Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Tech bounces back on earnings, Uranium shortage deepens

Tech investors ignored the Fed’s warnings of “higher rates for longer” and bought the dip overnight leading into 16% of the S&P500 delivering earnings after the bell. Meanwhile uranium investors rejoiced at 17-year highs as the worlds biggest producer, Kazatomprom, flagged a 20% reduction in forecasted production leaving a 5% supply gap.

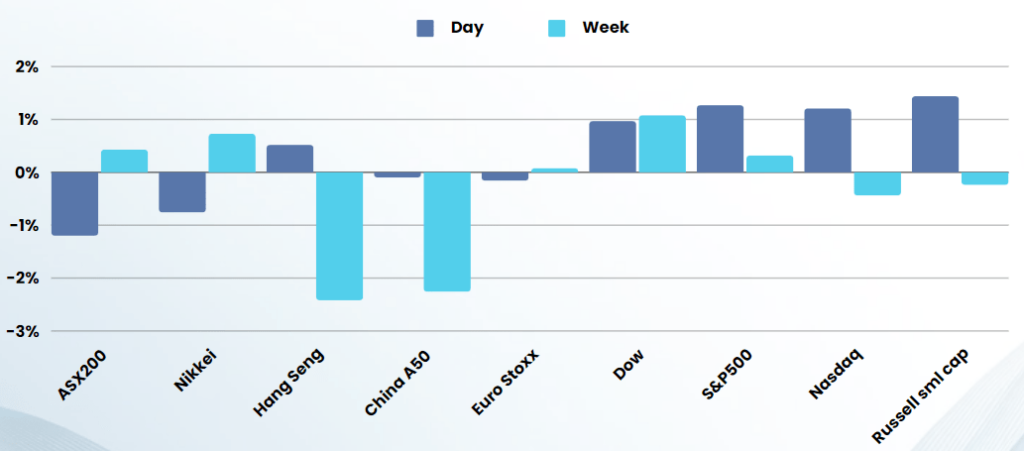

The Federal Reserve kept interest rates on hold at more than two-decade highs on Wednesday, as widely expected, but Chair Jerome Powell prompted a hefty selloff after he reined in hopes that the central bank would soon start to cut interest rates. In a press conference on Wednesday, Powell noted that a reduction as soon as March was not his “base case” despite growing signs of cooling inflation. Goldman Sachs pushed back its expectation of the Fed starting interest rate cuts to May from March, while maintaining its forecast of five 25 basis points rate cuts this year. The influential investment bank expects four consecutive cuts starting in May through September and a final cut in December.

U.S. regional banks sold off again on Thursday, adding to losses from a day earlier when New York Community Bank reported pain in its commercial real estate portfolio, renewing fears about the industry’s health. The KBW Regional Banking Index slipped 1.6%, after seeing its biggest single-day decline since the collapse of Signature Bank in March 2023. NYCB shares lost another 8.5% of their value and were last trading at $5.92, partially erasing deeper losses from earlier in the morning. The stock experienced a record single-day drop of 37.6% on Wednesday

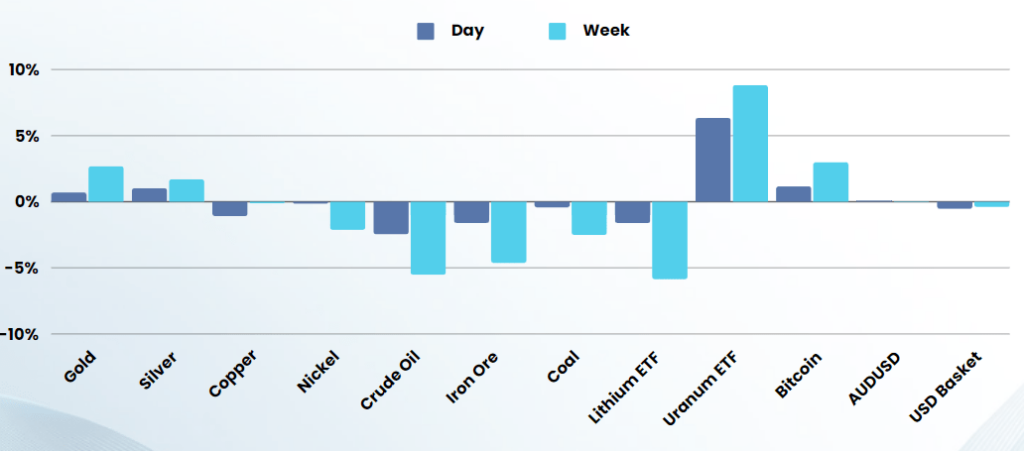

Oil prices rose Thursday, helped by the elevated tensions in the Middle East but amid caution with OPEC+ meeting.The Organization of Petroleum Exporting Countries and allies, known as OPEC+, held its first major meeting of 2024, but had little price impact as production policy changes weren’t on the agenda.

