Last Night's Market Recap

S&P 500 - Heatmap

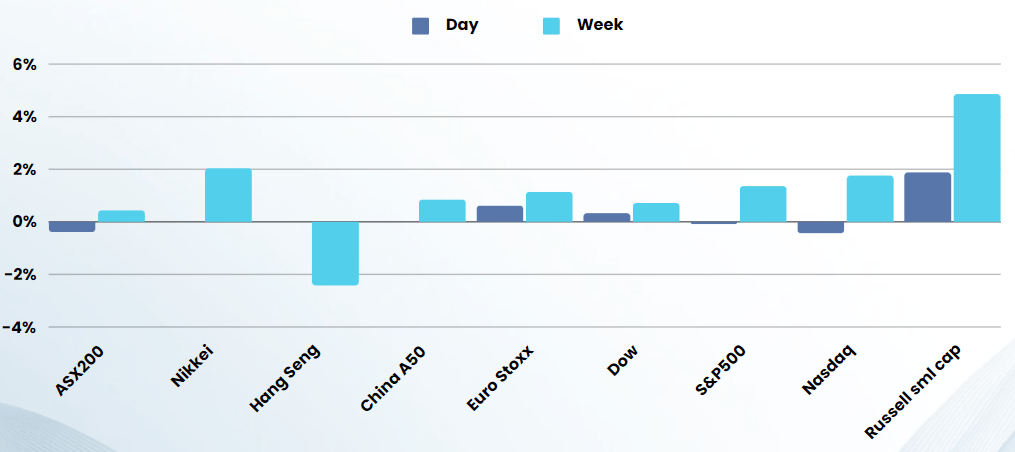

Overnight – DOW hits record high as energy stocks surge

The Dow closed at record highs Monday, led by energy stocks ahead of a busy week of top-tier economy data, and fresh round of corporate earnings.

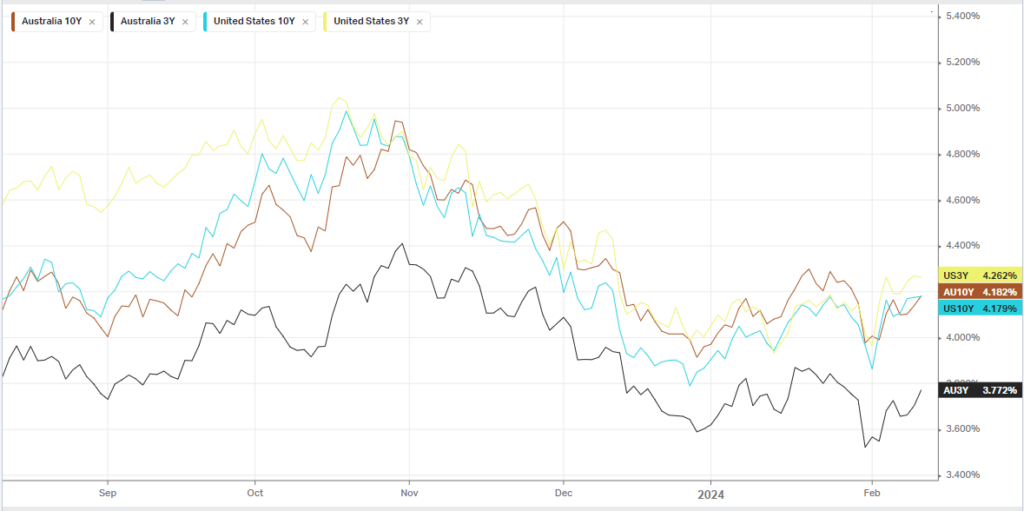

Federal Reserve officials continued to signal that early rate cuts aren’t on the table, with Federal Reserve Governor Michelle Bowman saying she doesn’t expect the Fed to cut rates “in the immediate future” as tight monetary policy measures are needed to keep inflation trending lower. The remarks arrive a day ahead of fresh inflation data, with the U.S. consumer price index for January expected to show that headline price growth in the world’s largest economy slowed on both an annual and monthly basis.

