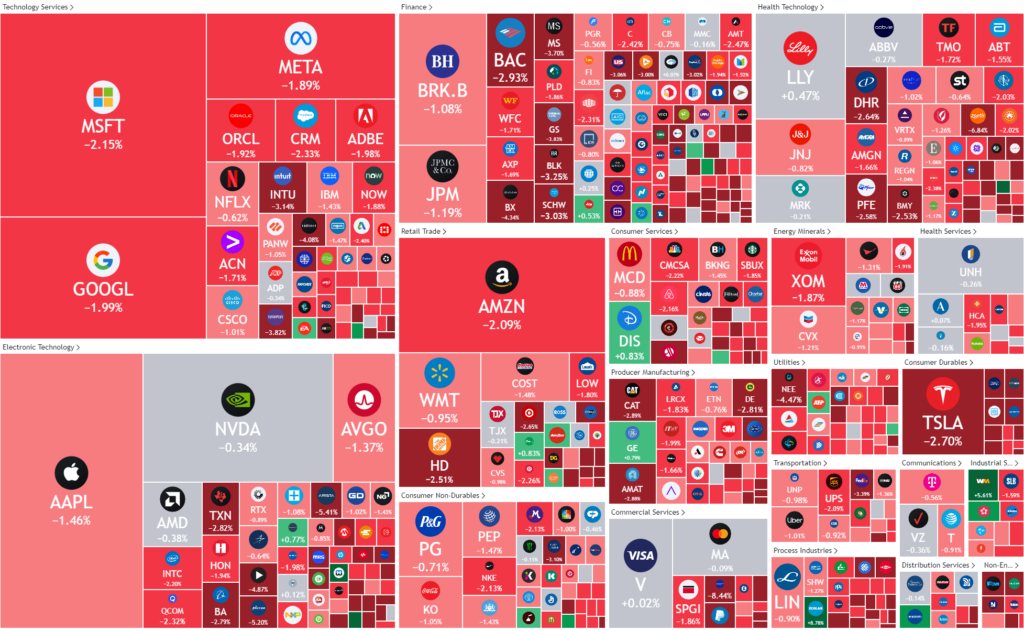

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Hot inflation numbers wipe out rate cut hopes

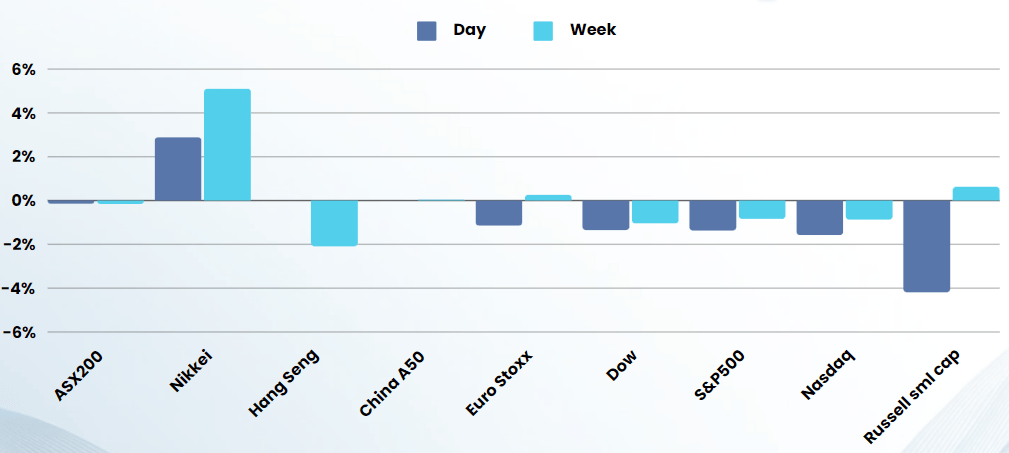

The Dow had its worst day in 11 months as US inflation numbers all but wiped out hopes of aggressive rate cuts in the first half of this year.

