Last Night's Market Recap

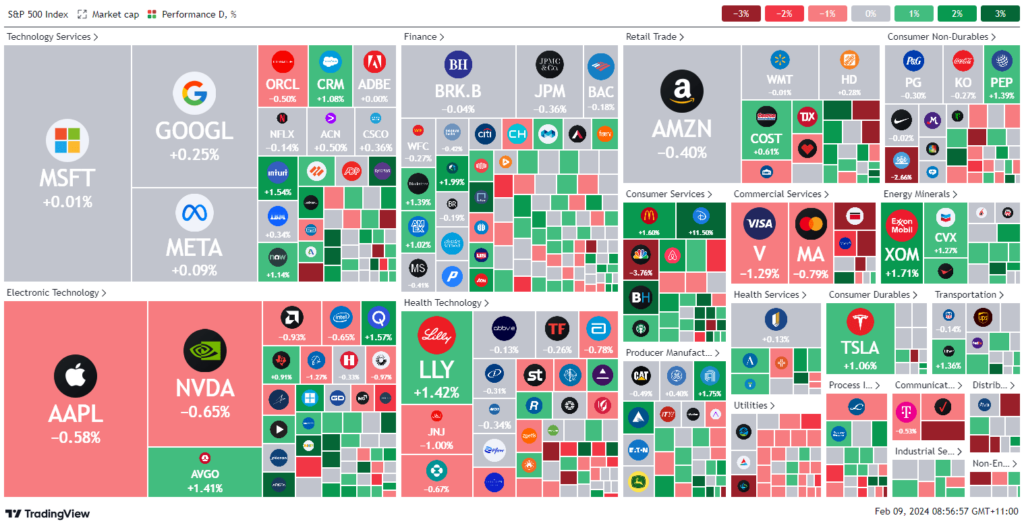

S&P 500 - Heatmap

Overnight – S&P500 touches 5000 for the first time but closes just under

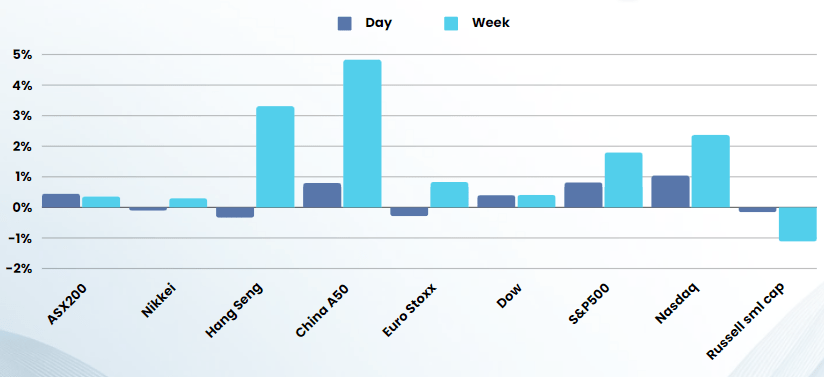

On Thursday, the S&P 500 marginally increased by 0.06% to close at 4,997.91, after momentarily surpassing the 5,000 mark for the first time, peaking at 5,000.40. The Dow Jones Industrial Average witnessed a modest rise, gaining 48.97 points to settle at 38,726.33, a 0.13% increase. Meanwhile, the Nasdaq Composite advanced by 0.24%, ending the day at 15,793.71. Jay Woods of Freedom Capital Markets commented on the market’s condition, suggesting that the ongoing rally might be losing its momentum despite the positive headline.

The recent market boost has been largely driven by strong earnings and significant gains in major technology stocks, yet concerns about the sustainability of this rally persist due to its concentrated nature and renewed rate cut uncertainties expressed by Federal Reserve officials, including Chair Jerome Powell.