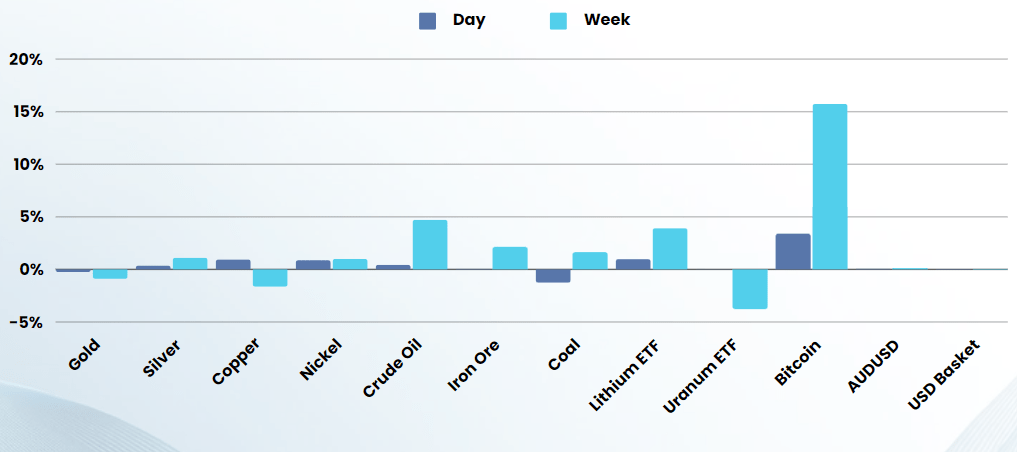

Bitcoin jumped above $50,000 for the first time in more than two years as demand for the cryptocurrency continues to swell following the launch of the Bitcoin spot-ETF last month.

Crude benchmarks rallied about 6% last week due to persistent threats to shipping in the Red Sea, Ukrainian strikes on Russian refineries and U.S. refinery maintenance. U.S. gasoline futures edged up about 1% on Monday to a three-month high after soaring 9% last week during refinery downtime. The Iran-backed Houthis in Yemen have targeted shipping with drones and missiles since November in solidarity with Palestinians in Gaza. The U.S. has led retaliatory strikes on Houthi missile sites since January.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7595 (unchanged)

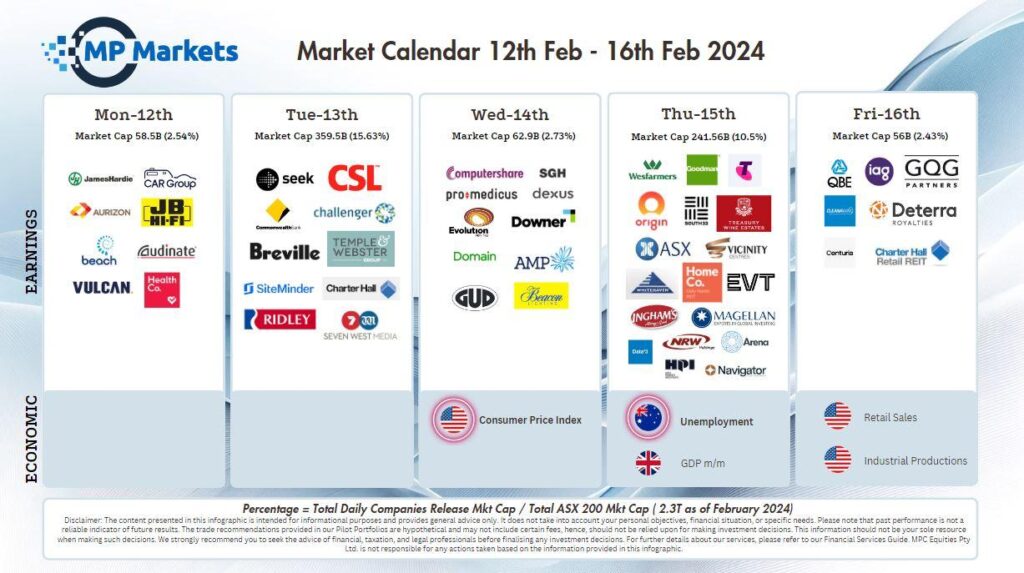

The ASX will be earnings focused this week with the rest of the market waiting on CPI from the US and employment in Australia on Thursday.

Reporting Today: Breville (BRG) | Challenger (CGF) | Charter Hall Social Infrastructure (CQE) | CSL (CSL) | HealthCo Wellness REIT (HCW) | James Hardie quarterly (JHX) | Seven West Media (SWM) | Temple & Webster (TPW).

Breville’s profit rose 6.7 per cent to $84 million in the first half of 2024, from a year ago, in a subdued consumer backdrop.

HealthCo Healthcare & Wellness REIT reaffirmed funds from operations (FFO) and distribution guidance of 8¢ per unit for fiscal 2024 thanks to attractive demographics supporting long-term demand for medical services.