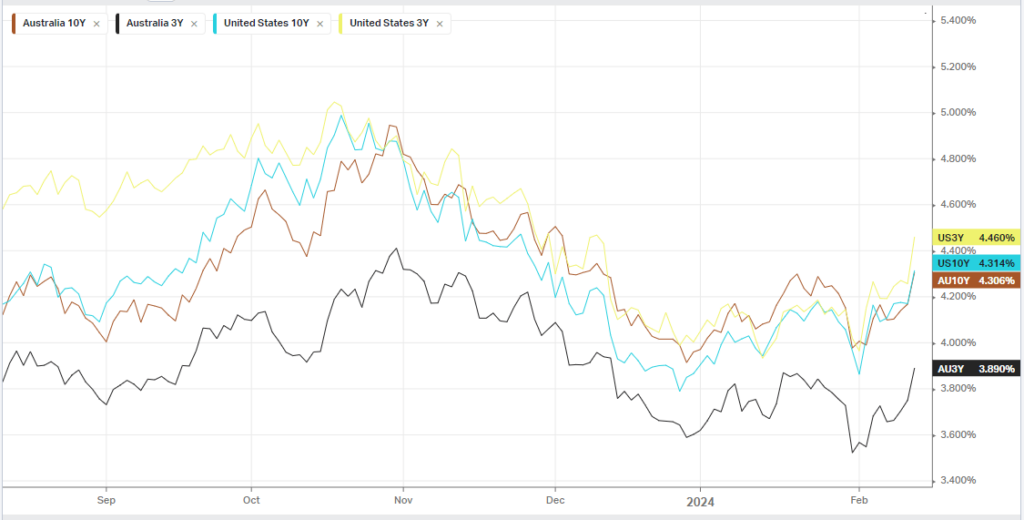

Headline annual U.S. inflation slowed to 3.1% pace in January, from 3.4% a month earlier, but that was still above economists estimates of 2.9%. Core inflation, which the Fed watches more closely as it strips out volatile items like food and fuel, remained at the same annual pace of 3.9% posted in December, but was expected to slow to a 3.7% pace. Treasury yields jumped, with the 2-year Treasury yield rising 17 basis points to 4.637%, while the yield on the 10-year Treasury surging 14 basis points to 4.316%. The hotter inflation report was driven by the “lumpy shelter/rent component,” RBC said, adding that broader signs of reacceleration in inflation pressures” as well as a strong labor market “are reinforcing the risk that the Fed won’t need (or be able to) pivot to interest rate cuts as quickly or aggressively as previously expected.”

With a March rate cut all but priced out, investors cut their bets on a May rate cut to 31.6% from nearly 50% the prior day, Fed Rate Monitor.

NVIDIA sidestepped the heavy selling to trade just below the flatline after Mizuho upgraded its price target on the stock to $825 from $625, as the chipmaker will continue its market dominance amid rising AI demand. The bullish backing comes come just ahead of the fourth-quarter results due Feb. 21. Nvidia is up 231% over the past year, with market cap of about $1.79 trillion. NVIDIA is one of the finest comparable examples from the tech bubble and the rally in our eyes is more of a concern than a positive

Earnings

- Coca-Cola fell nearly 1% after better-than-expected fourth-quarter results and guidance was cast aside by worries about waning pricing power as top-line sales growth from a year earlier.

- Biogen fell more than 7% after the company reported lower-than-anticipated profit and revenue in its latest quarter, driven by weaker sales across multiple products including Vumerity, Spinraza amid competition and pricing pressures.

- Hasbro also stumbled on the earnings stage, after its fourth-quarter results and guidance missed Wall Street estimates, sending its shares more than 3% lower. The toy maker’s performance was dragged by it entertainment segment, which came under pressure from industry strikes, and a losses owing to goodwill and intangible asset impairment charges.