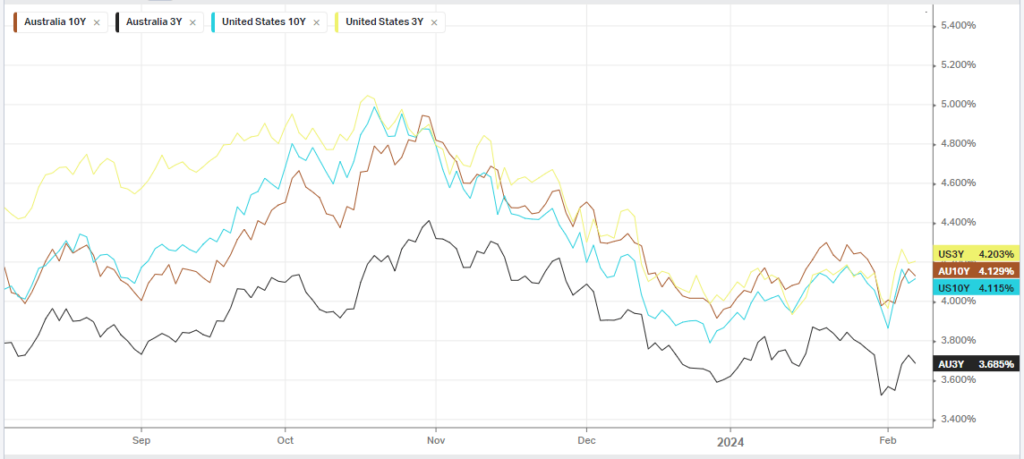

Disney’s shares soared by 11.5% following quarterly earnings that exceeded expectations and an improved outlook. Similarly, Arm Holdings experienced a remarkable surge of 47.9% after outperforming earnings forecasts and issuing a positive profit outlook. Despite strong earnings bolstering market confidence in a resilient economy capable of sustaining corporate growth, rising yields from the 10-year Treasury note, which last stood at 4.15%, applied pressure on equities. The earnings season is set to continue with upcoming reports from Expedia, Affirm Holdings, and Take-Two Interactive, maintaining investor focus on corporate performance.

Bonds

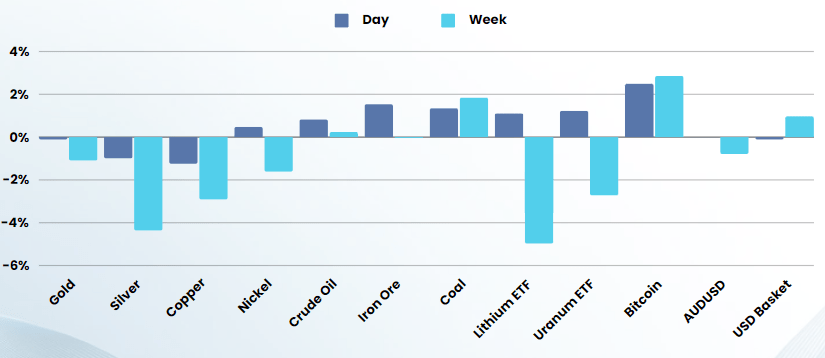

Commodities & FX

The Day Ahead

ASX SPI 7588 (+0.27%)

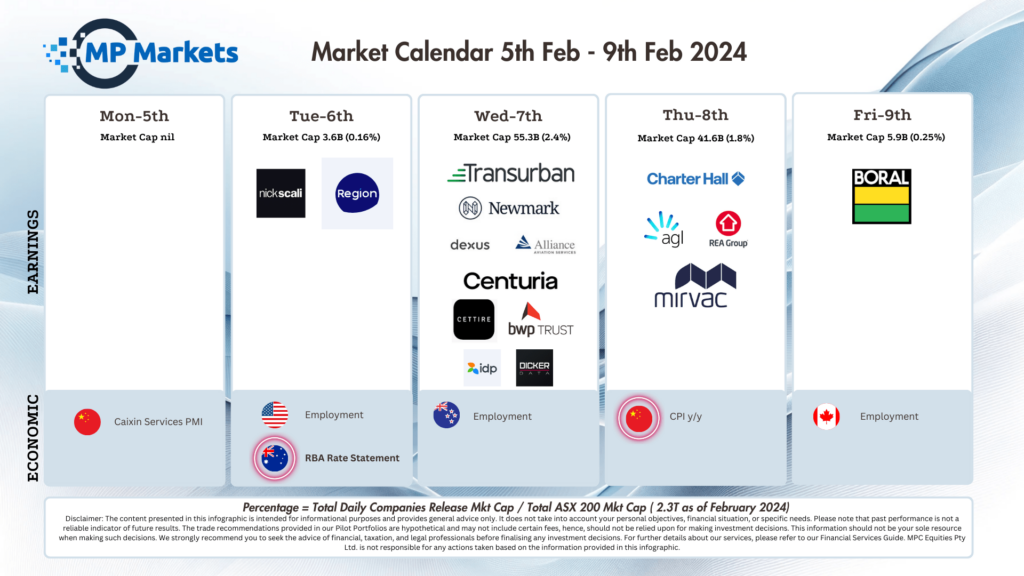

The ASX should have a positive day with SPI grinding out some modest gains overnight. Uranium was sold off last night after Cameco earnings but a drop in production may see support for the spot price. Earnings season will go into full swing next week, so expect some book squaring in some stocks. The main focus will be at a company level for the next 3 weeks,

- Boral upgraded its earnings guidance in a result it attributed to solid volumes for its building materials business and pushing price rises through to customers at the same time as managing costs