Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks ride Energy and Small Caps to yet another record high

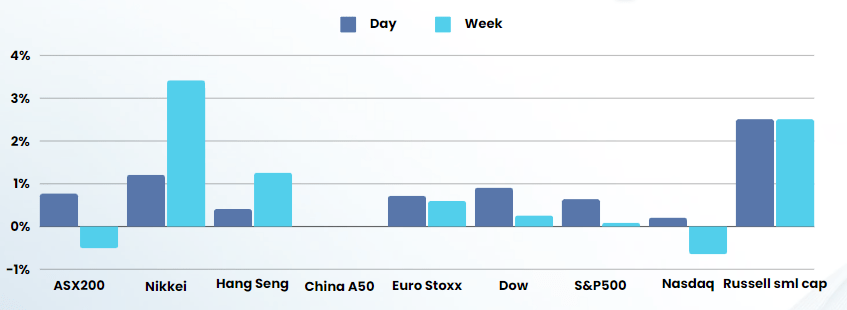

Stocks climbed Thursday, as a jump in energy and small-caps supported the ongoing rally and offset an Apple-led dip in tech and economic data showing possible signs of weakness in the consumer.

Energy and Small caps drove the rally as tech fell away due to the weaker retail sales numbers stoking speculation that the Fed will be forced to cut rates sooner rather than later. Recently underperforming sectors such as utilities, materials and energy notched strong gains. The small-cap Russell 2000 Index also advanced 2.3%.

A Commerce Department report showed U.S. retail sales dropped 0.8% in January, weighed by declines at auto dealerships and gasoline service stations. The data had investors less stressed about hotter than expected inflation data on Tuesday that had sent stocks lower.

Alphabet dropped 2.17% after investment firm Third Point dissolved its stake in the megacap. Apple shares were pressured as Warren Buffett’s Berkshire Hathaway trimmed its large stake in the iPhone-maker and Soros Fund Management entirely dissolved its stake. But the stock bounced in late trading and closed down just 0.1%.

Oil briefly rallied above $US83 a barrel, gold edged above $US2000 an ounce and iron ore moved back towards $US130 a tonne, reflecting weakness in the US dollar. Bitcoin was holding above $US52,000.

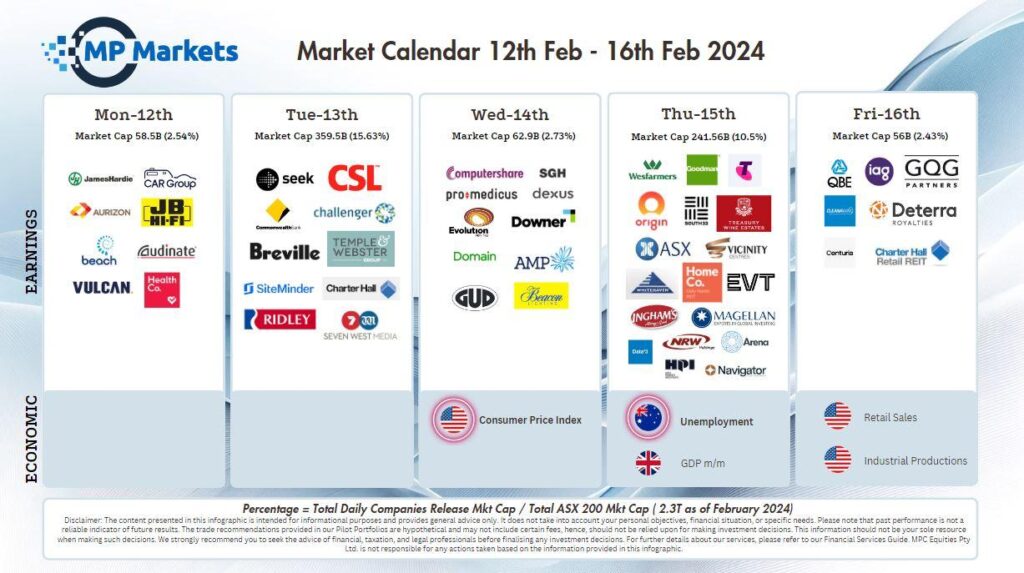

Earnings

- Cisco Systems fell 2.43% as it announced plans to cut 5% of its global workforce and lowered its annual revenue target.

