Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Magnificent 7 flex muscles ahead of earnings and Fed

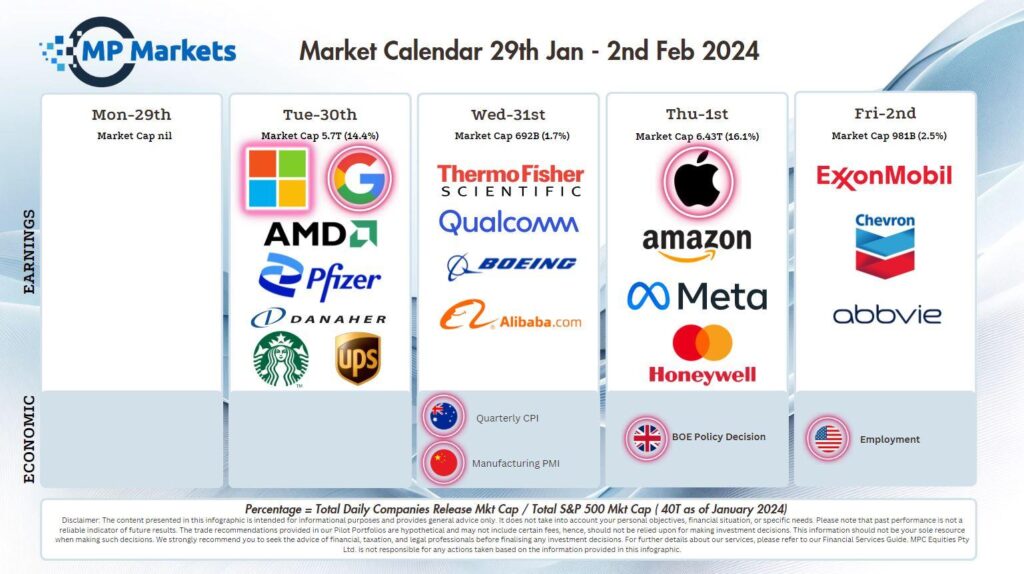

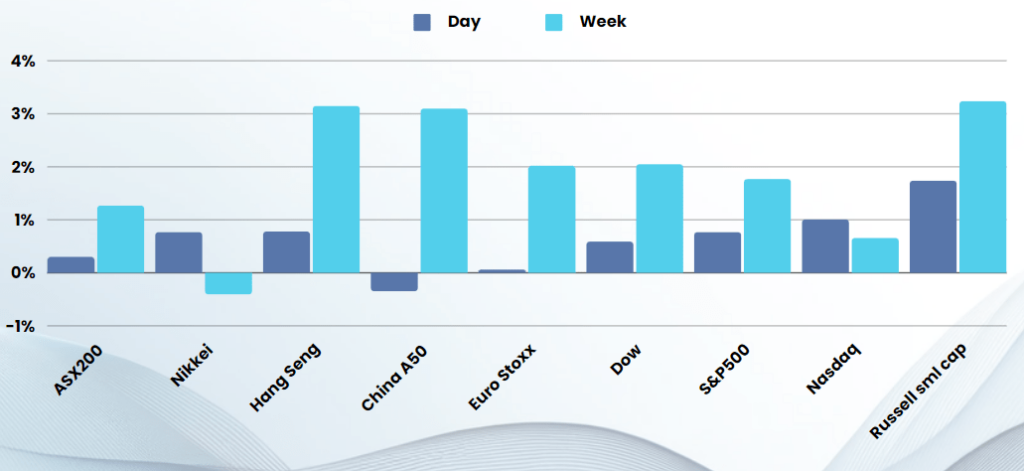

Stocks climbed overnight as investors added to bullish bets on tech ahead of earnings from several mega-cap tech companies, with key macro-economic events including Federal Reserve policy-setting meeting and monthly jobs report due later this week.

Tech stocks continued to rack up gains as the countdown to the busiest week of the earnings season, with 19% of the S&P 500 including five of the “Magnificent Seven” tech stocks. This week marks the busiest week of the earnings season, with 19% of the S&P 500 including five of the “Magnificent Seven” tech stocks set to report earnings.

The Federal Reserve’s two-day policy-setting meeting gets underway on Tuesday, but while the expectations for a unchanged a decision on rates is priced-in, investors will keen for a fresh update or clues on rate cuts. In the weeks, leading up to the Fed decision, investors have reined in their expectations for a March cut as signs of ongoing strength in the economy has lessen the need for speed on rate cuts.

The widely-watched monthly payrolls report is scheduled for Friday, and ahead of that comes JOLTS job openings and consumer confidence on Tuesday, followed a day later by a report on private sector payrolls and weekly data on initial jobless claims on Thursday.

US Earnings

- Only small cap earnings overnight

Bonds

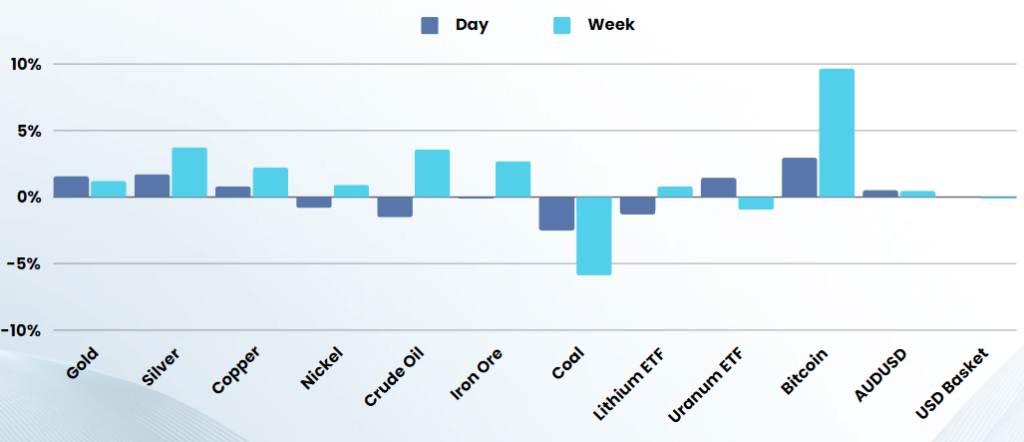

Commodities & FX

The Day Ahead

ASX SPI 7580 (+0.50%)

The offshore markets may have fallen Friday night, however they ended up for the week, just off record highs. Tech was the laggard, which should affect our market too much. The rise in Iron ore prices should help the materials sector and rising oil prices the energy sector.

- Atlas Arteria and Megaportboth release sales updates. Eagers Automotive hosts a meeting.

- Nickel Industries andVulcan Energy issue production results.