Last Night's Market Recap

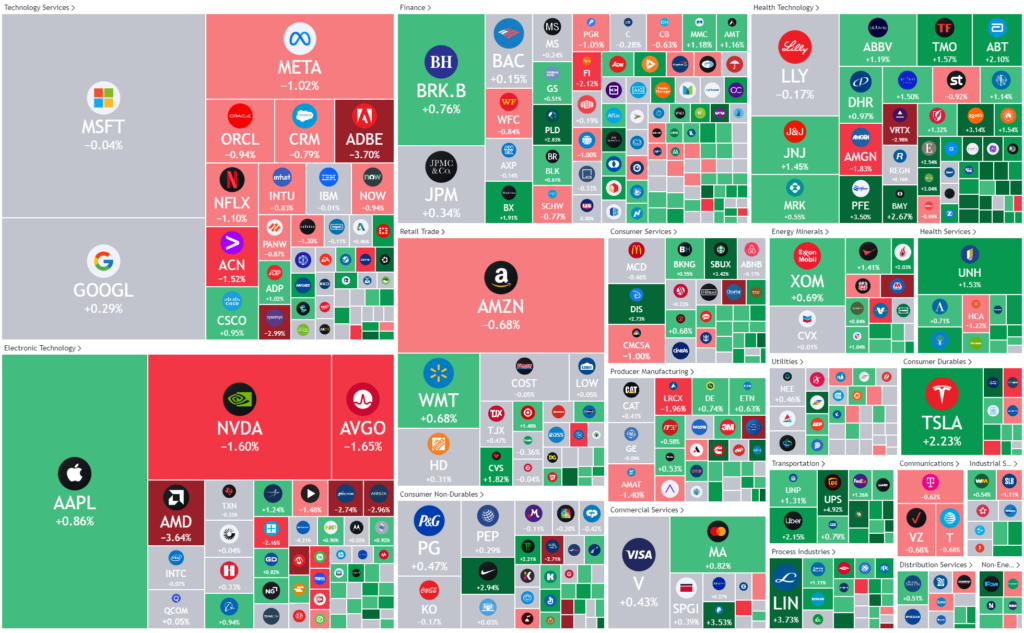

S&P 500 - Heatmap

Overnight – Stocks lose momentum as “Higher for Longer” sinks in

Equities staged a late dash from the lows of the day as the race to record highs resumed following a recent stumble as broadening out of the rally on stronger corporate earnings helped soften the blow from chip-led weakness in tech stocks.

Federal Reserve officials continued to reiterate that the Fed isn’t in a rush to cut rates as there remains work to be done on slowing inflation to the 2% target. Minneapolis fed president Neel Kashkari said recent inflation data on a six-month, or three months basis, show that inflation is “basically” at target, though cautioned that it is “not all the way there yet.” The remarks arrived on the heels of Federal Reserve Bank of Cleveland President Loretta Mester saying that policymakers will likely cut rates later this year should inflation continue to cool, though added that there was “no rush” to cut.

Tech stocks, meanwhile, were dragged lower by weaker semiconductor stocks, with NVIDIA, Advanced Micro Devices, and Rambus leading the declines, with latter slumping 19% after reporting a slip in revenue in Q4 year-on-year. DocuSign fell 2% after the company said it would layoff of 6% of its workforce and signaled that it would remain a public company following a Reuters reports that talks with potential suitors had stalled. The job cuts were part of restructuring plan that company said will help it “realize its multi-year growth aspirations as an independent public company

Oil climbed over $1 a barrel on Tuesday after the U.S. Energy Department said crude oil production would grow less than forecast but then gave up some of the gains on talk of a possible lengthy cease-fire in the Gaza War.

US Earnings

- Eli Lilly ended just below the flatline after giving up gains despite reporting fourth-quarter results that topped estimates, driven by soaring demand for its new suite of obesity and diabetes drugs.

- Palantir Technologies surged nearly 31% after reporting Q4 beat on both the top and bottom lines as commercial revenue jumped underpinned by new business deals. “Its clear that as AI use cases explode enterprise chief investment officers are looking towards [Palantir CEO] Alex Karp as the AI golden child for a platform to build out AI frameworks for the future,” Wedbush said in a note, after lifting its price target on the stock to $30 from $25.

- Spotify Technology meanwhile, narrowed its losses in fourth quarter after revenue climbed 17% as the music streaming racked in more monthly active users than Wall Street expected. Its shares rose nearly 4%.