- Deere & Co, the world’s largest farm-equipment maker, lost 5.2% after cutting its 2024 profit forecast.

- West Pharmaceutical Services tumbled 14.1% after forecasting full-year results below estimates.

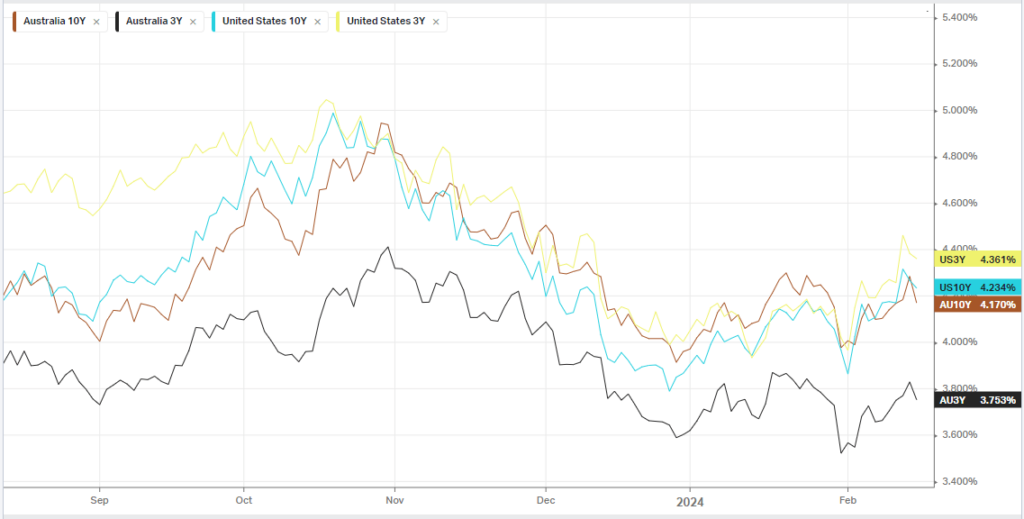

Bonds

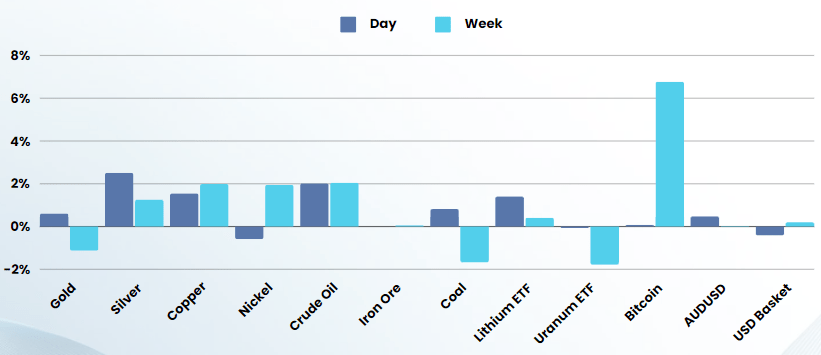

Commodities & FX

The Day Ahead

ASX SPI 7630 (+0.95%)

We are in for a positive but quiet day as the crossover of US earnings and AU earnings eases. The weakness in the US data triggered hopes of sooner rate cuts, which support weakness in the AU employment data yesterday.

Earnings will still be the focus with a huge week next week. At first glance this morning IAG’s first half profit slipped, although it guided for double digit premium growth in 2024. QBE almost doubled its net profit in 2023. Cleanaway confirmed guidance for 2024

Companies reporting today: ASX (ASX) | Centuria Office (COF) | Charter Hall Retail REIT (CQR) | Deterra Royalties (DRR) | GQG Partners (GQG) Inghams (ING)