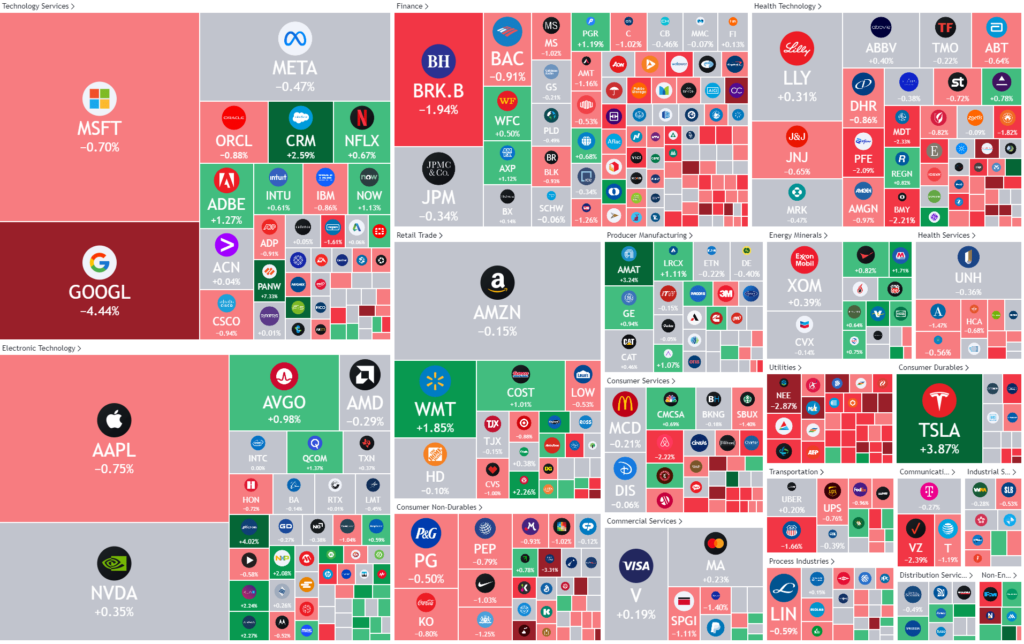

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks Ease from highs as investors wait on inflation data

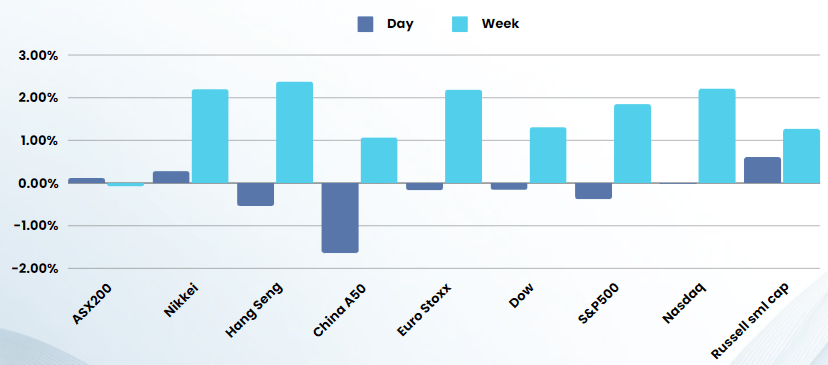

Stocks eased back from the AI fueled rally as investors mulled ongoing quarterly earnings from corporate America and awaited further catalysts including the release of key inflation data later this week.

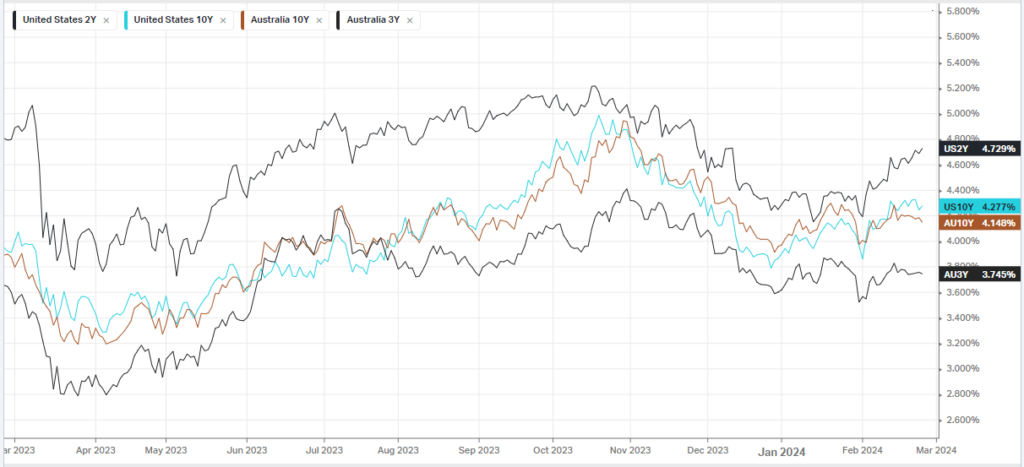

Due to Nvidia, AI and corporate earnings stealing the headlines, investors are starting to realise bond yields have crept up 30bps over the last month due to a string of signals from the Federal Reserve last week showing that the central bank was in no hurry to begin trimming interest rates in the near-term limited the gains.