Bonds

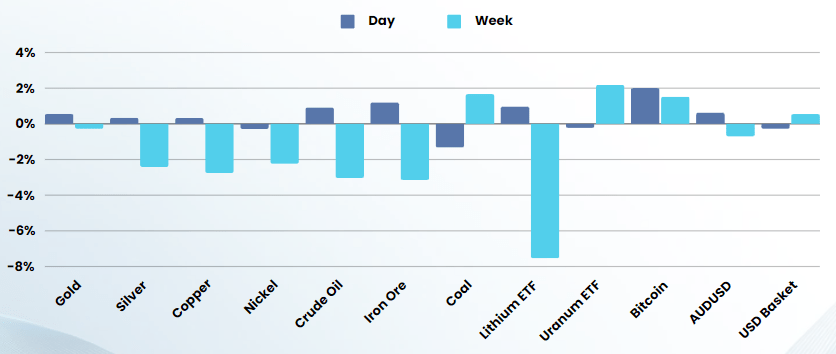

Commodities & FX

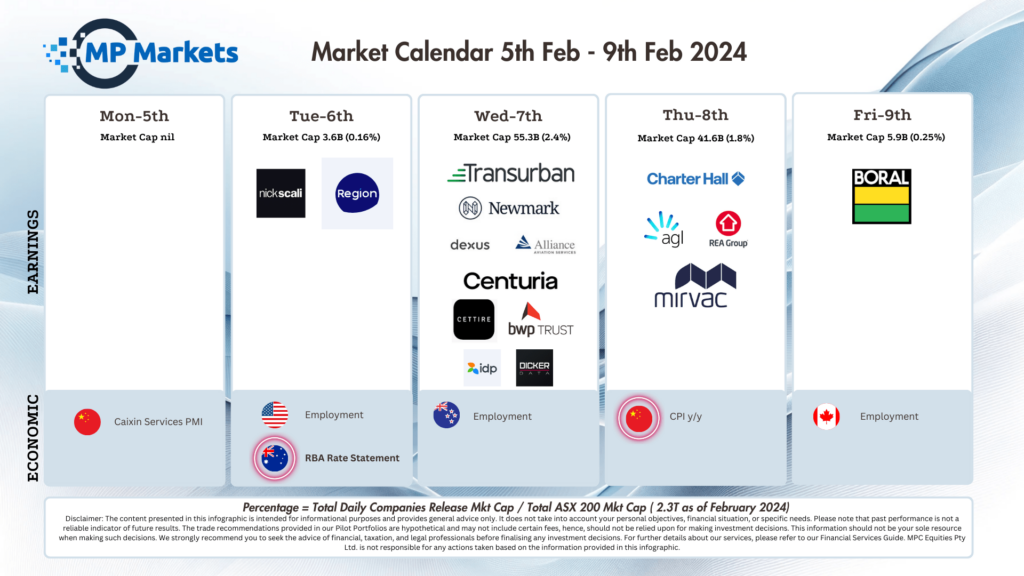

The Day Ahead

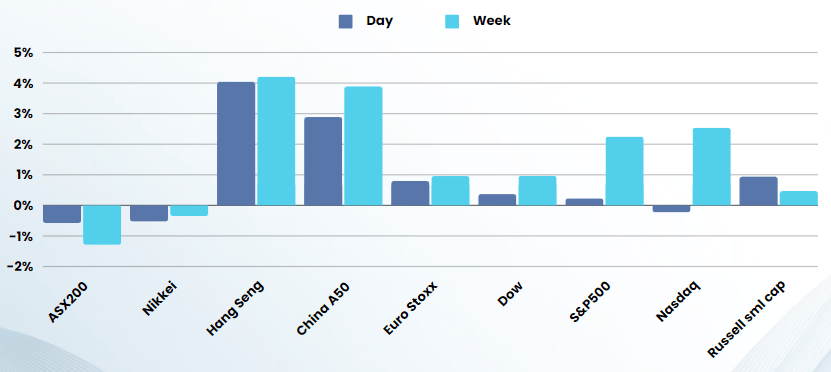

ASX SPI 7588 (+0.77%)

The ASX should be buoyed today by rising commodity prices and news that China is in the initial stages of a stimulus package and regulation changes like banning short selling, incentivizing brokers to support the market amongst other initiiatives. The Chinese stock market was up around 6% after the ASX close yesterday

- National Australia Bank group CEO and managing director Ross McEwan will step down from the role in April. He will be replaced by Andrew Irvine, currently NAB’s group executive business and private banking lead, a role he’s held the role since 2020.

- BWP Trusthas recorded a drop in net profit in the six months to December 31, but has held firm on its 9.02¢ dividend.

- Cettire’s sales jumped 89 per cent to $354.3 million in the online retailer’s first half, underpinned by more active customers, and higher orders from those shoppers.

- ResMed trades ex-dividend.