Last Night's Market Recap

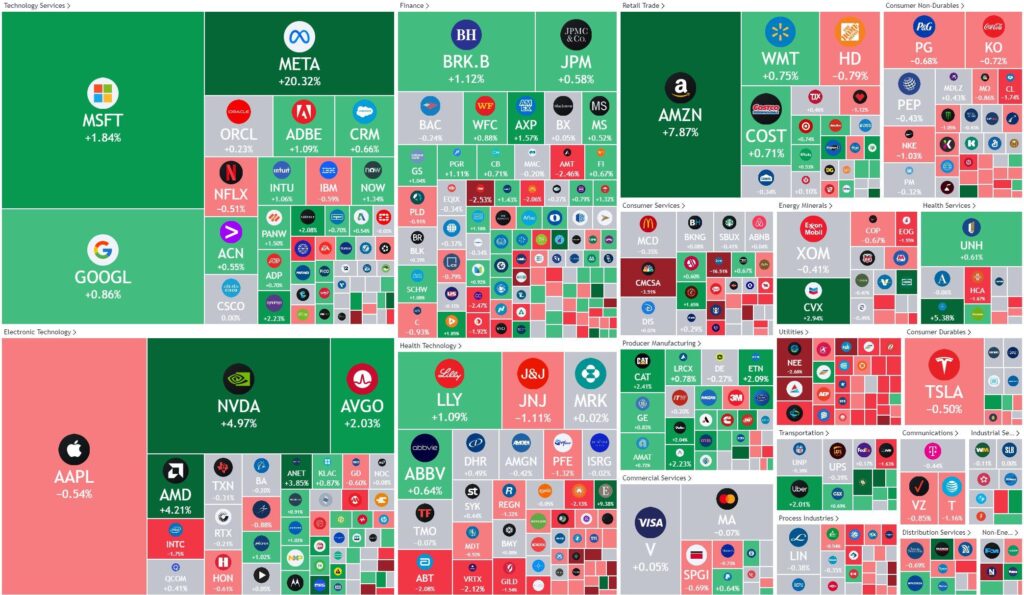

S&P 500 - Heatmap

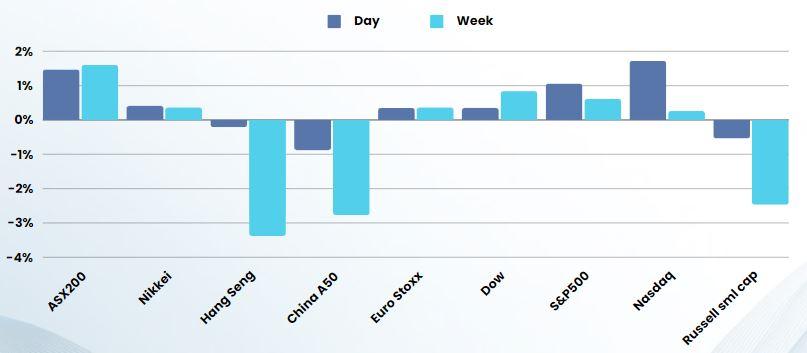

Overnight – Meta Platforms rally drives tech higher, despite strong jobs data

An extreme rally in Meta platform (Facebook) stoked bullish bets on big tech even as a blowout jobs report muddied the Federal Reserve rate-cut outlook.

The U.S. economy added far more jobs than expected in January, with nonfarm payrolls in the world’s largest economy rising by 353,000 last month, much more than the 187,000 jobs expected. The strong hiring activity comes as the number of people that entered the job market, or the participation rate, unexpected fell, albeit slightly, pushing average hourly earnings, or wage growth, to 0.6% from 0.4% a month earlier, confounding economists expectations for a decline 0.3%.