Anticipation of more key inflation readings this week, specifically the PCE price index, which is the Fed’s preferred inflation gauge, is keeping traders on edge at the start of the new week. Investors were seen largely pricing out the prospect of May and June rate cuts by the Fed, amid increasing signs that inflation remained sticky. Beyond the PCE data, focus is also on a second reading of fourth-quarter GDP data, which is due on Wednesday. The while U.S. economic growth has remained resilient in comparison to other developed countries, it has also cooled in recent quarters.

With the fourth quarter earnings season now coming to a close, earnings reports from a string of major retailers are on tap this week. Lowe’s, Macy’s, TJX, and Best Buy will release their quarterly readouts through the week, with any signs of a spending slowdown squarely in focus. The slew of retail earnings will offer clues into the strength of the consumer at a time when many are concerns about the impact of sticky inflation and higher for longer interest rates.

Earnings

- Domino’s Pizza stock soared over 5% after reporting quarterly results that topped Wall Street even as inflation weighed on margins. The pizza chain hiked its dividend and gave the green light to further share repurchases.

- Freshpet stock soared nearly 19% after the pet-food manufacturer’s fourth-quarter revenue and profit topped analyst estimates, helped by a rise in sales as it boosts media spending.

- Berkshire Hathaway fell 1.7% despite Warren Buffett’s conglomerate posting its second straight record annual profit, bringing it closer to a $1 trillion market value.

Bonds

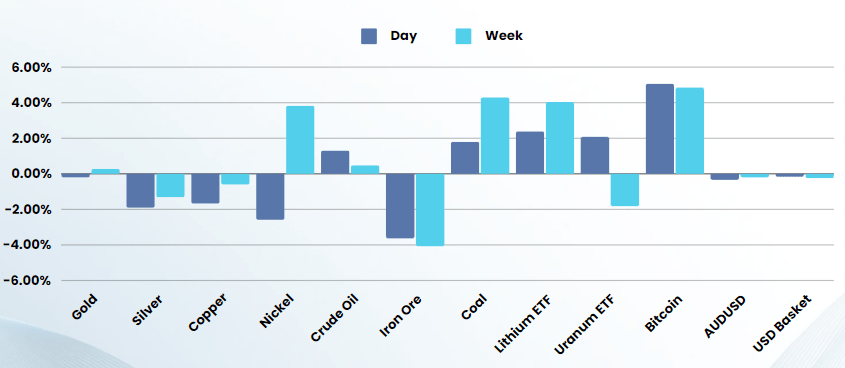

Commodities & FX

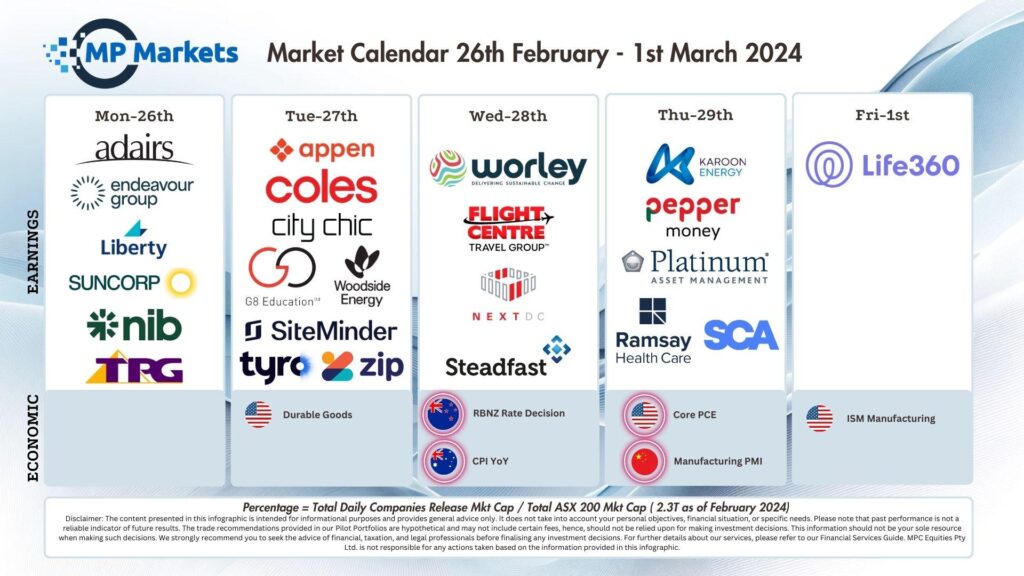

The Day Ahead

ASX SPI 7607 (-0.01%)

The ASX are set to open lower, tracking losses in Europe and on Wall Street with local investors awaiting the last busy day of earnings ahead of a barrage of inflation data this week. Futures on the S&P/ASX 200 Index are 0.1 per cent down to 7604, suggesting a muted start following a 0.1 per cent gain on Monday. Australian consumer confidence is out at 11.30am AEDT. Coles and Woodside will likely take the spotlight with their earnings reports.

Companies reporting today: Abacus | Altium | Alumina | Appen | Chorus | Coles | City Chic | Cooper Energy | E&P | G8 Education | Keypath Education | Light & Wonder | Prospa | Siteminder | Tyro Payments | Woodside | Zip Co