Uranium hit a new 17 year high after Kazatomprom dropped production guidance by 20% for 2024. The Kazakhstani national producer is 23% of world supply, meaning a 4.5% supply gap the year after 33 countries (representing 45% of global GDP) committed to triple nuclear power in the next 25 years

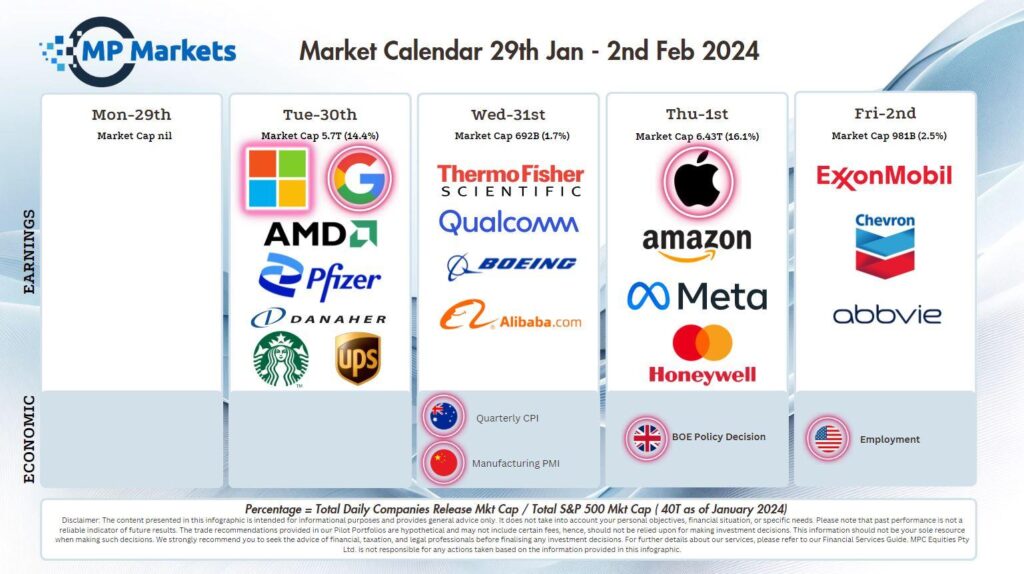

US Earnings

- Amazon reported better-than-expected fourth-quarter results as cloud growth met expectations and e-commerce benefited from a strong holiday shopping season. The stock rose more than 3% in afterhours trading following the report. Amazon reported Q4 adjusted EPSof $1.00 on revenue of $170.0 billion, beating estimates of $0.80 on revenue of $165.95B. “This Q4 was a record-breaking Holiday shopping season and closed out a robust 2023 for Amazon,” the company said, with sales in North America rising to $105.5B in the quarter from $93.36B a year earlier. Amazon web services, its margin- heavy cloud revenue segment, which drives the bulk of operating profit grew 13%, to $24.2B, in-line with analyst estimates of 13%

- Meta Platforms saw its stock rise more than 11% following the announcement of strong fourth-quarter earnings and the introduction of a new buyback program. The internet company reported a Q4 EPS of $5.33, easily surpassing the analysts’ estimate of $4.96. Revenue jumped 25% year-over-year to $40.11 billion, again topping the expected $39.02 billion.

- Apple Earnings were not released at the writing of this report

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7577 (+0.39%)

The ASX is likely to bounce back today in line with the positivity on Wall St, however our largest sectors, Finance and materials may hold the market back as regional banking worries and the falling iron ore price will weigh. Uranium stocks will have a stellar day with record highs likely in many uranium stocks

- Atlassian is scheduled to report after New York’s closing bell.

- Shares of Euroz Hartleys Groupand Nickel Industries both trade ex-dividend.