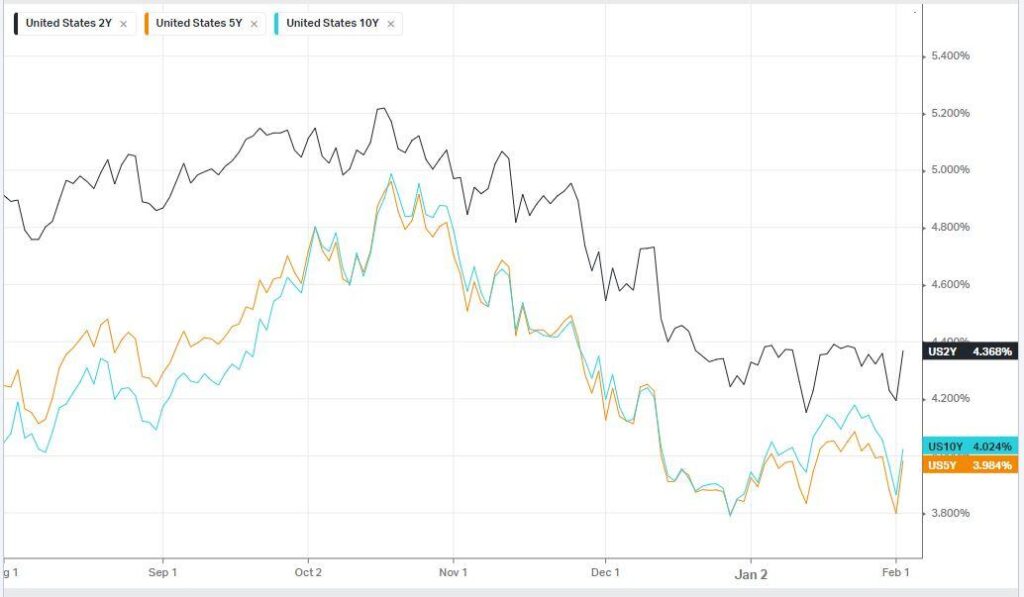

The stronger wage growth, which threatens to boost inflation, mudded the outlook for rate cuts with some economists now suggesting that a first rate cut could be delayed. This morning’s report coupled with ongoing solid indications of consumer activity and uncertainty in terms of the disinflationary trend should be more than enough to justify higher for longer, potentially into the second half of the year

Energy stocks were pushed higher by a rise in Exxon Mobil Corp and Chevron after the duo reported better-than-expected quarterly results as higher production helped offset the hit from falling oil prices.

Uranium hit a new 17 year high although uranium stocks were slightly weaker after a strong showing on Friday

US Earnings

- Meta Platforms stock rose 20% as the tech giant declined its first dividend and rolled out additional $50 billion in share buybacks after quarterly profit at the Facebook parent tripled from a year earlier. The move to return a chunk of capital to shareholders could help expand Meta’s base to dividend hunters, UBS said in a note. “The step up in capital returns does open up META shares for incremental demand from dividend/income funds.”

- com jumped more than 7% after its fourth-quarter results topped Wall Street estimates as cloud growth and strength in e-commerce bolstered performance.

- Apple meanwhile, cut losses to end the day just above the flatline after iPhone sales fell short of Wall Street estimates following weakness in China. China represents roughly 20% of iPhones sales, and is struggling to battle Huawei and geopolitical headwinds near-term, Wedbush said, though remained adamant that the company on optimism that users of older iPhone models in China are set to upgrade their phones.

- Intel Corporation however, fell more than 2% after as the chipmaker is reportedly delaying construction of its semiconductor factory in Ohio amid market challenges and a slower than expected roll out of government grants to help build chip plants.

- Chevron delivered solid financial results and outlining strategic plans for the future. The company achieved an adjusted Return on Capital Employed (ROCE) of 14%, returned $26 billion in cash to shareholders, and made significant progress in acquisitions and operational efficiency. Chevron also emphasized its commitment to reducing carbon intensity and expanding its lower carbon businesses.

- Exxon delivered a robust financial performance in the fourth quarter of 2023, with Chairman and CEO Darren Woods and Senior Vice President and CFO Kathy Mikells discussing the company’s achievements and future outlook during the earnings webcast. The company reported $36 billion in earnings, a strong cash flow, and a 15% return on capital employed. ExxonMobil’s strategic moves included divesting less strategic operations, reducing costs, and focusing on high-value projects like the Guyana and Permian developments. The company is also investing in innovative technologies such as lithium business and carbon capture and storage, aiming for $15 billion in structural cost savings by 2027.

Bonds

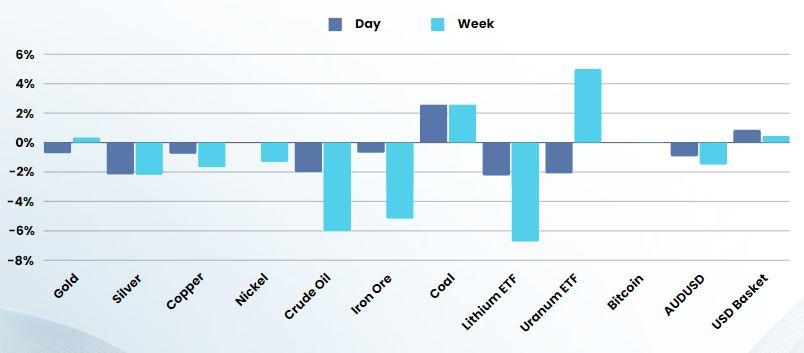

Commodities & FX