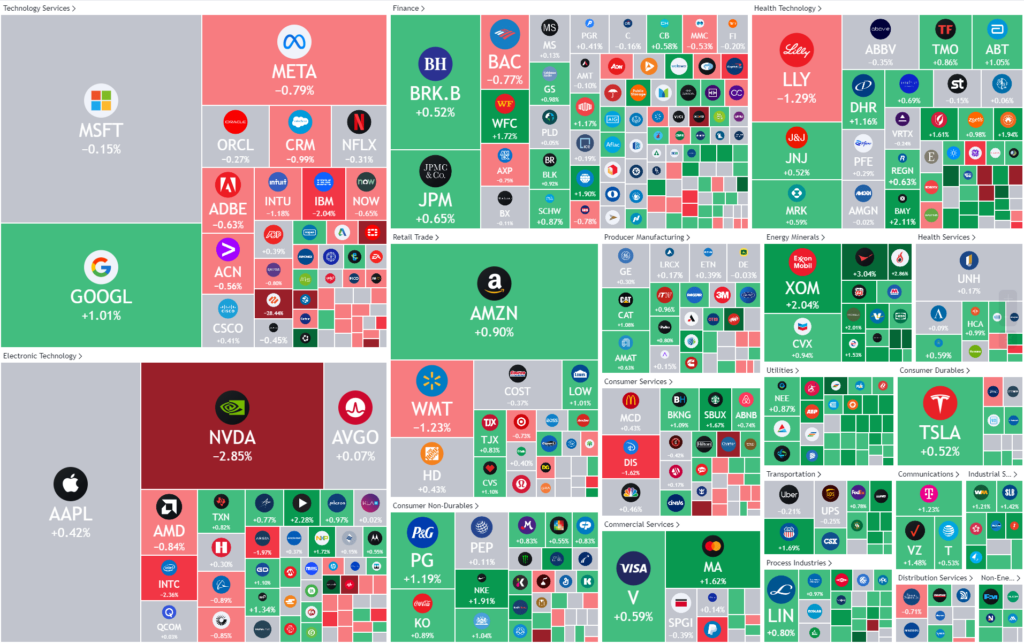

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Fed concerned about cutting rates too soon, NVIDIA tops market estimates.

Stocks struggled overnight as sentiment was further soured following the release of the minutes of the Federal Reserve’s January meeting showing members were concerned about cutting interest rates too soon.

