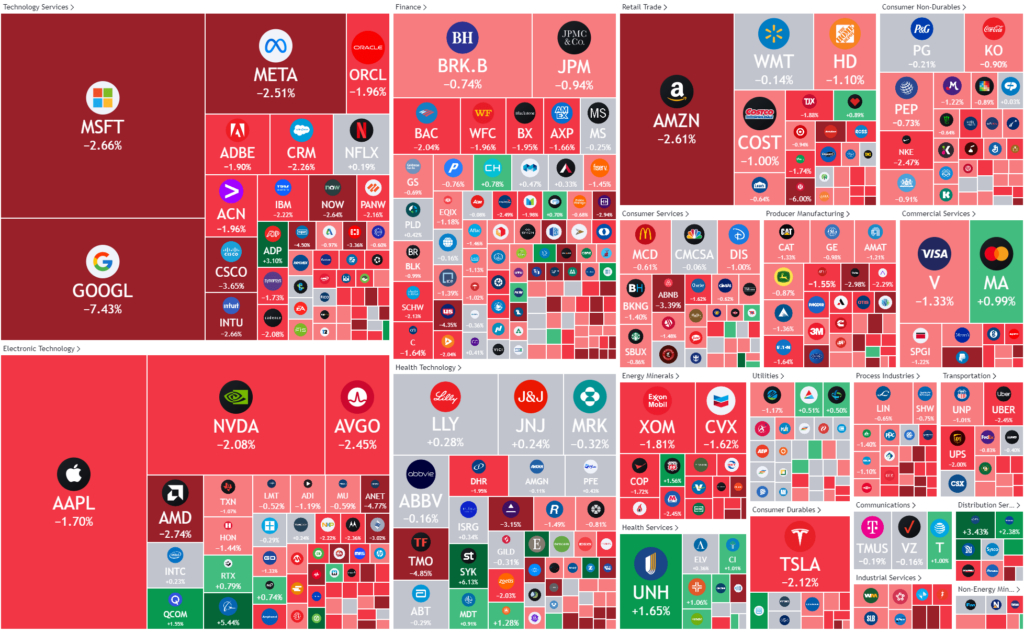

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Powell delivers knock-out blow to March cuts, leaving tech stocks on the canvas

Tech stocks led the market lower as the Federal Reserve’s chairman Jerome Powell said it was unlikely that the Fed would cut rates in March, dealing a blow to hopes for sooner rate cut that added fuel to the tech-led selloff.

In blow to sentiment for sooner rather than later rate cut, the Fed said it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” In a further sign that the Fed isn’t likely to cut in March, Federal Reserve chairman Jerome Powell said that it wasn’t likely that the committee will reach a level of confidence by the time of the March meeting to cut rates, though continued to stress that future policy decisions would depend on incoming data. The updated view on monetary policy arrived on the heels of unchanged rate decision that was largely expected. Despite the less dovish than expected monetary policy statement, Treasury yields continued to languish in the red, with the Fed rate-sensitive 2-year Treasury yield falling 9.3 basis points to 4.262%.

The “Magnificent 7” were down over 3% on average with Alphabet the biggest loser down 7.5% on yesterdays poorly received earnings report.

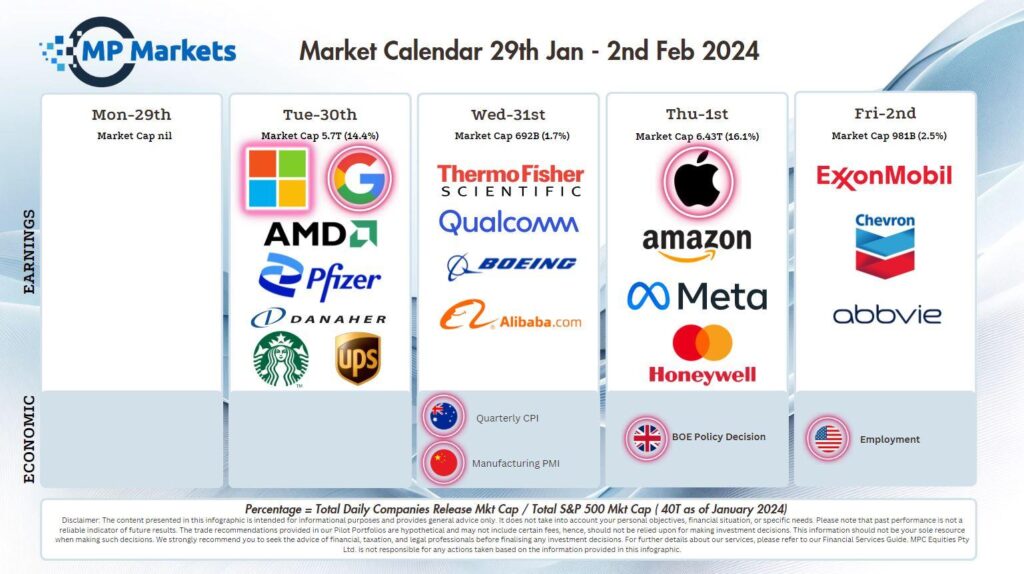

US Earnings

- Mastercard reported fourth-quarter earnings of $3.18 per share, $0.10 better than the analysts’ estimate of $3.08 per share. Revenue for the quarter came in at $6.5 billion, up 13% year-on-year and above the consensus estimate of $6.48 billion. The company put the revenue increase down to growth in its payment network and its value-added services and solutions. Payment network net revenue increased by 9%. In addition, its results were helped by healthy consumer spending and cross-border volume growth. Q4 cross-border volume growth rose 18% on a local currency basis. Q4 gross dollar volume was up 10%, and purchase volume increased 11% year-on-year.

