Last Night's Market Recap

S&P 500 - Heatmap

Overnight – S&P500 closes above 5000 for the first time on AI frenzy

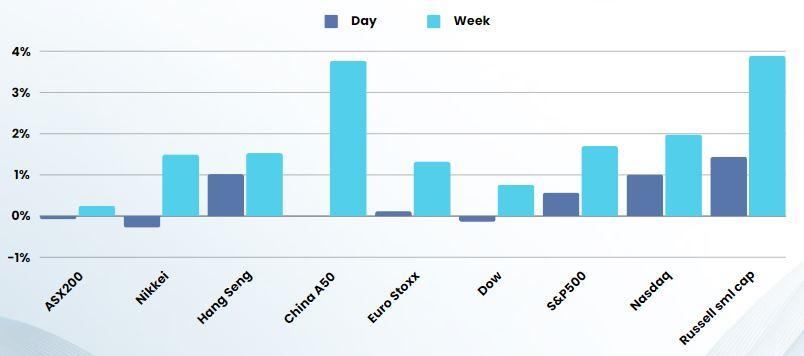

Equities surged higher with the S&P500 closing above 5,000 for the first time on Friday and Nasdaq briefly traded above 16,000, with boosts from megacaps and chip stocks, including Nvidia as investors bet on artificial intelligence technology and eyed strong earnings data.

Nvidia finished up 3.6% and hit a record high after Reuters reported it was building a new business unit focused on designing bespoke chips for cloud computing firms and others, including advanced artificial intelligence (AI) processors.

Along with outperformance by the Philadelphia semiconductor index, which closed up 1.99%, technology-focused market heavyweights, including Microsoft, Amazon, and Alphabet also contributed to index gains.

With results in from about two-thirds of S&P 500 companies, LSEG data now shows Wall Street estimates for fourth-quarter earnings growth of 9.0% versus expectations for 4.7% growth on Jan. 1 while 81% of companies are beating estimates, compared with a 76% average in the previous four reporting periods.

The yield on benchmark U.S. 10-year notes rose 0.7 basis points to 4.177%, from 4.17% late on Thursday. The 2-year note yield, which typically moves in step with interest rate expectations, rose 3.2 basis points to 4.4883%, from 4.456% late on Thursday.

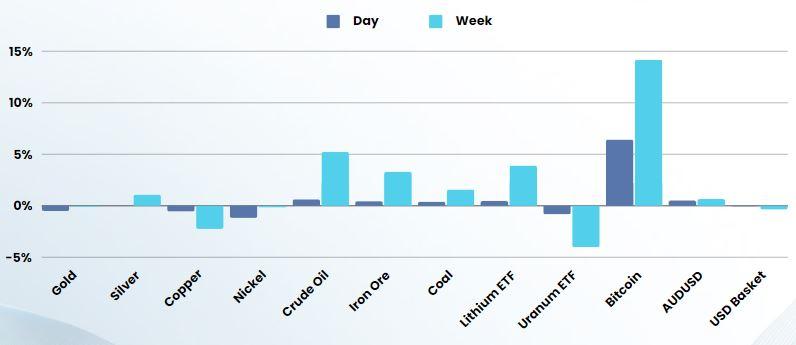

Gold prices came under pressure from the stronger yields, with spot gold down 0.44% at $2,024.16 an ounce. U.S. gold futures settled 0.4% lower at $2038.7.

Brent crude futures settled up 0.7% at $82.19 a barrel, and U.S. crude futures finished up 0.8% at $76.84.

U.S. monthly consumer prices rose less than initially estimated in December, but underlying inflation remained a bit warm, data showed on Friday. The data revision did little to alter expectations for central bank rate changes. U.S. inflation data for January is coming this week

US Earnings

- PepsiCo reported mixed-quarter results and cut its guidance as the food and beverage pricing power wanes and volumes come under pressure. its shares ended more than 3% lower. Still, more favorable movements in currency, and Pepsi outlook for dollar EPS of $8.15, should “actually result in a slightly positive earnings revision for 2024 based on current Street estimates,” Wedbush said in a note.

- Pinterest tumbled nearly 10% after the social media company missed fourth-quarter revenue expectations and issued soft guidance for the March quarter. Some on Wall Street, however, continued to flag the company’s current valuation as a concern, which is “pricing in a lot of upside despite the immaterial contribution today,” UBS said in a note.

- Take-Two Interactive has cut its annual bookings guidance, citing projected softness for titles like “NBA 2K24” and a planned release moving out of its fiscal fourth quarter. Shares in the video game publisher fell more than 8%.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7595 (unchanged)

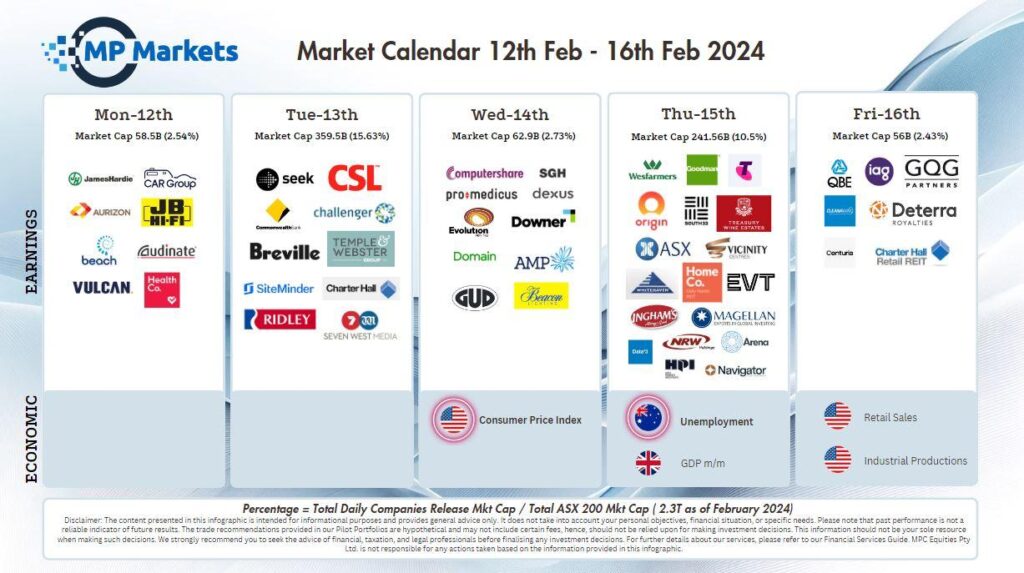

The ASX have a look at higher prices, although earnings will be the main focus this week with around 30% of the ASX200 reporting this week. We expect earnings to be patchy, with quality, consistently well run companies to be the standouts.

Chinese New Year will put the brakes on commodity markets this week, especially iron ore and lithium which are very China centric