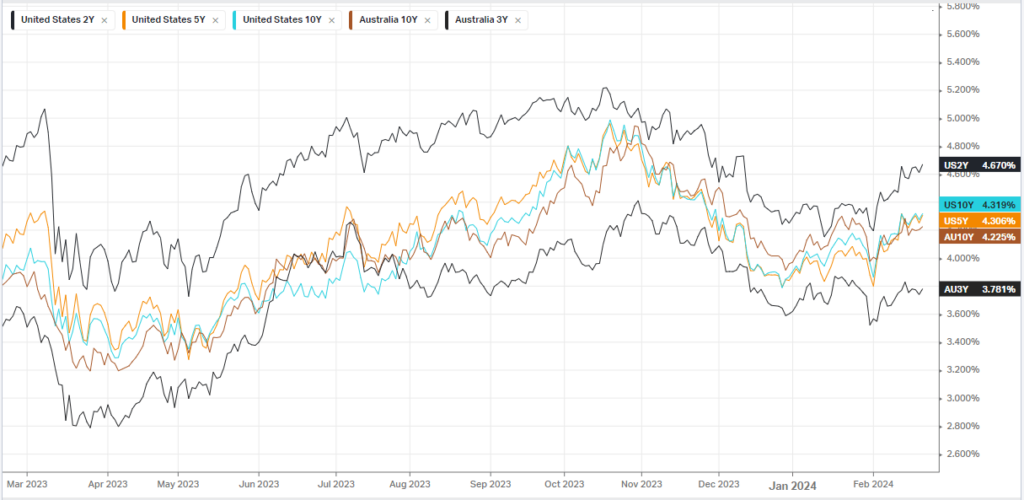

Federal Reserve policymakers signaled no urgency to pivot to rate cuts as concerns of “upside risks” to inflation begin to emerge, according to the minutes of the Federal Reserve’s Jan.30-31 meeting released Wednesday. In a further sign that more confidence is needed to ensure that inflation continues to slow, the minutes also flagged “uncertainty associated with how long a restrictive monetary policy stance would need to be maintained.” Treasury yields remained near session highs following the release of the minutes, with the rate-sensitive 2-year Treasury yield up 4 basis points to 4.655%.

Nvidia struggled ahead of its earnings falling more than 3% adding to a 4% loss a day earlier as jitters persist ahead of the the chipmaking heavyweight quarterly results.

Palo Alto Networks fell more than 28% after cutting its full-year guidance as the cybersecurity company changed its strategy by increasing free product offers — expected to weigh on billings growth for 12-to-18 months — to customers in the hope of accelerating adoption of its offerings. Amazon.com was up 0.3% as the e-commerce giant is set to replace Walgreen Boosts Alliance in the Dow Jones Industrial Average index before markets open on Feb. 26. The move was triggered by Walmart’s decision to do a 3-to-1 stock split, which will cut its weighing in the index.

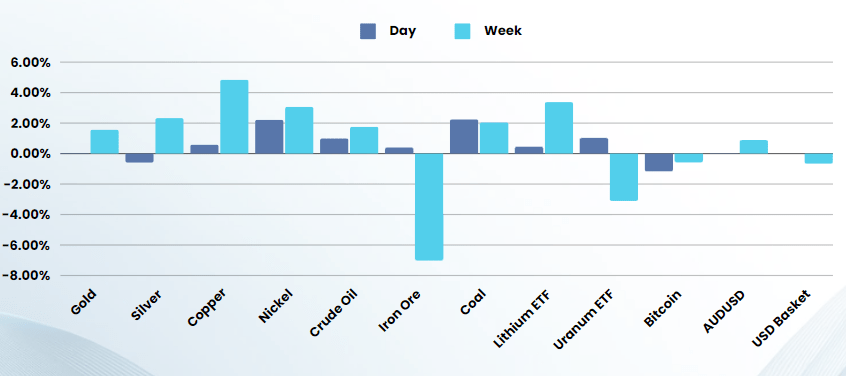

Oil prices settled higher Wednesday as investors awaited further catalysts including a flurry of economic data and an update on U.S. crude inventories due later this week after the Federal Reserve’s minutes from its January meeting reinforced expectations for higher for longer rates.

NVIDIA rose 6% in the afterhours following the report. For the three months ended Dec. 31, NVIDIA announced earnings per share of $5.16 on revenue of $22.1 billion. Analysts anticipated EPS of $4.64 on revenue of $20.55 billion. Data center revenue swelled to $18.49 billion, up 409% from a year earlier, beating estimates of $17.06B amid rising demand for its AI GPUs including the H100. The beat comes even as data center sales to China “declined significantly” in the fourth quarter due to U.S. government licensing requirements, the company said. For the fiscal Q1, revenue is expected to be $24B, give or take 2%, topping analyst estimates for $22. 01B.Analysts are questioning the companies ability to maintain margins as many chipmakers catch up with task specific chips that are far more power efficient and cheaper

Bonds

Commodities & FX

The Day Ahead

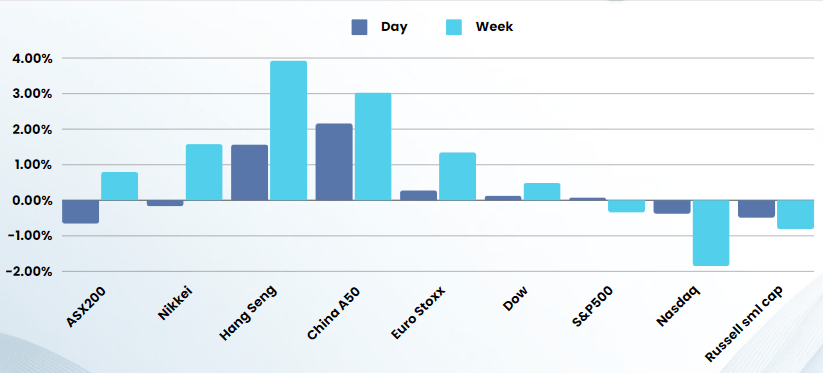

ASX SPI 7542 (-0.2%)