- Thermo Fisher Scientific on Wednesday forecast annual profit and revenue below Wall Street estimates, signaling that a slump in demand for its services used to make therapies and vaccines will extend at least into the first half of the year. The medical equipment maker also said it does not expect demand in its key market, China, to improve this year. Thermo’s shares fell nearly 4%

- Qualcomm shares rose more than 2% in after-hours trade following the report. The chipmaker reportedadjusted EPS of $2.75 on revenue of $9.92 billion. Analysts polled by Investing.com anticipated EPS of $2.37 on revenue of $9.49B. The better-than-expected results were boosted by a 16% jump in handset sales to $6.69B, compared with a 27% slip in the prior quarter.

Bonds

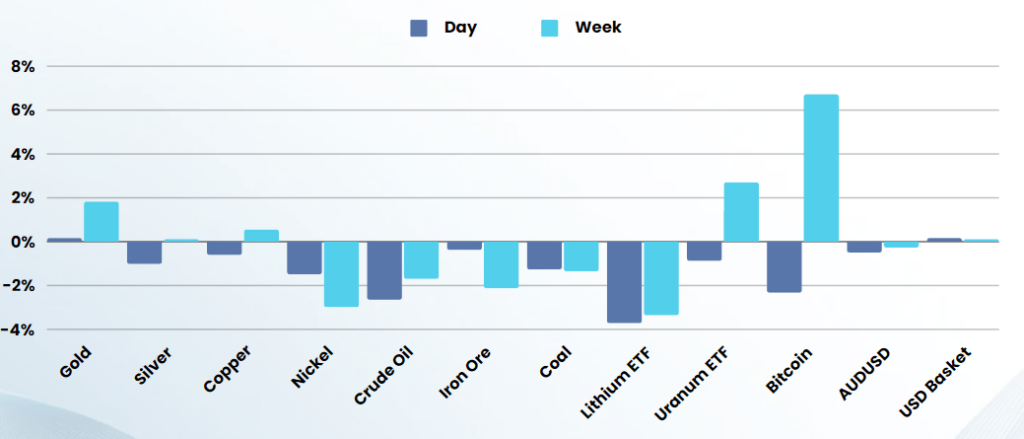

Commodities & FX

The Day Ahead

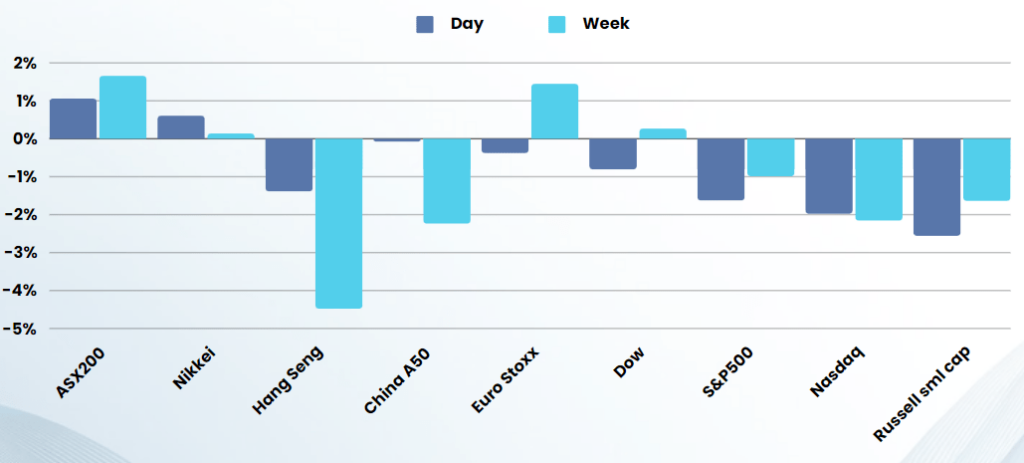

ASX SPI 7559 (-1.10%)

The ASX reached a record close yesterday, after 3 years of trying, only to have the momentum thwarted by a sell off in US tech overnight. While we are likely to open lower, the technical break of a record high and the lack of weighting to tech in our index, we think the market will bounce over the day. The Magnificent 7 have outperformed the ASX200 by a whopping 28% in the last 12-months so a correction in the relative value is warranted.

- Pinnacle Investment Management and Kelly Partners issue earnings with a sales update from St Barbara. Nufarm hosts an AGM.