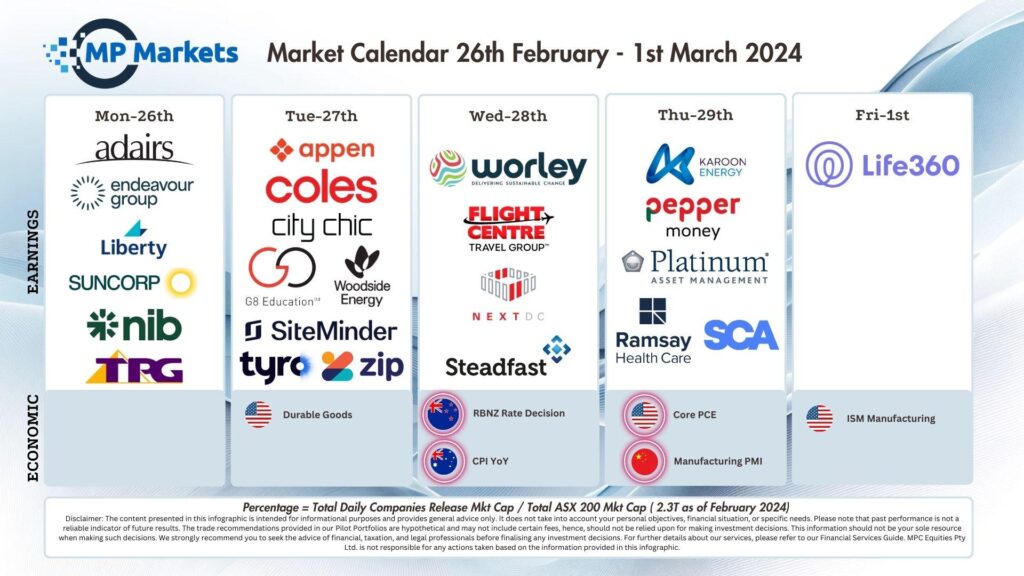

The last of earnings releases will drop today, and Core PCE tonight in the US

Companies expected to report results on Thursday: Atlas Arteria | Cromwell | Karoon Energy | Pepper Money | Platinum Financial | Ramsay Health Care | Southern Cross Media, Star Entertainment

Beacon Lighting, Corporate Travel Management, Medibank Private, Pro Medicus, Suncorp and Vulcan Steel trade ex-dividend on Thursday.