Relative to the US, we should see a firm market on the ASX today after China banned institutions from selling stocks on market open/close, monitoring of short selling. Coupled with the rate cuts delivered last week, this has seen a few commodities like coal and lithium stabilize. After Wednesday’s closing bell, Rio Tinto reported a 12 per cent tumble in underlying profit, citing weaker commodities prices and rising costs. It said it will pay a final dividend of $US2.58 per share. RIO shares were down 0.67%

French building materials giant Saint-Gobain lobs $4.3b bid for CSR The European giant said late on Wednesday that it had succeeded in securing due diligence from the ASX-listed company’s board with the $9 a share offer.

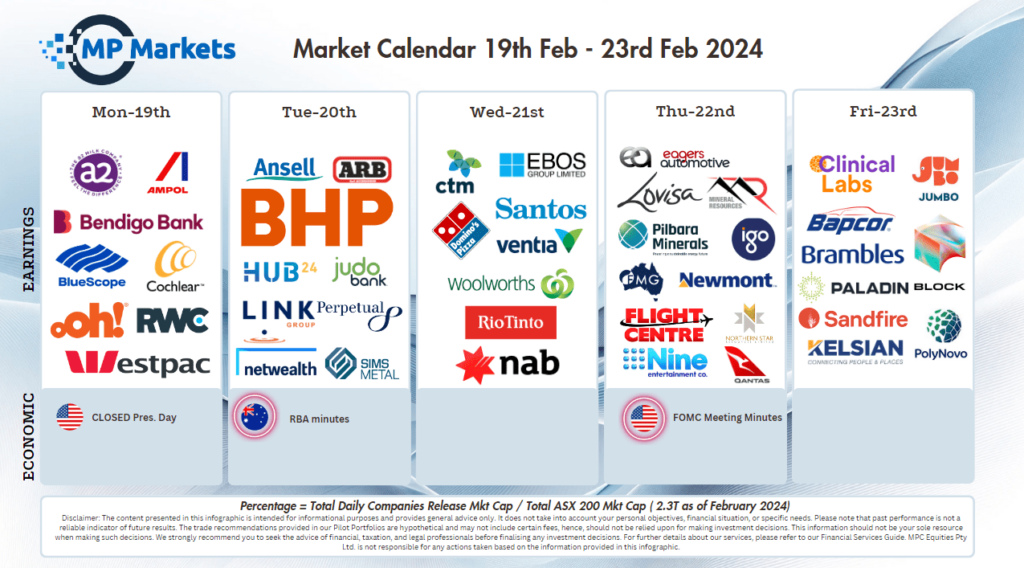

Earnings

- IGO reported a 53 per cent slump in half year net profit to $288.3 million, due to lower earnings from its lithium joint venture Tianqi Lithium Energy Australia. Revenue (from continuing operations) fell 19 per cent to $438.2 million. The company declared an interim dividend of 11¢ apiece.

- PLS The plunging lithium price saw Pilbara Minerals profit 82 per cent to $220 million for the six months to December 31, versus $1.24 billion in the prior corresponding half. Revenue tumbled 65 per cent to $757 million.

Companies expected to report on Today: APA Group | ARN Media | Auckland Airport | Block | Fortescue | IGO | Insignia Financial | Lovisa | Medibank | Mineral Resources | Nine | Northern Star | Qantas | Qube | Redbubble (Articore) | Regal Partners | Super Retail | Tabcorp | The Reject Shop