Last Night's Market Recap

S&P 500 - Heatmap

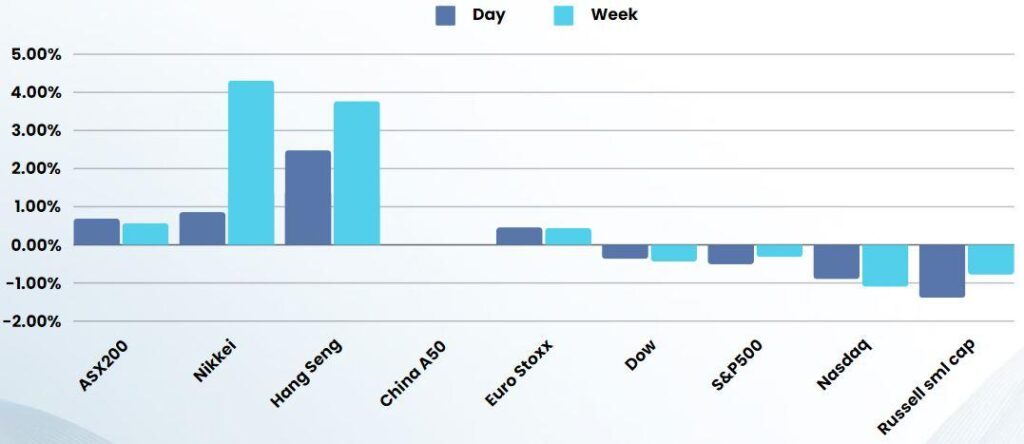

Overnight – 6-week rally in stocks ends on further strong inflation data

Stocks ended their 6-week winning streak as data this week showing inflation remains rein in investor bets on sooner rather later rate cuts.

Treasury yields jumped, with yields on the 2-year Treasury rising 8 basis points points to 4.652% as rate-cut bets were sullied after the U.S. producer price index by 0.3% in January from 0.1% in December, above economists expectations for a 0.1%. The data arrived just days after consumer inflation surprise to the upside to further muddying investor bets on aggressive rate cuts. The stronger PPI report was driven by a 0.5% rise in trade services, which includes gross wholesale and retail margins and accounting for nearly a quarter of the core, Pantheon Macroeconomics said, though added the overall trend is slowing.

Earlier on Friday, Japan’s benchmark Nikkei rallied to a 34-year high and was on the cusp of eclipsing the all-time peak reached during the heyday of the nation’s bubble economy in the 1980s. Figures on Thursday showed that Japan and Britain slipped into recession at the end of last year.

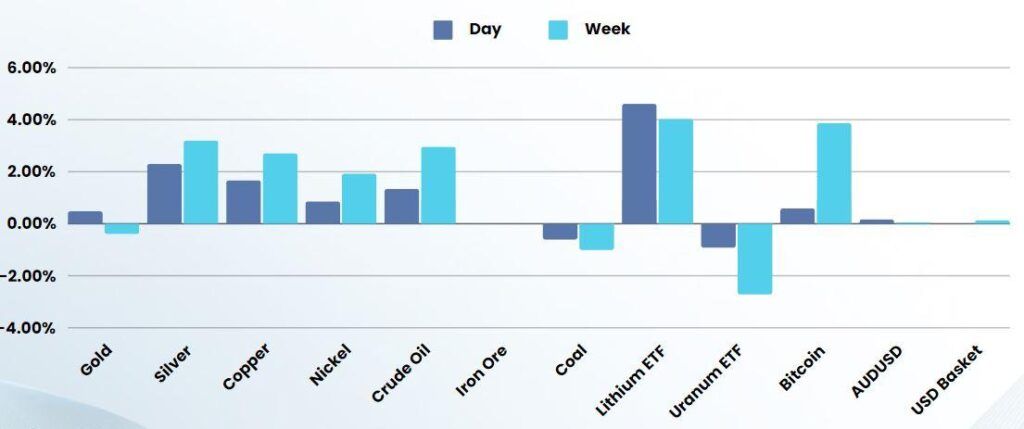

Gold eased early on Friday and was set for a second straight weekly fall, but gold was last up 0.4% on the day at $2,012.86 per ounce.

Oil prices rose amid geopolitical tensions in the Middle East. Brent crude futures gained 61 cents to settle at $83.47 a barrel, while U.S. West Texas Intermediate crude rose $1.16 to settle at $79.19.

Bonds

Commodities & FX