Bonds

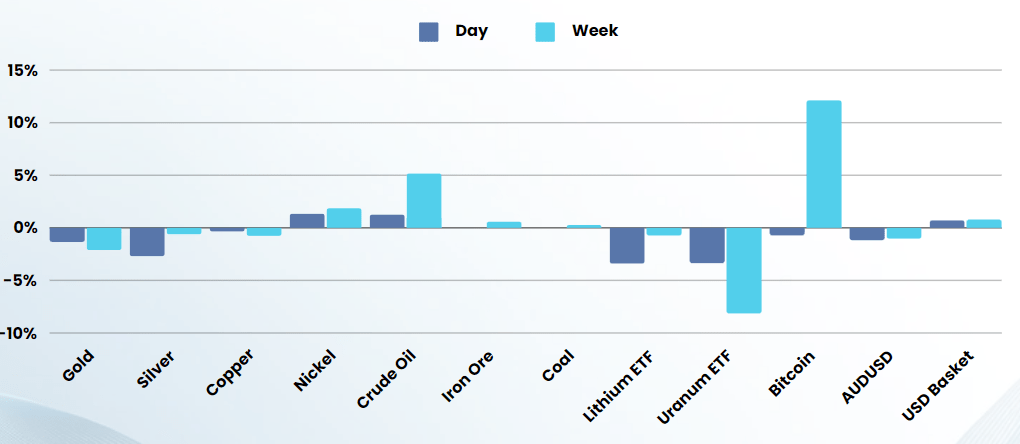

Commodities & FX

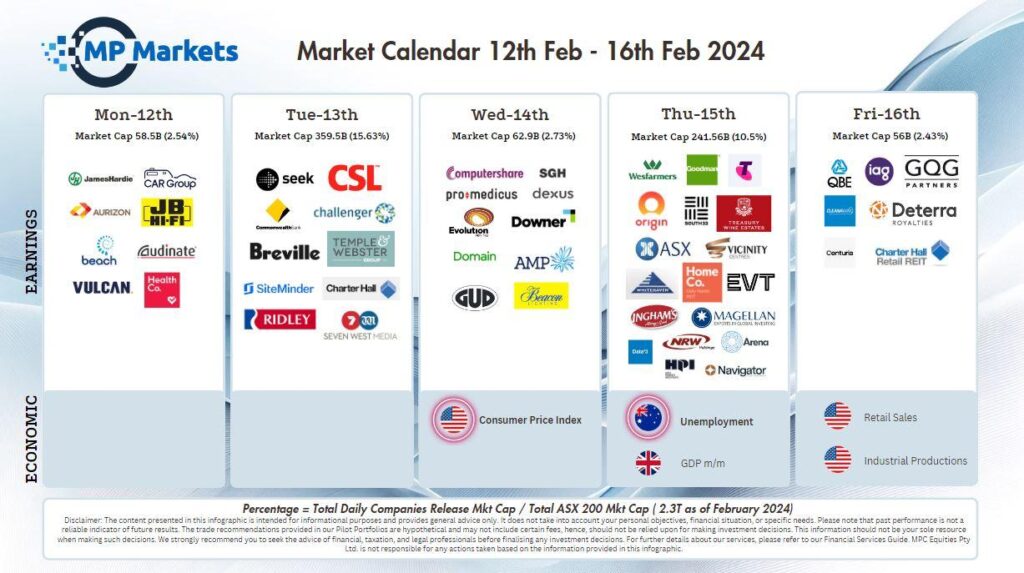

The Day Ahead

ASX SPI 7460 (-1.2%)

Today will likely be fairly ugly for the ASX as US inflation numbers have thwarted any chance of H1 rate cuts and major index contributor CBA has deliver underwhelming results at record highs. We will remain earnings focused this week. Oil prices should help the energy sector, while defensive sectors should fare best

Earnings

- Commonwealth Bank’s cash profits have fallen 3 per cent in the first half of the financial year to $5 billion as profit margins continued to suffer from competition in the mortgage market. The bank will pay a $2.15 per share dividend, however, even as chief executive Matt Comyn reiterated that 2023 represented a challenging year for Australia’s largest lender and the broader economy.

- Seven Group has upgraded its group level guidance to “mid to high-teen” EBIT growth for the full year, citing outperformance from its industrial services segment which includes its WestTrac, Coate and Boral businesses. The company has also upgraded its forecasts for the industrial services businesses with 20 per cent to 25 per cent EBIT growth expected for the full year.

Companies earnings due: AMP (AMP) | Ansell (ANN) | Commonwealth Bank (CBA) | Computershare (CPU) | Dexus (DXS) | Domain (DHG) | Downer EDI (DOW) | Evolution Mining (EVN) | GUD Holdings (GUD) | IDP Education (IDP) |